Is Sector Performance Following History?

It’s been said the more things change, the more they stay the same. And right now, the performance of stock market industry sectors is behaving right in line with that view.

During the first quarter, the total U.S. stock market (NYSEARCA: VTI) rose almost 6% in value. Driving the stock market’s strong start has been bullish momentum in ETFs tied to sectors like consumer discretionary (NYSEARCA: XLY), healthcare (NYSEARCA: XLV), and technology (NYSEARCA: XLK). Interestingly, these are the same equity groups that tend to do well during the first year of the presidential term. In other words, the current market trend is rhyming with history.

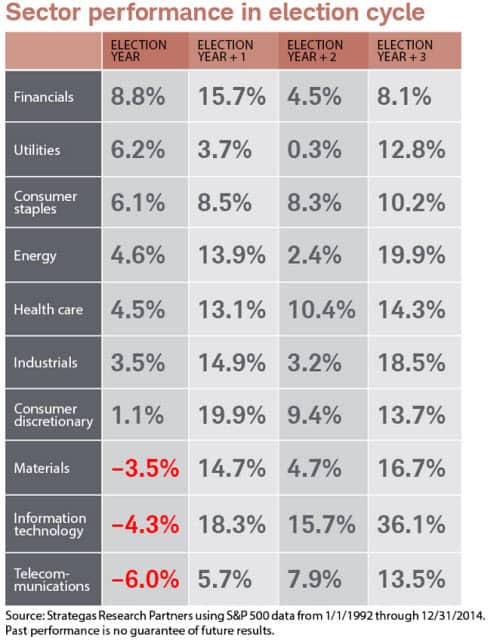

Over the past 25-years, top performing industry sectors during the first year of the presidential term are consumer discretionary, financials, and technology. Historically, these particular sectors have produced double-digit gains ranging from +15.7% on the low end to +19.9% on the top.

Thus far in 2017, S&P 500 financial stocks (NYSEARCA: XLF) and energy (NYSEARCA: XLE) have both lagged the broader U.S. stock market and aren’t following their historical script.

Energy stocks are coming off a great 2016, but this year they haven’t been able to find their groove yet. Meanwhile, financial stocks have modest year-to-date gains near +2.5%. Their performance has been capped by a number of economic factors, including the backdrop of rising interest rates in the U.S.

The first year of the cycle, which matches up with the first year of the presidential term, has historically been the most difficult climate for stocks. Going back to 1950, the S&P 500 has finished with gains just nine out of 16 times.

Instead of trying to predict future prices, investors are best served by having an adequate cushion or margin of safety within their portfolio. Why? Because when market prices finally correct – and they will – the investors who have an adequate margin of safety will be better positioned to cope with falling prices. And better yet, this same group will be in a better position to capitalize on rocky market conditions by scooping up wonderful assets that have gone on sale.

Disclosure: None

Disclaimer: Ron DeLegge has analyzed and graded more than $125 million with his Portfolio ...

more