Is Jerome Powell Just As Clueless To Market Risks Today As Ben Bernanke Was In 2007?

One of the greatest Fed gaffes in history was former Fed Chair Ben Bernanke’s 2007 claim that the subprime meltdown was “contained” and would not “seriously hurt the economy.”

What followed was the 2008-Crisis… the largest, most systemic crisis in 80 years.

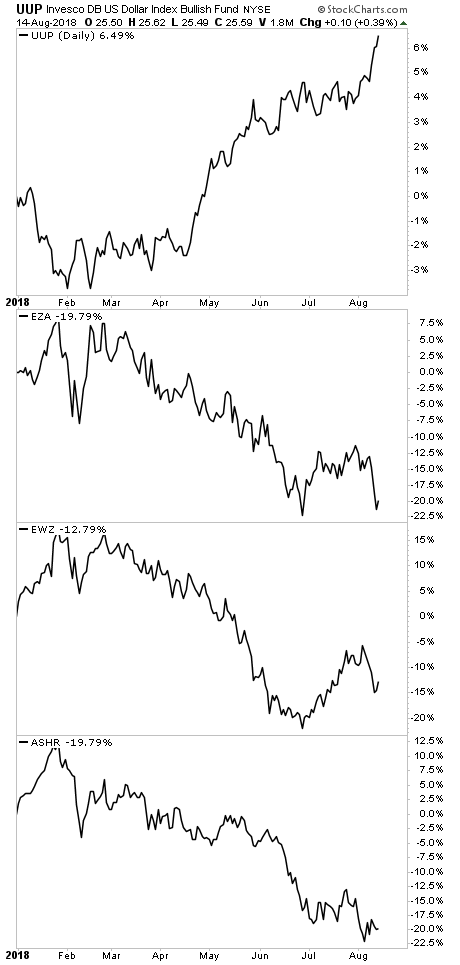

Fast forward to today, and this time around Fed Chair Jerome Powell seems to think that the Fed’s hawkishness is NOT having any noticeable effect on the markets. Bear in mind, the $USD is going straight up, and most Emerging Market stocks are in full-fledged crises, down 20%+ this year.

There are only two ways to read this.

1) Powell is clueless about the impact the Fed is on the markets and doesn’t believe this situation will spread to US stocks.

2) Powell KNOWS what he is doing and simply doesn’t care because again he doesn’t believe this situation will spread to US stocks.

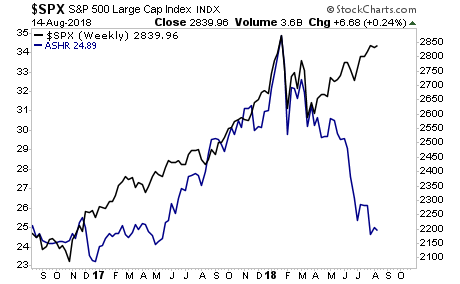

Regardless of which it is, Powell is wrong if he thinks the US is immune to global contagion. The fact is that since the 2016 bottom, global stock markets have been trading in sync based on projections of global growth.

Not anymore. And if the EM space is anything to go by, the US markets are on a VERY thin ice.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.

Powell is more concerned about bonds than about workers. He will sacrifice stocks too if necessary to keep demand for bonds up. JMO.