It’s That Time Again: Q1 Earnings Preview

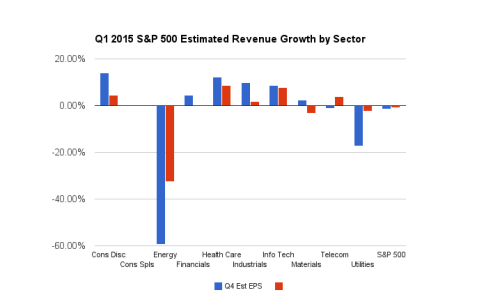

With Q1 earnings season set to kick off today, you’d have to be living under a rock not to know about the tepid expectations. The Estimize consensus is currently looking for S&P 500 profits to decline 1.5% year-over-year, this would be the lowest growth rate since 2009. Revenues are facing a similar fate, down 1% from the year-ago quarter.

Why are expectations so low?

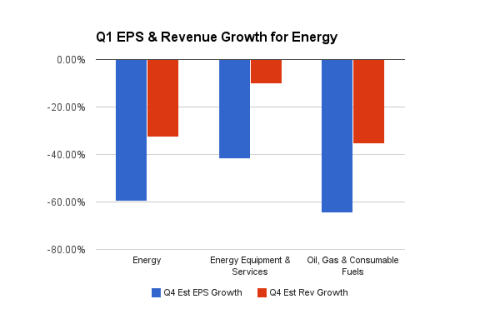

For one thing, it seems weakness in the energy (XLE) sector is finally catching up to us. Last quarter the sector saw profits decline 19%, but the benefit of lower gas prices to various other sectors such as consumer discretionary and industrials created a net positive effect for the index, with S&P 500 earnings growing 6.3% and those two sectors putting up double digit growth. This quarter, however, the state of energy earnings worsen considerably. The sector is expected to be down 59%, and while consumer discretionary and industrials are still winners for the quarter, growth in those two sectors just isn’t enough to offset energy weakness.

Sectors aside, the stronger dollar will no doubt have the largest negative impact on corporate earnings this season. The S&P 500 derives about 40% of sales from overseas, therefore relying heavily on global strength. Only 19 companies from the index have reported thus far and nearly all have mentioned currency headwinds. Some notable names include: Monsanto (MON), FedEx (FDX), Oracle (ORCL), Adobe (ADBE), Micron (MU), Costco (COST), General Mills (GIS), and Autozone (AZO). These companies hail from a variety of sectors (materials, industrials, information technology, consumer staples, and consumer discretionary), proving that the impact will be broad based as almost all sectors will feel forex fluctuations to some degree, with the exception of telecommunications and utilities which are mostly domestically focused. With that being said, there are some well managed companies that have been able to hedge against the stronger dollar, and somewhat offset its negative affect. Of the aforementioned companies, AutoZone and Adobe Systems were still able to beat top and bottom-line estimates. This season, beware of companies using the stronger dollar as a cover up for missed earnings.

Sector Winners:

While Energy is expected to be the biggest loser in the first quarter, which sectors are showing strength?

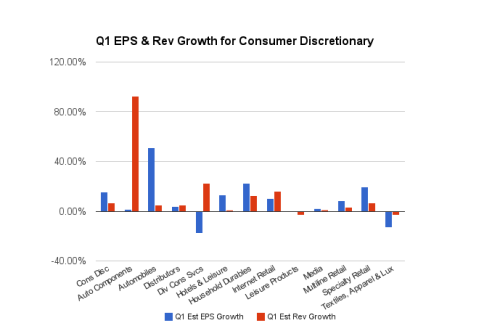

Consumer discretionary (XLY) will be one of the big winners again this quarter, with earnings growth expected to hit 15.4% and revenues of 7.0%. Despite some recent setbacks with nonfarm payrolls and retail sales, the economy still seems to be improving, and lower gas prices have resulted in elevated levels of consumer confidence. The best performing industries within the sector are anticipated to be automobiles (51.2%), household durables (22.3%) and specialty retail (19.4%). There are only three automobile companies in the S&P 500, Ford (F), General Motors (GM) and Harley Davidson (HOG), and while all are facing easy comparisons from the year-ago period, GM is really expected to take the cake with 276% profit growth. Within household durables, certain homebuilders such as Lennar are expected to take the lead, with home appliance maker Whirlpool at the top as well. Specialty retail also seems to be getting a boost from the improving housing market, with home improvement retailers such as Lowe’s and Home Depot anticipated to show profit growth of 30% and 22%, respectively.

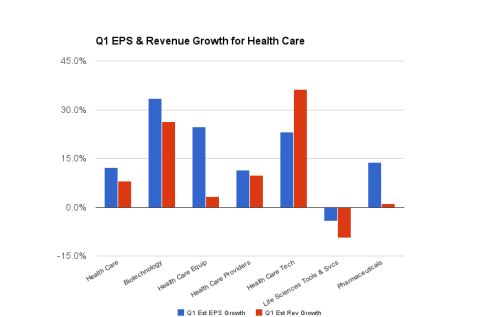

The health care sector (XLV) is on a tear again this quarter, expecting profit growth of 12.3% and revenues of 8.1%. High estimates are mainly driven by the biotech industry, which is looking for profit growth of 33.4%, in most part due to Gilead Sciences (GILD) and Biogen (BIIB). Gilead Sciences has been wildly successful over the last few quarters due to sales of its Hepatitis C drug, Slovaldi, and recently introduced Harvoni. They have penned exclusive deals with CVS Caremark (CVS), Anthem Inc.(ANTM) and UnitedHealth Group (UEEC) to carry their drugs as the primary option to patients. However, the company’s growth is starting to slow down as competitors such as Abbvie (ABBV) come to market. On the other hand, Biogen’s stock is up about 25% this year on news that an early-stage study of its Alzheimer drug showed that it slowed the mental decline of a small number of patients that had early indications and mild cases of the disorder.

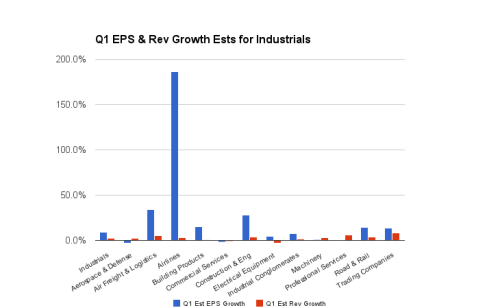

Like consumer discretionary, the industrials sector (XLI) has also seen profit growth tied to lower oil prices. The sector is anticipated to post bottom-line growth of 9.0% but revenues of only 2.4%. It should come as no surprise that the two industries expecting the highest growth this quarter are once again airlines and air freight and logistics, with earnings growth estimates of 186.6% and 34.2%, respectively. Airlines, which should pass fuel surcharge savings onto customers, have instead increased flight fares and padded the bottom-line. Airlines are expected to boost profits by at least another 11% in 2015 according the International Air Transport Association, so expect this industry to remain hot. For logistics companies like FedEx (FDX) and UPS (UPS), it should have been a no-brainer that they reap the the rewards of lower fuel costs, but losing higher fuel surcharges and battling the strong dollar has limited potential profits.

Beat/Match/Miss

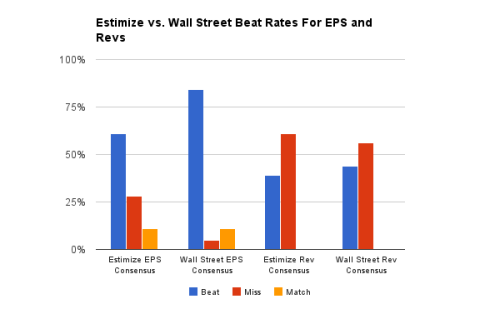

At this point only 19 S&P 500 companies have reported for the quarter, 61% have beat the Estimize EPS consensus, 28% have missed and 11% have matched. On the revenue front, 39% of companies have beat the Estimize consensus and 61% have missed. By comparison, a much larger 84% of companies have beat the Wall Street EPS consensus, 5% have missed and 11% have met, while 44% have beat the revenue consensus and 56% missed.

This week a total of five S&P 500 companies are scheduled to report, including Bed Bath & Beyond (BBBY), Family Dollar (FDO), Alcoa (AA), Walgreens Boots Alliance (WBA) and Constellation Brands (STZ). Next week the season gets into full swing with 34 companies set to release Q1 results.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.