King Digital Entertainment Drops 10% On Mediocre Q2 Outlook

By Carly Forster

Candy Crush maker King Digital Entertainment (NYSE: KING) announced its first quarter 2015 earnings report late Thursday, May 14, sending shares down 10%. Although the game maker’s first quarter results beat expectations, a mediocre second quarter outlook sent shares down.

Highlights from King Digital’s first quarter report include earnings of $0.51 per share and $569 million in revenue, up from $0.41 earnings per share and down from $606 million in revenue from the same quarter a year prior. Wall Street had expected the company to post $0.46 earnings per share.

King Digital’s Q2 guidance includes a range of $490 million to $520 million in gross bookings, which is significantly less than the company’s first quarter gross bookings of $604 million. The company said it expects its gross bookings to “be seasonally softer” due to its “game release schedule, the impact of foreign currency changes to date and recent trends.”

King Digital received a big boost in downloads for the sequel to its wildly popular game, Candy Crush, in the fourth quarter of last year, which picked the company up from out of a deepening hole. The company has said the success of the second Candy Crush game proves its ability to create popular games and extend the lifespan of its brands. The company has yet to launch a game with the same success as Candy Crush.

A handful of analysts weighed in on King Digital Entertainment following the company’s earnings announcement.

According to Smarter Analyst on May 15, RBC Capital analyst Mark Mahaney maintained a Sector Perform rating on King Digital with a price target of $17. The analyst is “incrementally cautious” on KING because of “the overall softness [of its Q2 guidance] in the mid-year” and the company’s “implied [quarter over quarter] decline this year is much greater than last year’s.” Mahaney noted, “For us to become constructive on the stock, we would need to see stable trends showing bookings growth AND diversification away from CC – which likely isn’t attainable until 2016.”

Overall, Mark Mahaney has a 65% success rate recommending stocks and a +22.7% average return per recommendation.

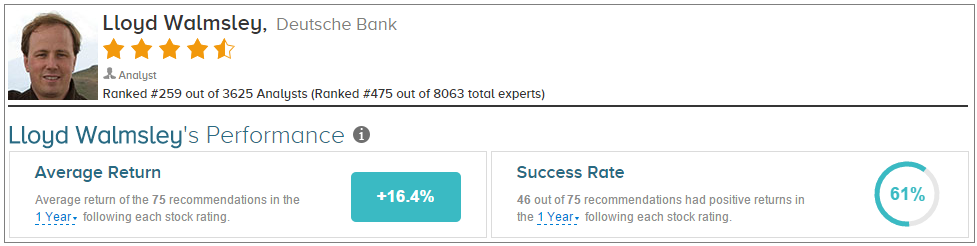

Similarly on May 15, Deutsche Bank analyst Lloyd Walmsley maintained a Hold rating on King Digital and cut his price target from $21 to $16. The analyst said that although KING’s “1Q results were solid,” the company’s upcoming games must be successful or else its revenue and margins will most likely decline.

On average, Lloyd Walmsley has a 61% success rate recommending stocks and a +16.4% average return per recommendation.

On the other hand, Wedbush analyst Michael Pachter reiterated an Outperform rating on KING with a $21 price target on May 15, according to Smarter Analyst. Having an optimistic outlook, the analyst believes “King is on the right path” and that “The company’s entry into non-casual genres involves more complicated game development than it has dealt with in the past.” Pachter thinks “the gap in its release schedule is a symptom of a deliberate approach to these new genres” and he expects “’all other’ game bookings to fully offset continuing declines in the core business beginning in Q3.”

Michael Pachter currently has an overall success rate of 46% recommending stocks and a +0.1% average return per recommendation.

On average, the top analyst consensus for KING on TipRanks is Hold.

Disclosure: To see more visit more

But didn't they fully recover and then some by end of day?