Jockeying For Position: Interest Rates And The Currency Markets

All eyes are focused on the Federal Reserve as ponders a rate increase before year’s end. Recent speeches among the members of the FOMC give strong indications that the Fed is about to raise its policy rate as part of its longer term strategy of returning rates to more “normal” levels. But what about the impact of “normalization” on currencies? The level of a nation’s currency plays a significant rolein influencing the impact of monetary policy . For exporters, a falling currency, for example, is the equivalent of easing monetary conditions, giving the exporter a comparative advantage similar to that of lowering the cost of money.

Interest rate differentials go a long way in explaining exchange movements. Today`s divergence in monetary policies between the US and other major economies is already universally understood and expected. The U.S. economy is expanding, albeit slowly, while its major competitors, Japan and the EU countries, stagnate. Thus, the interest-rate differential, like the US rate hike itself, should already be priced into currency values.

As expected the Fed hints of a rate increase has already had an appreciable increase in the US dollar index ( Chart 1). The index is a weighted measure of the euro, yen and other currencies including the U.K. pound, Canadian dollar, and Swiss franc. Currently, the index is at the highest level since the 2008 crisis, and it may continue to climb further should the Fed raise the Fed funds rate.

Chart 1U.S. Dollar Index

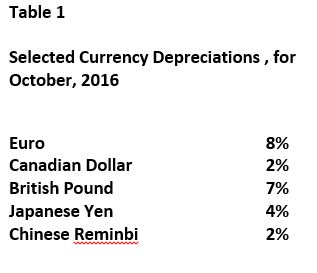

However, interest rate divergence is not enough to explain why the US dollar index is appreciating so rapidly. While most currencies may be depreciating (Table 1) in response to US monetary tightening, countries have specific conditions which further influence currency movements. It is generally agree that the correlation between monetary policy and currency values are not as strong as once believed. Let`s look at some of these conditions that currently influence currency movements.

Canadian Dollar. The Canadian economy continues to struggle as it adjusts to the decline in oil prices. Non-energy exports have not picked up the slack due to the loss of energy export revenues. As a result, the adverse terms of trade remains a real concern. Governor Poloz of the Bank of Canada admitted that Bank came very close to approving a rate cut to spur economic growth, even though it had already cut the rate twice this year. The dovish stance of the Bank is reflective of a weak domestic economy and the sluggish exports.

U.K. Pound. The pound has taken quite a beating in the past couple of months in the wake of the Brexit vote and the pending negotiations with the EU. The nation continues to run large current account deficits and remains a target for further devaluation in the wake of uncertainty surrounding these negotiations. The ramifications of the political decision to leave the EU is the overarching consideration that is hitting the pound.

The Euro. With the ECB continuing to pursue quantitative easing and generally a loose monetary policy, the euro will continue to be under pressure should the Fed raise its discount rate. As the continent endures weak growth and deflationary pressures, negative rates are becoming increasingly embedded into the banking system, thus encouraging investors to seek higher rates of return in the United States.

Japanese Yen. Although Japan runs a current account surplus, both exports and imports have dramatically fallen, a reflection of the worldwide pullback in trade flows. In addition, negative interest rates have encouraged capital outflows seeking better returns.

Chinese Renminbi. Similarly, Chinese trade flows have fallen off considerably. The renminbi has been steadily falling in value with the decline in world trade and capital outflows. As a ``managed`` currency, the renminbi behavior is more influenced by government intervention than in any other country and a weaker currency appears to be official policy.

Emerging Economies. Given that major commodities are priced in US dollars, there is widespread concern that a rising US dollar index will hurt exports from emerging economies which rely heavily on natural resource exports. Their problems are compounded by the fact that many of these economies have taken on large-scale dollar dominated debt.

In sum, taken as a whole, the major countries have undergone a currency re-alignment as the Fed signals it will raise short-term rates this year. However, the decline in world trade is probably a greater factor in understanding these currency devaluations. In this light, the Fed should be more concerned with what is appropriate policy for domestic purposes, rather than what impact a rate hike will have on the external value of the dollar.