June FOMC Meeting And Gold

Yesterday, the Fed hiked its interest rates for the fourth time during the current tightening cycle. What does it imply for the gold market?

In line with expectations and our Wednesday’s preview, the Fed raised the federal funds rate by 25 basis points. This way, the U.S. central bank delivered the first hike since March, and the fourth rate increase in the post-crisis period. As there were not any other significant changes in the monetary statement, the most important paragraph of the released monetary policy statement is as follows:

“In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.”

The FOMC members justified the move by pointing out the fact that “labor market has continued to strengthen and that economic activity has been rising moderately so far this year”. The Fed officials noted that inflation had declined recently, but expressed their conviction that it would “stabilize around the Committee's 2 percent objective over the medium term”. Just like the last time, there was one dissenting voice, as Neel Kashkari, Minneapolis Fed President, preferred to keep rates unchanged.

To not disrupt the structure of interest rates, the U.S. central bank also lifted its other interest rates by 25 basis points. In particular, as we can read in an implementation note, the Fed raised interest paid on required and excess reserve balances to 1.25 percent, the overnight reverse repo rate to 1 percent and the discount rate to 1.75 percent.

When it comes to the Summary of Economic Projections, the FOMC members generally stuck to their forecasts from March, as we predicted yesterday. They reduced the unemployment rate over the years, and cut slightly the expected inflation rate this year, but the forecast for 2018 and beyond was unchanged. Importantly, the expected path of interest rates hikes remained unaltered, which could be interpreted as slightly hawkish, since investors expected ‘dovish hike’.

On the contrary, the Fed also issued an addendum to the Policy Normalization Principles and Plans, which provides details about the balance sheet normalization. Importantly, the Committee expects to start reducing its holdings of Treasury and agency securities this year.

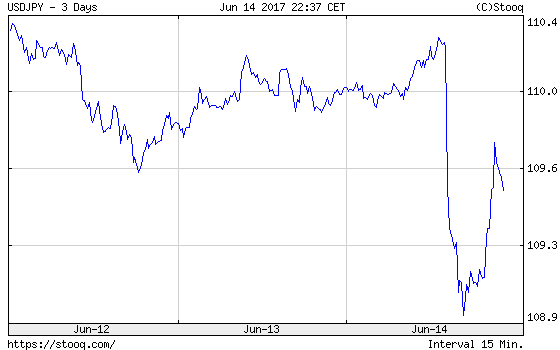

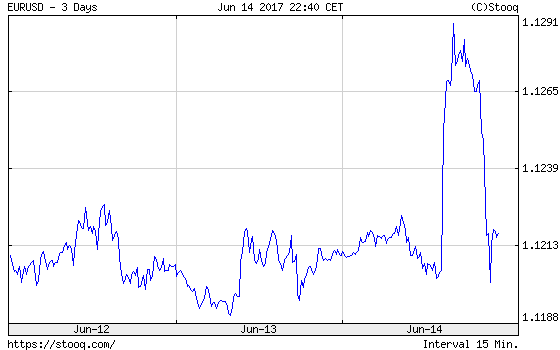

Anyway, the U.S. dollar plunged initially against the Japanese yen and the euro, but quickly rebounded, as traders digested the FOMC statement and Yellen’s press conference, as one can see in the charts below.

Chart 1: The USD/JPY exchange rate over the last three days.

(Click on image to enlarge)

Chart 2: The EUR/USD exchange rate over the last three days.

(Click on image to enlarge)

Indeed, Yellen’s comments were surprisingly hawkish, as she shrugged off concerns about weak inflation. That was too much for the yellow metal – despite early gains, the price of gold declined after the release of statement and press conference, as the chart below shows.

Chart 3: Gold prices over the last three days.

(Click on image to enlarge)

The key takeaway is that the Fed delivered the fourth rate hike, as expected. The U.S. central bank did not change its economic forecasts significantly, which means that it remains on course to raise interest rates once more this year and to start its balance sheet normalization. We will analyze the press conference in more detail in the near future, but we can say that the June FOMC meeting was more hawkish than expected, on balance. It’s bad news for the gold market, as the recent hikes were accompanied with ‘dovish messages’, which supported the price of the yellow metal. This time may be different.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly more