It’s Baaaack: Q2 Earnings Season Kicks Off This Week, Could It Be The Worst Quarter Since 2009?

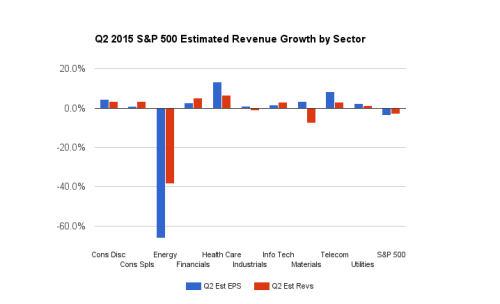

Earnings season for the second quarter of 2015 unofficially kicks off on Wednesday when Alcoa (AA) reports. Similar to last quarter, we head into the season with negative top and bottom-line growth expectations for the S&P 500. Currently the Estimize community is expecting earnings per share (EPS) to decrease 3.4% for the quarter, and revenues to decline 2.9%.

Why are expectations so low for the second quarter?

Lower Year-over-Year Energy Prices

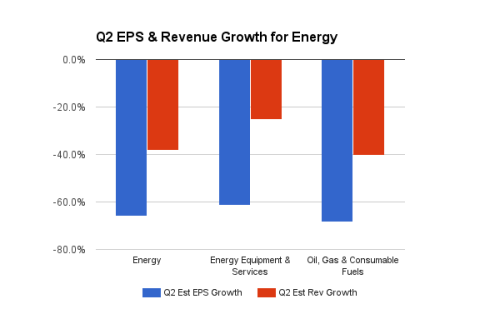

Many of the same concerns from the first quarter have carried over into the second quarter, and are responsible for the negative growth expectation. Weakness in the energy sector remains, with profits anticipated to decline 66% and revenues down 38% year-over-year (YoY). However, oil prices increased throughout the second quarter, so it is possible those growth numbers will improve once energy sector companies start to report. Brent Crude Oil ended the first quarter at $56.21 a barrel, and closed out Q2 at $62.57, up nearly 11%, with a peak of $68.47 in early May. Similarly, West Texas Intermediate ended Q1 at $49.34 a barrel and closed last week at $57.30, a 16% increase.

Despite the improvement in oil prices, the YoY difficult comparison for energy companies is still there, but that effect is likely to dissipate during the second half of the year. There are of course benefactors of lower gas prices, such as the consumer discretionary and industrials sectors, but even so, those benefits are not enough to offset weakness in energy. Ex-energy, S&P 500 growth would be closer to 3%.

The Strong Dollar

The stronger dollar will no doubt be heavily mentioned once again as a detractor to Q2 earnings, despite the fact that F/X headwinds cooled during the quarter. The S&P 500 derives about 40% of sales from overseas, therefore relying heavily on global strength. Only 21 companies from the index have reported thus far and 13 of them have mentioned currency headwinds.

Some notable names include: Monsanto (MON), FedEx (FDX), Oracle (ORCL), Adobe (ADBE), Carnival (CCL), Nike (NKE), and General Mills (GIS). These companies hail from a variety of sectors (materials, industrials, information technology, consumer staples, and consumer discretionary), showing how broad based the impact is as almost all sectors will feel forex fluctuations to some degree, with the exception of telecommunications and utilities which are mostly domestically focused. With that being said, the stronger dollar is nothing new, and many companies have figured out how to hedge against it by entering into currency swaps, localizing production etc.

The good news is, this will be the last quarter of difficult YoY comparisons due to the strong dollar effect, as the currency began to rise in the third quarter of 2014. Therefore, as Q3 2015 reports it will be compared to a year-ago quarter that also faced a strengthening dollar. The same can be said for the energy issue, as energy prices began to fall in the middle of Q3 as a result of the rising dollar.

The Greek Crisis

With currency headwinds about to even out, now a new crisis has presented itself … Greece. After the country defaulted on its $1.6B payment to the IMF last week, there have been concerns that Greece could leave the EU and potentially open the door for other countries to do the same. So are US companies concerned? Typically companies mention international events that could have an impact on earnings during their quarterly call, but thus far none of the 21 companies that have reported from the S&P 500 have mentioned Greece by name. Other countries such as China are mentioned in about half of the reports. However, close to 15% of S&P 500 sales do come from Europe, so if Greece does leave the EU and that reverberates throughout the continent, you could see those implications filter through to U.S. companies’ bottom-lines.

Higher Labor and Commodity Costs

Another issue that companies are contending with this quarter is increased costs. While violent swings in commodity prices is to be expected, extreme cost fluctuations in raw materials have been problematic this quarter, as have labor costs, which up until recently were depressed. Inflation has remained below the Federal Reserve’s 2% target for the last three years or so, and while the US employment situation has improved, wage growth has not. Despite suppressed growth for both CPI and U.S. average weekly earnings, both figures have gradually creeped up, and many companies have begun to cite increasing costs in their Q2 press releases. As the labor market continues to tighten, employers will have to increase wages to stay competitive and keep talent. We’ve seen many large retailers such as Wal-Mart (WMT), McDonald’s (MCD) and Target (TGT) commit to raising the minimum wage for all employees. As such, companies such as Nike and Lennar have mentioned increased labor costs in the second quarter, while increased commodities prices have impacted the likes of ConAgra and Monsanto. Expect this sentiment to continue as the earnings season rolls on.

Sector Winner

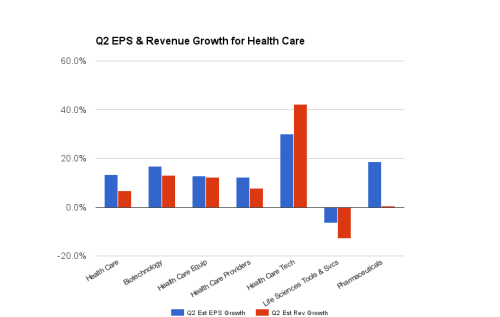

While Energy is expected to be the biggest loser in the first quarter, which sectors are showing strength?

The health care sector is on a tear again this quarter, expecting profit growth of 13.5% and revenues of 6.7%. Unlike the last three quarters, biotechnology, while expecting profit growth of 16.8%, is not the industry winner in Q2. The highest profit growth rate of 30% is expected to come from health care technology, although it only contains Cerner, followed by pharmaceuticals at 18.8% growth. Within pharma, Mallinckrodt (MNK) (53%), Mylan (MYL) (34%), Allergan (AGN) (29%) are anticipated to show the largest profit growth. For biotech, investor favorite Gilead (GILD) is only expected to grow 19% after 5 quarters of triple digit growth. New drugs tend to have their greatest impact in the first two quarters after their release, which is why most of Gilead’s strength was seen in 2014 and early 2015 after the introduction of their popular hepatitis C drugs, Slovaldi and Harvoni.

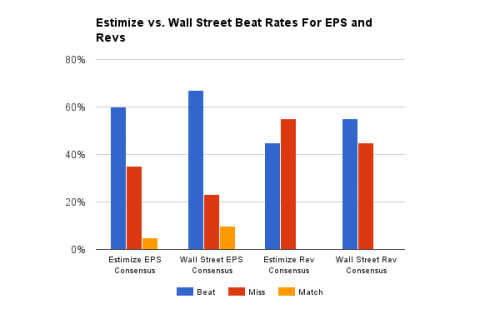

Beat/Match/Miss

At this point only 21 S&P 500 companies have reported for the quarter, 60% have beat the Estimize EPS consensus, 35% have missed and 5% have matched. On the revenue front, 45% of companies have beat the Estimize consensus and 55% have missed. By comparison, a much larger 67% of companies have beat the Wall Street EPS consensus, 24% have missed and 10% have met, while 55% have beat the revenue consensus and 45% missed.

This week starts out light, with only three S&P 500 companies scheduled to report, including Alcoa (AA), Pepsico (PEP) and Walgreens Boots Alliance (WBA).

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.