Is The S&P 500 Now Safer Than A Diversified Portfolio?

Both the media and a wide array of financial advisers preach owning a diversified portfolio. Below, I have created a hypothetical asset mix that a moderate growth investor might employ:

30% iShares S&P 500 IVV

25% Vanguard Total Bond BND

12.5% iShares MSCI EAFE EFA

7.5% SPDR S&P Mid-Cap 400 MDY

5% SPDR High Yield JNK

5% Vanguard Short-Term Bond BSV

5% Vanguard Emerging Markets VWO

5% iShares Russell 2000 Small Cap IWM

2.5% Vanguard REIT VNQ

2.5% iShares TIPS Bond TIP

Perhaps ironically, the approximate weightings and approximate asset classifications (not the funds themselves) already exist in a well-known ETF of ETFs, the iShares Growth Allocation ETF AOR. By description, AOR intends to provide a cost effective approach for capturing growth and income gains with moderate risk. Naturally, one would presume that a combination of asset classes would be less risky than an ultra-aggressive 100% allocation to large-cap stocks alone.

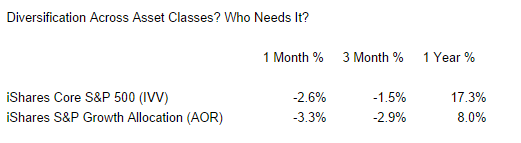

Here is a comparison of the moderate growth and income approach via AOR versus the “all-in” approach with an S&P 500 proxy like IVV:

Over a single year in which large-caps produced 17%-plus and bonds, in aggregate, offered 4.5% in total return, a 62.5% growth / 37.5% income allocation model like AOR might have garnered 12.5%. Yet AOR only served up 8%. The drag from foreign stocks, emerging stocks as well as small caps is to blame.

More unnerving, however, is the discrepancy in the shorter time intervals. Both in July and in September, the S&P 500 experienced significant selling pressure. An investment like AOR should have reduced some of the downside risk with more than 1/3 allocated to fixed income. The problem? High yield bonds and REITs struggled nearly as much as the S&P 500. Small- and mid-caps suffered far worse than the S&P 500. Meanwhile, foreign developed stocks suffered dramatic declines in both July and September. Consequently, any help that investment grade fixed income typically provides a diversified portfolio in stock sell-offs fell by the roadside.

Put another way, a combination of different asset classes designed to be less volatile and perform better in a down period actually performed worse. Over 1-month and 3-months when large-cap stocks have toiled, a diversified basket had even more trouble breathing. Specifically, AOR registered steeper declines over 1-month and 3-months than IVV.

In spite of the recent evidence suggesting that the S&P 500 has been more rewarding and less risky than a diversified portfolio, one need not look too far in the past to see a different set of circumstances. For instance, bonds, emerging markets, REITs and foreign developed stocks all added positively to account values in the last decade (2000-2009). The asset allocation mix that AOR follows would have compounded near 5% in the period, turning a $500,000 account into roughly $800,000. In contrast, the same account sitting in a S&P 500 fund would have compounded at -1.1% for a final tally of about $448,000.

In other words, buy-n-hold diversification may not always work, but neither will trusting a single stock index to solve all of your asset allocation needs. In general, AOR is still a strong contender for an ETF enthusiast’s bag. You do not have to hold it through thick and thin, however. Consider selling 1/2 of an asset in your mix if the price falls below and stays below a 200-day moving average. Give the same consideration on slimming down if a stop-limit loss order has been reached. Indeed, I minimized exposure to U.S. small caps when iShares Small Cap Value IJS hit a pre-determined stop in mid-July; IJS went on to breach its trendline later that month.

ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser ...

more