Is Gold’s Relationship With Key Market Indicators Changing?

Gold perhaps retains its reputation as the perfect store of value, especially during tough economic periods. Historically, the yellow metal has demonstrated its ability to act as a haven when stock markets are bearish. As such, gold prices tend to rally during a recession and fall during bullish markets.

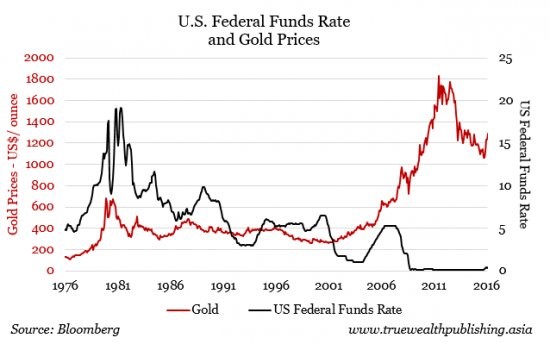

The price of gold has also demonstrated in the past that when interest rates are rising, the prices fall and vice versa. It has also shown that when the USD strengthens, against major currencies, gold prices decline.

However, the yellow metal has exhibited an unpredictable relationship with some of these indicators over the last few years, especially since the time the U.S. federal reserve started hiking rates in December 2015.

When many would have expected the price of gold to fall, at times it responded to the rate hikes positively rather than negatively as demonstrated by that little spike at the end of this 2016 chart by Bloomberg. The price of the yellow metal has also at times trended upwards even during bullish markets.

So, what does this mean for traders?

Ideally, many traders today use automated trading systems like an Expert Advisor or a forex trading simulator installed in various trading platforms such as the MT4 to trade forex or Gold. These systems use complex algorithms that are derived from historical relationships between various currency pairs and commodities to predict what might happen in the foreseeable future.

Since things seem to be changing, these systems might need regular upgrades now that the markets are evolving at alarming levels rendering past correlations unreliable. As such, if you are going to use an Expert Advisor or a forex simulator to trade, then it is paramount that the system is updated to mirror market changes. These changes are becoming difficult to capture because there is too much hype that almost seems to overshadow fundamentals.

So, what are some of the items to consider when trading gold?

According to analysts, the price of gold is now more reliant on the strength of the USD than what the Federal Reserve does with interest rates. Furthermore, trading activity in the gold market has also been affected by the emergence of crypto coins, which seem to be taking the currency markets by storm.

The leading cryptocurrency, Bitcoin recently smashed past the $8,000 level, setting a new all-time high. At the time of this writing, the world’s most valuable cryptocurrency with a market cap of $137 billion was trading at about $8,230 per coin. Many are not quite sure where to classify Bitcoin, with some referring to it as having an identity crisis between digital gold and cash.

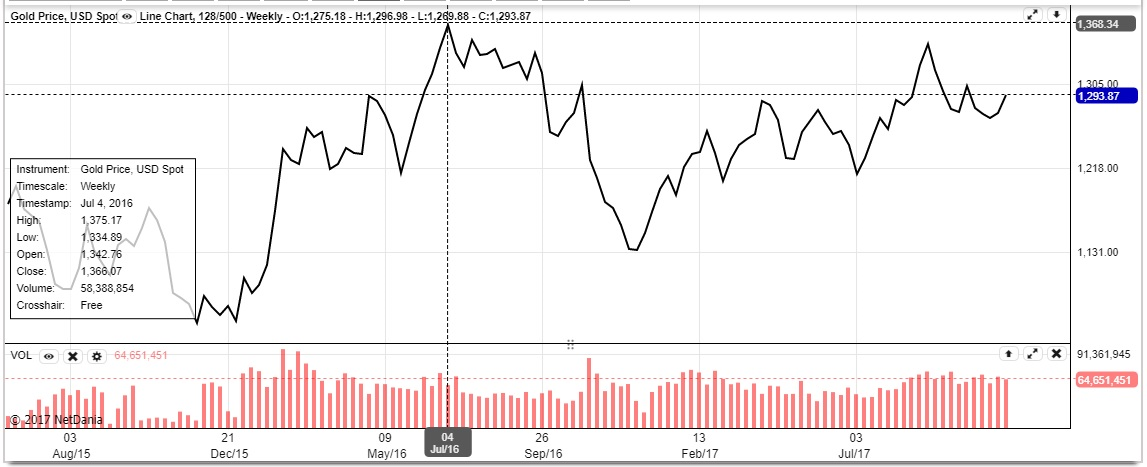

Bitcoin’s recent rally, especially during the last three to four months appears to have coincided with a significant pullback in the price of gold. In July, the yellow metal traded at about $1,350 but it has now fallen to trade at about $1,275.

(Click on image to enlarge)

This decline might not be as significant as the bitcoin price rally (mind the market hype though), but analysts believe that some investors have divested some of their gold holdings to invest in the bitcoin bubble.

Therefore, there is a genuine concern amongst gold investors on whether the yellow metal is still the preferred store of value. Some predict that Bitcoin could take that slot in the foreseeable future given its market changing influence.

However, this is not the first time that gold is being tested for its haven status. We had the industrial age come and go and internet boom of the 1990s has also come and gone, but gold has for much of the part still been the preferred store of value when markets crashed. It might take some investors a while before they can retreat to the safety of the yellow metal, but history dictates that they eventually will.

Conclusion

In summary, the yellow metal may have experienced some periods of high unpredictability, but in the long run, gold always trends upwards with no major crashes as witnessed in other markets.

Its changing relationship with some major economic indicators might yet be due to the fact investors are slowly ignoring fundamental indicators and investing in the moment to capitalize on the market hype.

And even as bitcoin threatens to take over by becoming what some are referring to as digital gold, we will have to wait and see how it will embrace the test of time.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more