Is Real Estate The "Sleeper Buy" For 2017?

The real estate cycle does not follow the stock market cycle.

There are times, of course, when the stocks of real estate-related firms will rise in concert with or decline as the rest of the market enters panic mode. But there have been just as many occasions in history where real estate marched to the beat of a different drummer.

In 2017, I believe the two will overlap – by which I mean we are most likely to see growth in corporate revenues and earnings, growth in workers’ wages, and an increase tax receipts, creating a fine economic revival. This would, of itself, be excellent for our selected real estate firms but in addition to the economic expansion, there are three other reasons I believe we’ll see an exceptional market for the real estate firms we find most undervalued.

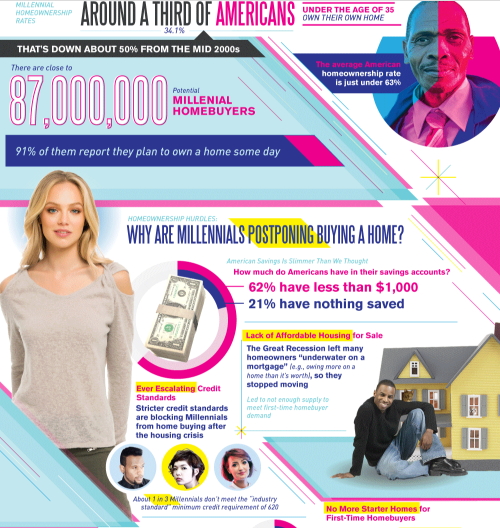

The first of these are the Millennials, the largest demographic bulge now that we Boomers are dying off at an alarming rate due to some disease called old age. Many Millennials have been quite happy to stay at home, often in the rooms, they spent their childhood in, remodeled now to give them private access and a place for more of their stuff. Others have left that particular comfort and security behind but, like most of us when we are single, prefer to rent an apartment in urban areas where there are plenty of restaurants, bars, schools and easy and cheap public transit.

Here’s the thing. Even those of us who left home at 17 to make our way and the world and didn’t marry until 35, sooner or later, will frequently want to start a family. When that happens, even we want to find good schools, a house with a backyard where the kids can play and you can say yes when they beg for a puppy which they really believe they will take care of 100% of the time until they get it. When this transition happens in large numbers, people begin leaving their apartments behind and looking for single-family homes.

We no longer own any of the multi-family REITs we recommended a couple years ago. They still enjoy great occupancy numbers – and their stock prices reflect it. We’d rather buy the shares of companies that will benefit from the demographic trend just beginning as Millennials fall in love, marry and – gasp! – move to the close-in suburbs or, if financially successful, stay in town but move to a plot or townhome of their own.

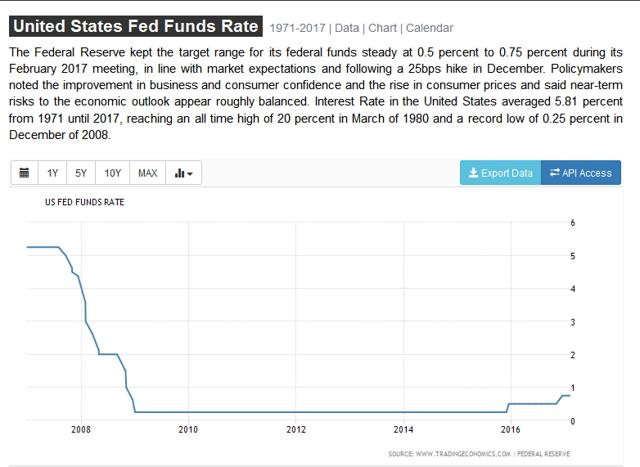

The second reason we like real estate right now are rising interest rates or, more specifically, the rate of rising rates. If interest rates were to rise 50 basis points this month and 50 more next month and 50 more in 2 more months, that would stifle this nascent opportunity we have for growth. But the lessening of an onerous and questionable regulatory regime and the creation of American jobs should mean that less money will go to feed a self-perpetuating central government and more will be used to invest in new business and buying homes and furnishings.

This is a change that takes time and involves some dislocation from government jobs back to the private sector. It’s all good in that it moves us in the good direction but it means interest rates will likely rise at a pace just fast enough to make people think “I’d better take that mortgage now while rates are still low” – and allows them to do so over the weeks and months it takes to actually close on their home or complete their business loan from the bank. Rising rates are not bad for economic growth, and certainly not bad for real estate, as long as they rise slowly. I think 2017 will be such a sweet spot.

(Click on image to enlarge)

Finally, we have a president who made a lot of mistakes in real estate early on, seems to have learned from those mistakes, and done quite well since. Having seen his own net worth and those of others being secured by real estate investing, I think he will be favorably disposed to encourage more Americans, by a different regulatory structure, to form businesses and buy homes.

I imagine his administration might also be open to ideas that would not have been acceptable in the past. An example? Rather than provide housing for the less fortunate by placing them in tenement housing, might he be willing to provide them with loans to buy their own homes? There are derelict houses in scores of cities that get boarded up, then razed, leaving debris-strewn lots. Might these provide at least some respite from dark hallways and dangerous neighbors? Who knows what innovative strategies might be pursued if we change the thinking that the poor must be treated as wards of the state?

For all these reasons -- Millennials movin’ on up, a better economy, a Goldilocks rising rate environment, and an administration willing to consider new ideas – we think 2017 will be very good for real estate. But which area of real estate is likely to do best? There are many candidates for this honor. Here are a few of ours:

Homebuilders. There are dozens of publicly-traded homebuilders serving the USA. In this case, we would favor those who build entry-level homes near the biggest urban areas. Most Wall Street analysts spend their time researching the latest numbers from the bigger firms with a wealthier clientele and more expensive homes since these buyers tend to provide the builder with a higher profit margin per home and a greater likelihood of securing financing. Such companies include Toll Brothers (TOL), D.R. Horton (DHI) and Meritage (MTH). The ones that are currently overlooked but are likely to see revenue and earnings rise as more Millennials begin buying homes and starting families include Beazer Homes (BZH), Pulte Group (PHM) and KB Home (KBH). I’m still narrowing this large field down, but we will be buying one or more of these this month. I’ll advise all subscribers of our choice.

Commercial lenders. These are the firms that lend money to developers of retail, industrial, medical and other offices, storage, distribution and warehousing firms. This is an example where many investors incorrectly assume that rising rates are bad for such firms. If we were at 10% and rates were rising to 12% I might agree. But from this depressed level, rising rates will simply be passed along to the corporate borrowers. As long as a developer is looking at a 9.5% annualized return over the life of the loan, the difference between borrowing at 5 1/8 and 5 3/8 isn’t enough to dissuade borrowing. Most often organized as REITs, two of the leading lights in this area are Starwood Property (STWD) and Ladder Capital Corp (LADR). We own both in our personal accounts.

Commercial loans are typically big loans with lots of what-ifs and how-abouts written into them. In Starwood’s case, it is managed by Starwood Capital and therefore affiliated with its home builder, regional mall operator, and Starwood Hotels. Starwood Capital is one of the largest asset managers in the world, which gives STWD access to information and deal flow that other firms may not have.

We believe Ladder is particularly well-positioned for growth here.

Medical office facilities. There are a whole lot of different ways to play the graying of the developed world. Health care is likely to be one of the most profitable. But which part of health care? Ethical drugs from Big Pharma? Cutting-edge biotech? Robotic surgery? Medical devices? All very tempting, likely to have big returns – and big risks along the way. One of our preferred choices, however, is much more boring. And predictable. And, I believe, will be as much or more profitable. You can sleep well at night and eat well the next morning with REITs that specialize in medical office facilities. As our populace ages and as we find good alternatives to our current health care system to bring more people into doctors’ offices, the REITs providing triple net lease (NNN) office space well-located on a hospital campus or very nearby will be in the catbird seat.

There are quite a few companies in this side of the NNN business. We’ve narrowed down our choices to two we believe offer the best combination of safety, geographic positioning, dividend yield and future growth. They are Healthcare Realty Trust (HR) and Physician’s Realty Trust (DOC). I will be writing an in-depth analysis of DOC in an upcoming premium post.

Lodging. As business improves, so does corporate travel. Hotels benefit. As the economy improves, people take vacations and enjoy weekend getaways. Hotels benefit. We have researched and owned a number of lodging companies’ stock over the past few years. Our most recent purchase was Sunstone Hotels, first suggested for your due diligence in these pages back in September 2016. It’s up 12% since then but I still consider it fairly priced. We’ve also owned Hersha Hospitality (HT) and Host Hotels & Resorts (HST) and sold both of them at a nice profit. HST has been coming down the last couple weeks so we may be snapping some more of it up as well.

There are too many individual subsectors of the REIT and real estate market to do justice in a single article. Stay tuned and I’ll do my best to delve into the others in the next few articles!

Disclosure: I am/we are long STWD, LADR, DOC, SHO.

Disclaimer: I encourage you to do your own due diligence on issues I discuss to see if they might be of value in your own ...

more

thanks for sharing