Is Our Exuberance Irrational?

Remember “irrational exuberance?” Those words were employed by former Fed chairman Alan Greenspan to describe the frothy equity market of the late 1990s. Recall how uncharacteristically direct Greenspan was in this 1996 speech:

“Clearly, sustained low inflation implies less uncertainty about the future and lower risk premiums imply higher prices of stocks and other earning assets … But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions …?”

Has irrational exuberance taken hold of the equity markets again? Several sentiment indicators seem to say that exuberance for stocks has certainly ballooned over the past month. Irrationally, though?

Let’s put this in perspective. The S&P 500 has now reached a bullish price objective at the 2,520 level set back in May. The thirst for stocks hasn’t been slaked, however. Take a look at the chart below which depicts investors’ appetite for high-beta stocks within the S&P 500. After slumping for several months, passions for the big movers have been reignited.

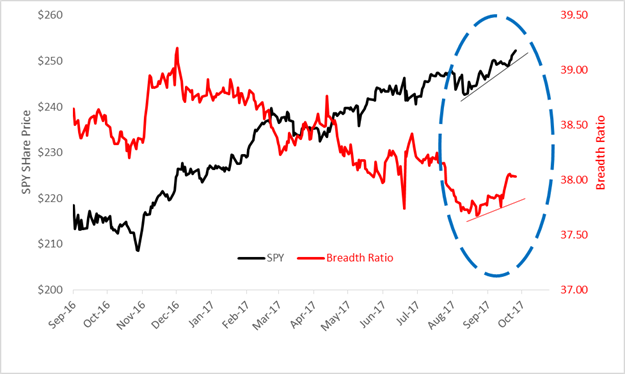

The taste for stocks has become more wide ranging, too. The S&P’s smaller stocks have been getting play, coincident with the blue chip benchmark’s breakout from a summer consolidation. That you can see in the chart of the breadth ratio below.

After a six-month climb, the risk premium is becoming thinner as well. This very metric was cited by Greenspan as a symptom of potential excess valuation.

Another premium worth noting is the yield differential between S&P 500 dividends and the ten-year Treasury note. Fear is reflected in a negative premium, that is when the dividend yield is higher than the T-note rate. Exuberance, if you will, is signaled whenever the Treasury note yield is significantly higher than the dividend rate. The red dashed line in the chart below represents the 200-day moving average of the yield premium. Over the past week, the premium’s poked above the average after a month-long slump.

From this we can see that there’s certainly an exuberance for stocks. But is it irrational? That depends on your criteria. The S&P’s attainment of its recent price objective certainly gives money-managers a reason to take some money off the table. But where else to place it? Cash? No yield there. Fixed income? At the risk of Fed rate snugging? Surely those can’t be rational choices.

Even if money managers exit from some of their positions, it’s clear that others are rushing in to fill any void. And then some.

“Nothing is perfect,” says social researcher Hugh Mackay. “Life is messy. Relationships are complex. Outcomes are uncertain. People are irrational.”

Disclosure: Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) option ...

more

LOL, Greenspan was the creators of irrational exuberance by his own actions. America suffered from it and then embraced the answer, even more of the same socialistic command economy in the form of zirp rates and QE. The Communists would be proud saying capitalism will die from within. Since when have we decided to accept a command economy with socialist monetary policy? This is the number one threat to the economy and US, not because it will crash the economy, which it will do eventually, but because it distorts economic signalling so much and distorts asset prices so badly that it is hard to fix without a catastrophic reset. In the meantime, you are increasingly stuck with an economy that doesn't work and asset prices will eventually lead to valuations that make little sense and lots of danger, however, you can't avoid not buying them because you can't make any money doing anything else. Salaries don't increase although things like housing expenses do. Businesses don't expand or increase capital spending because low rates encourage them to buyback stocks and pay dividends rather than grow in an economy that is not growing. In many cases they also buy out competitors to grow although the whole pie actually shrinks.

It is a dark world getting darker every day Yellen and socialist machinations dominate our monetary policy. That said, the stock market will do fine for now. It takes a lot to kill American capitalism. Good businesses are still surviving and profitable. It is just a sad and tiring fight right now.