ISM Summer

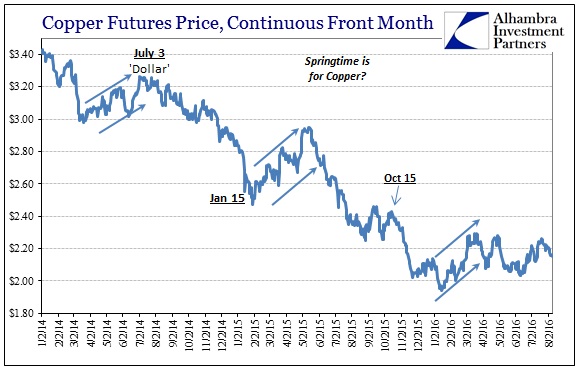

Because of the linearity that is presumed a fact of cyclicality, economists and the media continue to be shocked that what seemed like improvement one month doesn’t mean much for the economy in the coming months. And so time and again we find where conditions appear to progress and are thus extrapolated into the long sought after rebound from “transitory” weakness. That improvement, however, properly understood was nothing more than the economic unevenness that permeates every corner of the global “dollar” economy.

This stunning lack of awareness across these parameters is exposed by the ease in which the unstable nature is seen. It has become a visible seasonal pattern that the economy appears better in spring when compared to winter – but then worse in summer as compared to spring. That relative association should not be confused for a change in overall condition, but it is and has been consistently under the mainstream paradigm of linearity.

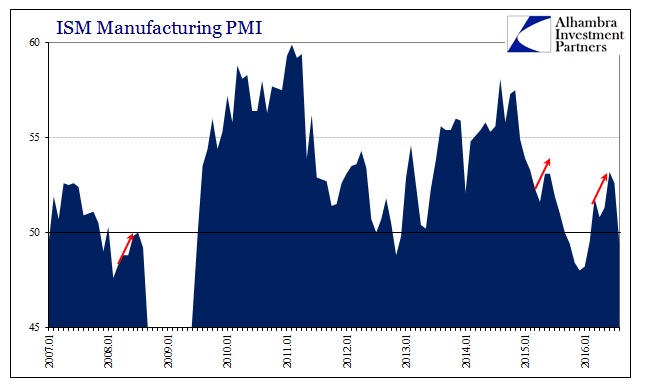

The latest “unexpected” retrenchment was today’s “shocking” level for the ISM Manufacturing PMI. Economists were expecting a mild deceleration from August’s 52.6 to 52.0. Instead, the ISM reports an overall number of 49.4 and once again on the wrong side of the assumed growth/contraction divide. New orders fell sharply, from 56.9 last month to just 49.1, while employment fell further below 50 to 48.3 from 49.4.

After falling below 50 from October last year to February this year, the index found its spring rebound, reaching a high of 53.2 in June. In especially PMI’s more than other data points, changes like these above and below 50 can be misleading. In conventional terms that is supposed to mean a meaningful shift from contraction to growth or vice versa, but in reality all it suggests is where conditions are now in relation to where they were just a short time ago. In other words, the apparent rise in the ISM index from March to June 2016 wasn’t signaling renewed and sustainable growth from here on, only that manufacturing firms were reporting that spring wasn’t nearly as bad as winter.

This was similar to 2015, where a sharp drop to start the year was also temporarily interrupted in May and June, with the PMI rising above 53 in both of those months. As summertime progressed, the ISM resumed its decline to ultimately what we saw in widespread economic weakness to start this year. So far, that seasonal pattern is being repeated right on schedule and in data points beyond the ISM or just PMI’s.

I honestly have no good explanation for this seasonal behavior except to notice it as a matter of financial conditions. When global funding appears to be much more robust, these structural hurdles (within the calendar and otherwise) are easily hidden or absorbed by monetary sufficiency. The best analogy I can use, admittedly still a rather poor one, is that of any body of water; if you were to somehow slowly empty one of the Great Lakes, for example, it would expose certain areas of the lake floor first that would otherwise be no problem for navigation. As the water level falls, so it is in terms of increasing navigational hazards revealed by the lack of water (as a clumsy but blunt metaphor for liquidity).

The lack of “dollar” liquidity and fluid function appears to be doing something similar, where natural, structural economic hurdles are left exposed in the handoff from spring to summer. It is not just the past few years of the rising “dollar”, as in financial as well as economic terms this pattern has remained constant in all the years where “dollar” conditions have been predominate in our attention as well as underlying.

Whatever ultimately the transferal between monetary cause and economic effect, the ISM Manufacturing PMI further relates that summer has unfortunately arrived. If nothing else, it is more of the same unstable economics that confounds the misleadingly singular attention to recession/not recession.

Disclosure: None.