Is HCP The REIT Buy Of The Year?

In a recent article, Chuck Carnevale wrote on four healthcare REITs and specifically he put together an excellent thesis aimed to assist investors with forecasting and what he defined as "the key to future investment success."

We all know that investing consists of exactly one thing: dealing with the future.

However, Carnevale put together a meaningful analysis in which he explained,

…there is still a great deal of value and importance that can be gained from reviewing history. In fact, I believe it is wise and prudent to look at history first, if for no other reason than determining whether or not an individual investment is worthy of the work required before conducting a forecasting effort.

One of the REITs that Carnevale included on his BUY list was HCP, Inc.(NYSE:HCP). I agreed with the conclusion in which Carnevale wrote:

As I indicated in the introduction, forecasting the future is the key to investment success. Although the leading analysts following the company and reporting to S&P Capital IQ continue to expect a moderately low future FFO growth, HCP's high current yield and low valuation suggest very attractive future total return.

Let's Start with the Past

One of my favorite investing tools is FAST Graphs and while Chuck Carnevale is considered a gifted writer, he is (in my words) a "genius" when it comes to this essential value investing toolkit, FAST Graphs. To be perfectly honest (and Chuck has no clue that I'm writing this) I have become addicted to FAST Graphs and it is "pound for pound" one of the best investments one could make.

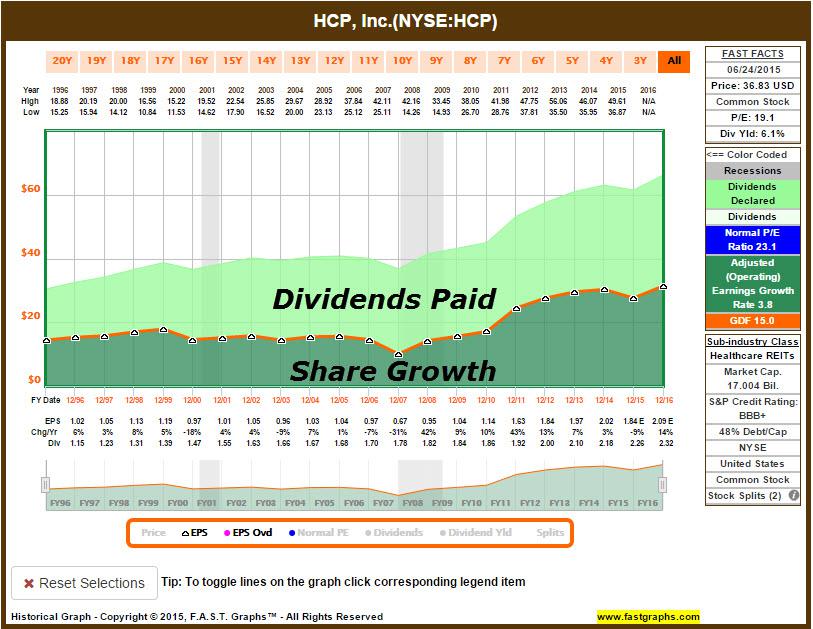

As it relates to HCP, the FAST Graph below illustrates a powerful REIT differentiated by over 30 consecutive years of dividend increases. There are just a dozen REITs that increased annual dividends during the last recession and HCP is one of just a handful of REITs that have increased through multiple recessions. Both of HCP's leading peers (Ventas (NYSE:VTR) and Health Care REIT, Inc. (NYSE:HCN)) stalled on the dividend bumps in 2009.

Click on picture to enlarge

As most would agree, dividend performance can tell us a lot about the future performance of a company and as Josh Peters with Morningstar said,

…dividends speak louder than earnings. A company's pattern of dividend payments - its dividend record - can offer valuable clues to underlying corporate performance, clues just as valuable as those provided by earnings reports and other financial data, and definitely more useful than conclusions someone might draw from looking at a three-month stock chart.

As we review HCP's past stock performance, we can see that there is a disconnect between the very predictable dividend performance and the share price. Keeping in mind that most REITs have pulled back considerably this year, HCP shares are down 17.5% (now a 52-week low).

We all know the biggest reason REIT prices are down is because of fears of rising rates; however, HCP's vessel has become more vulnerable. While the 30-year dividend history is most impressive, the market is telling us that the company is not as strong as the dividend history has demonstrated.

Yet, HCP is a battleship that has been "battle-tested" and as Carnevale suggested "nothing about the future is perfectly clear." It's time to dig deeper and determine if HCP can make it to 40-50- or 60 years of dividend growth…

The New CEO

Back in October 2013, I wrote an article, I'm Dumping Shares in HCP and Hiring Debra Instead. If you go back and read the article, you will likely sense my frustration with the unannounced termination of HCP's previous CEO, James "Jay" Flaherty III. I won't bore you with the details but I was not pleased with the board's sudden decision to boot Flaherty and hire Lauralee Martin. The board said it had "lost confidence" with Flaherty and that was also my conclusion: "I lost confidence with HCP."

It took me a while to warm up to the new CEO, in fact it took a few quarters. Martin was experienced in commercial real estate (previously led Jones Lang LaSalle US) but she had no experience as the CEO of a REIT, let alone an S&P 500 company.

In an April 2014 article, I wrote:

Lauralee has been on the playing field since October - that's just over 6 months. It appears that during that time, there hasn't been any hostility or disruption within the senior management ranks. The players seem to be aligned, and each of the 5 business units appear to be working smoothly.

Then in January 2015, I wrote:

Recently S&P lowered the credit ratings on Genesis HealthCare and HCR Manor Care citing softer margins and tightening profitability as a result of higher lease-adjusted leverage. The ongoing shift in the nursing home industry to a managed-Medicare system means patient stays are being shortened and reimbursement rates are typically lower.

Then on HCP's Q1-15 earnings call, Martin disclosed that the recent rent negotiations with ManorCare, resulting in, among other outcomes, a 12.6% reduction in rent, were accomplished without any prior knowledge that the Department of Justice (or DOJ) would intervene in a civil complaint against ManorCare.

Wow. That was not what I was expecting, especially since I had just re-established a position in HCP. I knew there was a potential there could be some volatility with ManorCare's profits but I had no clue that the REIT's #1 tenant would be facing DOJ fines.

On April 21, 2015, the DOJ intervened against ManorCare in civil actions that it submitted Medicare claims for therapy services that were not entitled to Medicare reimbursement, as they were either "not covered by the skilled nursing facility benefit, were not medically reasonable and necessary, [and] were not skilled in nature."

ManorCare's said it planned to "vigorously defend the DOJ's civil action" and that its Medicare billings are submitted to and approved for payment by the Centers for Medicare & Medicaid Services, which deemed the services in question to be medically necessary and in compliance with billing guidelines.

According to BMO Research, "there has been recent precedence with similar allegations of false claims against skilled nursing operators, The Ensign Group and Extendicare. Both of these complaints resulted in cash settlements with the DOJ ($48mm for Ensign and $38mm with Extendicare, in November 2013 and October 2014)."

How healthy is ManorCare? Given the fact that ManorCare is HCP's largest tenant, it's prudent that any investor should examine the risks. According to BMO Research, ManorCare has around $128mm of cash on its balance sheet, so if ManorCare gets hit with a similar fine (i.e. Ensign and Extendicare) the DOJ outcome would not be life threatening to ManorCare. BMO analyst, John Kim, says:

A low probability outcome (below 5% in our view) would be that HCR ManorCare loses its right to participate in Medicare or Medicaid programs. This risk was highlighted in HCP's own 2014 10-K.

In a research report, John Kim adds:

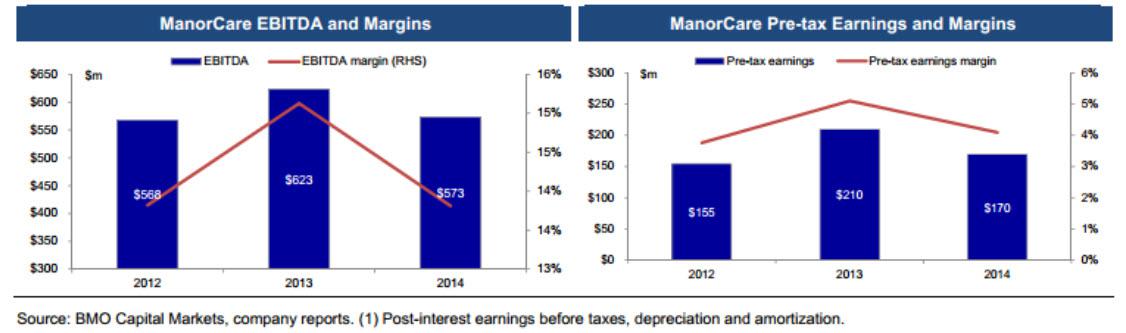

We believe a higher risk is that HCR ManorCare's revenue is affected in future periods, as its reimbursements will be more heavily scrutinized. HCR ManorCare receives a high percentage of revenue from Medicare and Medicaid: 71% from 2012-14. Additionally, HCR ManorCare's margins are already at low levels. We estimate its 2014 EBITDA margin at 13.8%, but its pre-tax earnings margin at a thin 4.1% in 2014 (given its high leverage). We estimate HCR ManorCare's pre-tax earnings turns negative with a 6-8% loss in revenues.

Click on picture to enlarge

BMO also cited another potential issue with HCR ManorCare's Facility EBITDAR Cash Flow Coverage that will likely be relatively weak post rent reduction and asset sales. At Q1-15, the Facility EBITDAR coverage stands at 0.83x (assuming 4% management fee), which HCP expects will improve to 0.99x post lease amendment and another 0.06-0.08x (to 1.05-1.07x) post asset sales.

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more