Is There A Turnaround Play At Western Digital?

What’s the new investment theme that is beginning to permeate Silicon Valley? It’s not mainstream as of yet, but it’s bringing in great numbers and attracting attention.

I call it the “Legacy Turnaround Play.” Find an ailing technology dinosaur from the Jurassic Period (i.e. the 1990s), infuse it with new management and technology, and the shares go ballistic.

The poster boy for the strategy is none other than the former beast of Redmond, Wash., Microsoft (MSFT), founded by Bill Gates and Paul Allen.

Up until the dotcom bust, it looked like Microsoft would rule the universe forever. Almost two decades later, its Windows operating system still runs 70% of the world’s computers.

The day Bill Gates retired from active management was the day (MSFT) went ex-growth. Steve Ballmer was never more than the custodian of a gigantic legacy business that went nowhere. The shares remained stuck in the doldrums for 15 years.

Also on that fateful day the Gates Foundation sold the bulk of its Microsoft shares, investing tens of billions of dollars into US Treasury bonds.

Steve Ballmer retired in 2014, and Satya Nadella succeeded him.

Nadella possessed a vision of The Cloud that was way ahead of its time and proved dead-on correct. Since Nedella joined Microsoft, the shares have rocketed some 163%.

This has spurred a frantic search for the next Microsoft, and every legacy tech company is being put under a microscope to ascertain its possibilities.

Intel (INTC ) and Cisco Systems (CSCO ) are now in the running for “Legacy Turnaround” status, and their share prices are reacting accordingly.

Another firm that may join its ranks is Western Digital (WDC). However, the burden of proof is still on the company’s management.

Spun off from Emerson Electric Company, Western Digital was the world’s largest manufacturer of chips for handheld calculators during the 1970s, which were the cutting-edge consumer technology products of its day. When the personal computer industry showed up, it moved rapidly into hard drives.

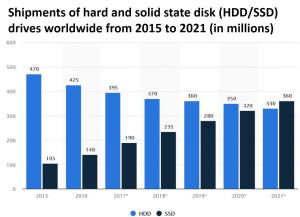

Since then, it hasn’t really done anything new, except build bigger and faster hard drives in physically smaller sizes. The problem with that approach is that the world has been moving toward solid-state storage now for years.

The hard drive is about to become one of the great dodo birds in the history of technology. Western Digital’s shares are virtually unchanged in three years, completely missing the 2016-2018 tech melt up.

Forget about buying Western Digital (WDC) for a quick-in-and out trade. HDD (Hard Disk Drive) sales are down a dreadful 5.6% YOY.

It was hard to identify a tech stock that didn’t have a phenomenal year in 2017 unless it was tainted with terrible offerings such as Snapchat (SNAP). The secular long-term growth story for technology is the crux of the bullish argument in equities.

A good chunk of Western Digital’s business is derived from the declining HDD storage industry, which is a continuing source of torment.

WDC is attempting to cross over into SSD (Solid State Drives), which is ripe for hyper-growth in tech storage. Gobbling up SanDisk in 2016 and Tegile Systems in 2017 were definitely positive steps in the right direction.

In 2014, HDD was a pristine $32 billion per year market but sunk to $20 billion by 2017.

Begrudgingly, WDC dominates 40% of the HDD market along with Seagate (STX), which also controls roughly 40% of market share.

HDD revenues still comprise the biggest portion of WDC’s total revenue.

Once that number shrinks down to 30%-35% then a resurgence in the stock could be in the cards and management can start beating the drums of resuscitation.

WDC sold off hard after last quarter’s earnings first and foremost because of the bitter tussle with Toshiba, which is mired in years of chaotic management and misled investors.

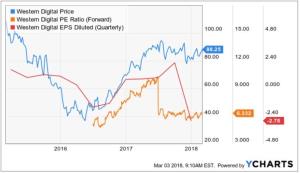

Traders dumped the stock after finding out guidance for earnings per share was between $3.20 and $3.30, down from the previous quarter of $3.95.

Making matters worse, WDC lost more than $800 million last quarter. WDC undeniably has a few dilemmas to solve.

Contrarians can argue that WDC is cheap on a PE multiple basis. However, WDC has been cheap for the past 10 years with no multiple expansion and could still be cheap 10 years from now.

This company has shown zero EPS growth. There is a difference between cheap and great value.

Client Devices revenue for the December quarter increased by 9% YOY, primarily driven by significant growth in SSDs. Their Client Devices segment was down 1% QOQ because of the heavy drag of HDD devices.

One warning sign is how management obscures revenue segments by “client devices” instead of filtering them out into separate categories in the earnings report clearly stating SSD and HDD unit sales.

Management is inherently camouflaging the HDD segment headwinds. It appears less harsh to the novice investor to group HDD weakness with SSD strength.

Data has been created at a record rate worldwide, and the value of data is increasing fueled by advancements in mobile, cloud computing, artificial intelligence and the (IoT) Internet of Things.

The intense growth in data is ramping up demand for larger and more reliable storage infrastructure. To be on the wrong side of this momentum is a death knell especially if you consider tech investors are willing to pay such a premium for growth.

Unfortunately, Western Digital utterly fails because its eggs are in the wrong basket and there is no growth story. The rhetoric is mainly a legacy business that must worry about survival even though revenues are increasing and emanating global synchronized growth.

Investors love tech but only the right tech. The wrong tech includes companies such as GoPro (GPRO), Blue Apron (APRN), or the Footlocker (FL) of video games, GameStop Corp. (GME), which have defective fundamental pillars that should be discarded right away.

The growth percolating in the pipelines is across the board but not in legacy tech dinosaurs with a deficient business model.

The guidance for total gross margin next quarter is 42% to 43%, and although quite healthy, analysts believe margin growth has peaked and further improvement in total revenue is limited.

There are better options in technology with more exciting charts and clear-cut growth stories such as Netflix (NFLX), which sports a parabolic chart and a long runway.

Tech is the poster child of growth, and any tech company not growing is not worth investing in.

There is a chance that WDC has put in a double top adding to the technically bearish sentiment.

Even if you analyze a broad swath of tech from software services such as Salesforce (CRM ) to hardware products such as NVIDIA (NVDA), accelerating users/units and higher revenue with secular growth is the constant variable.

There is an opportunity with the cost of owning stocks that are falling in a rising market. Stay out of Western Digital until positive clues surface concerning the turnaround.

And especially stay out of WDC until there is visible momentum and incontestable technical support.

Remember that great companies beat on the bottom and top line sequentially then confidently raise guidance. WDC is not a great company, not yet anyway.

The Diary of a Mad Hedge Fund Trader, published since 2008, has become the top performing trade mentoring and research service in the industry, averaging a 34.84% annual return for ...

more

Western Digital hasn't been a superstar but has clearly benefited from the tech run up. I agree with the author that there is little in the way of market catalysts to drive revenue and growth from here.

I'm not convinced #WesternDigital has any sort of competitive edge. I had thought they were making an impressive early foray into video streaming and turning TVs into Smart, all in one devices. But they were quickly eclipsed by #Roku, #Amazon, #Google and others. $WDC $ROKU $AMZN $GOOGL

I've had one too many WD hard drives fail for them to get my consumer or investor dollars.