Large Cap Best & Worst Report - December 16, 2014

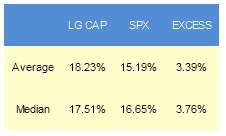

Since 2010, our top scoring weekly has outpaced the SPX by a median 376 bps in the following year. The best performers from our list one year ago are RCL up 79%, DAL up 78%, AA up 55%, GD up 54%, and SIAL up 53%.

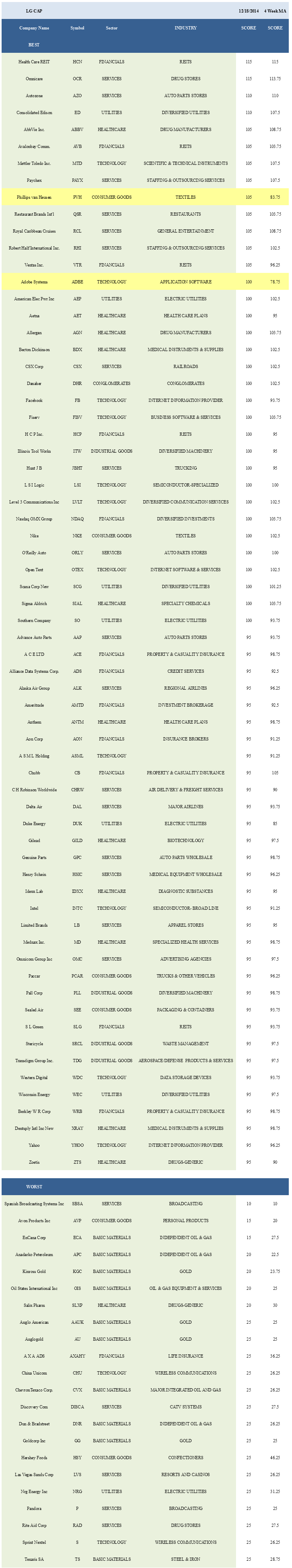

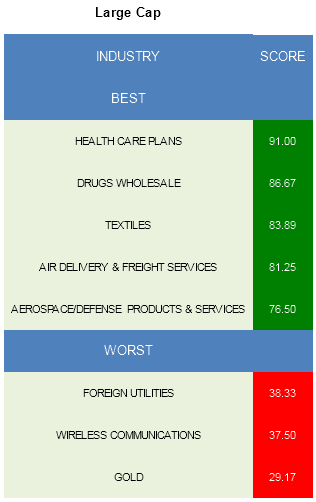

- Healthcare is the best large cap sector.

- The top large cap industry is healthcare plans.

The average large cap score is 63.40, below the four week moving average score of 68.77. The average large cap stock is trading -13.61% below its 52 week high, -0.50% below its 200 dma, has 4.19 days to cover held short, and is expected to post EPS growth of 10.3% next year.

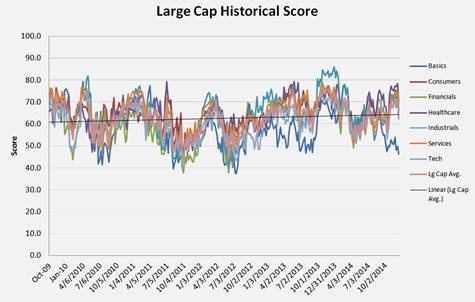

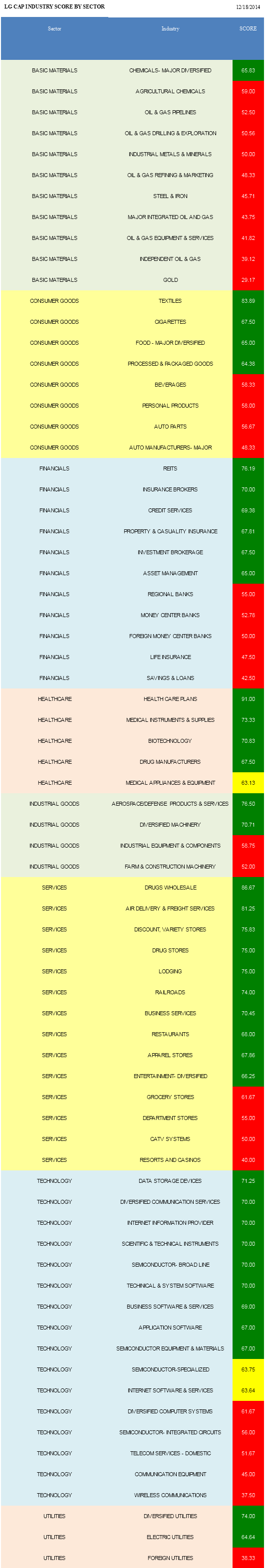

Healthcare is the top scoring large cap sector. Services, consumer goods, and financials also score above average. Utilities and industrial goods score in line. Technology and basics score below average.

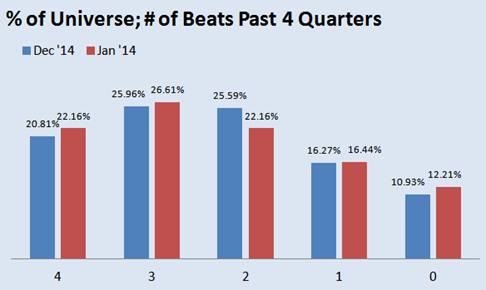

Intriguing observation: 20.8% of companies in our 1600 stock universe have beaten the street in each of the past four quarters, down from 22.16% in January. 10.93% of companies have failed to beat estimates at least once in the past year, down from 12.21% last year. The decline in the number of companies beating in at least 3 of the past four quarters may suggest that analysts are 'catching-up' to results and becoming too bullish/complacent. Stick with the best scoring list.

The best large cap industry is healthcare plans (AET, ANTM, UNH, CI, HUM). 1.4 million people have signed up for plans through the exchanges since open enrollment began on Nov. 15th. Medicaid expansion and increased awareness is expected to increase Medicaid enrollment by 13.2% nationally in the year ending June 2015, lending support to private Medicaid insurers. Wholesale drugs (MCK, ABC) score high thanks to rising script volume tied to increasing insurance enrollment. Textiles (PVH, NKE, RL, MHK, LULU) benefit from holiday seasonal demand and post-holiday inventory re-stocking. Clothing and accessories retail sales in November grew 3.6% year-over-year. Air delivery & freight (CHRW, UPS, FDX) continue to benefit from growing e-commerce volumes. November non-store retail sales were up 8.7% year-over-year. Aerospace/defense (TDG, RTN, GD, NOC) plays benefit from rising production and budget clarity.

In large cap basic materials, only major chemicals (SHW, ASH, APD) score above average thanks to falling input costs. Textiles, cigarettes (RAI, MO), and major food (ADM) are best in consumer goods. REITS (HCN, VTR, AVB, HCP, SLG, SPG), insurance brokers (AON, MMC), and credit services (ADS, SLM, EFX, MCO) are top scoring in financials. In healthcare, concentrate on healthcare plans, medical instruments (BDX, XRAY, SYK, BCR), and biotechnology (GILD, BIIB, INCY, CELG, BMRN). The highest scoring baskets across industrial goods are aerospace/defense and diversified machinery (ITW, PLL). In services, concentrate on wholesale drugs, air delivery & freight, and discount/variety stores (FDO, DG, COST, WMT, TGT). Data storage devices (WDC, STX, NTAP), diversified communication services (LVLT), and Internet information (FB, YHOO, NTES, EXPE) score best across technology.

Disclosure: None.