January 2018 Empire State Manufacturing Index Little Changed

The Empire State Manufacturing Survey insignificantly declined but remains strongly in expansion. It was at expectations. Important internals were positive.

Analyst Opinion of Empire State Manufacturing Survey

I am not a fan of surveys - and this survey jumps around erratically - but has been relatively steady for the last year.

- Expectations from Bloomberg / Econoday were for a reading between 15.0 to 20.0 (consensus 18.0) versus the 17.7 reported. Any value above zero shows expansion for the New York area manufacturers.

- New orders subindex of the Empire State Manufacturing declined but remainsin expansion, whilst the unfilled orders sub-index improved and is now in expansion..

- This noisy index has moved from +6.5 (January 2017), 18.2 February, +16.4 (March), +5.2 (April), -1.0 (May), 19.8 (June), 9.8 (July), 25.2 (August), 24.4 (September), 30.2 (October), 19.4 (November), 18.0 (December) - and now 17.7.

As this index is very noisy, it is hard to understand what these massive moves up or down mean - however this regional manufacturing survey is normally one of the more pessimistic.

Econintersect reminds you that this is a survey (a quantification of opinion). Please see caveats at the end of this post. However, sometimes it is better not to look to deeply into the details of a noisy survey as just the overview is all you need to know.

From the report:

Business activity continued to grow at a solid clip in New York State, according to firms responding to the January 2018 Empire State Manufacturing Survey. The headline general business conditions index, at 17.7, was little changed from last month's level. The new orders index and the shipments index both showed ongoing growth, although at a slower pace than in December. Unfilled orders and delivery times increased slightly, and inventory levels were higher. Labor market conditions pointed to a modest increase in employment and steady workweeks. Both input prices and selling prices increased at a faster pace than last month. Firms remained very optimistic about future business conditions and capital spending plans were robust.

Conditions Remain Favorable

Manufacturing firms in New York State reported that business activity continued to expand strongly. The general business conditions index was little changed at 17.7. Thirty-two percent of respondents reported that conditions had improved over the month, while 15 percent reported that conditions had worsened. The new orders index moved down seven points to 11.9, and the shipments index declined nine points to 14.4—readings that indicated ongoing growth in orders and shipments, although at a slower pace than last month. The unfilled orders index climbed into positive territory and, at 4.3, indicated a small increase in unfilled orders. The delivery time index was 3.6, indicating that delivery times lengthened somewhat, and the inventories index rose to 13.8, a sign that inventory levels grew moderately. Price Increases Pick

(Click on image to enlarge)

z empire1.PNG

The above graphic shows that when the index is in negative territory that it is not a signal of a recession - of 10 times in negative territory (since the Great Recession) - no recession occurred. Conversely, a positive number is likely to be indicating economic expansion. Historically, when it does make a correct negative prediction it can be timely - this index was only two months late in going negative after what was eventually determined to be the start of the 2007 recession.

This survey has a lot extra bells and whistles which take attention away from the core questions: (1) are orders and (2) are unfilled orders (backlog) improving?

(Click on image to enlarge)

z empire2.PNG

Unfilled order contraction can be a signal for a recession.

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

(Click on image to enlarge)

z richmond_man.PNG

Kansas Fed (hyperlink to reports):

(Click on image to enlarge)

z kansas_man.PNG

Dallas Fed (hyperlink to reports):

(Click on image to enlarge)

z dallas_man.PNG

Philly Fed (hyperlink to reports):

(Click on image to enlarge)

z philly fed1.PNG

New York Fed (hyperlink to reports):

(Click on image to enlarge)

z empire1.PNG

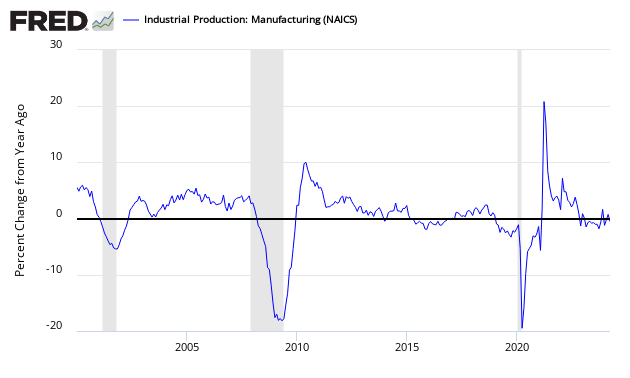

Federal Reserve Industrial Production - Actual Data (hyperlink to report):

(Click on image to enlarge)

Holding this and other survey's Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Dallas Fed survey (light blue bar).

(Click on image to enlarge)

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.

Caveats on the use of Empire State Manufacturing Survey:

This is a survey, a quantification of opinion - not facts and data. Surveys lead hard data by weeks to months, and can provide early insight into changing conditions. Econintersect finds they do not necessarily end up being consistent compared to hard economic data that comes later, and can miss economic turning points.

According to Bloomberg:

The New York Fed conducts this monthly survey of manufacturers in New York State. Participants from across the state represent a variety of industries. On the first of each month, the same pool of roughly 175 manufacturing executives (usually the CEO or the president) is sent a questionnaire to report the change in an assortment of indicators from the previous month. Respondents also give their views about the likely direction of these same indicators six months ahead.

This Empire State Survey is very noisy - and has shown recessionary conditions throughout the second half of 2011 - and no recession resulted. Overall, since the end of the 2007 recession - this index has indicated two false recession warnings.

No survey is accurate in projecting employment - and the Empire State Manufacturing Survey is no exception. Although there are some general correlation in trends, month-to-month movements have not correlated with the BLS Service Sector Employment data.

Over time, there is a general correlation with real manufacturing data - but month-to-month conflicts are frequent.

Disclosure: None.