Is Container Store Group Going To Disappoint Investors Once Again? Here Is What To Expect From Tomorrow’s Result

The Container Store Group (TCS) reports its FQ1 ’15 results after market close on Tuesday. Wall Street is predicting a large fall in EPS QoQ to reach a negative value of -$0.05 and a revenues number of $203.5M. The Estimize community are expecting EPS of $0.00 and revenues to come in at $196.64M.

Since debuting on the New York Stock Exchange in 2013, The Container Store’s share price has fallen circa 54.34%. A major concern for investors is that the retailer has struggled to stimulate sales growth as competitors offer discounts to steal market share. Management have recently announced a strategy in which they aim to capitalize on social media to drive sales and to also offer financing arrangements and in-home consultants as a way to differentiate themselves from their competitors.

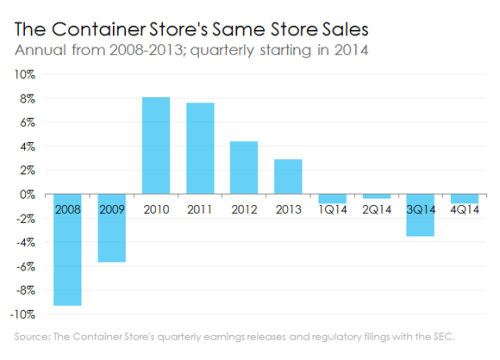

Despite management’s optimism, investors are cautious leading into the upcoming result for a number of reasons; rigorous cost cutting by competitors, a strengthening US Dollar and poor weather conditions have all limited the company’s ability to increase same-store sales QoQ. Disappointing same-store sales growth is possibly the greatest concern for investors leading into Tuesday’s result. During FQ4 ’14, The Container Store reported a negative same store sales of -0.8%. If the result on Wednesday delivers another negative same-store sales growth figure, it will mark the fifth consecutive quarter of negative growth.

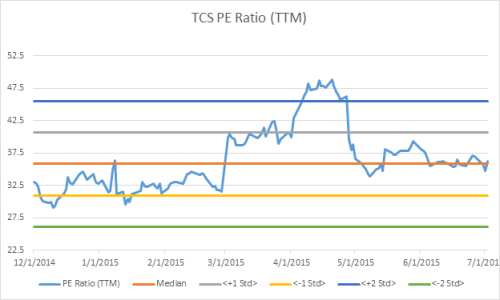

With expectations so low for the upcoming report, any positive surprise could have a material impact on the company’s share price. This report provides an opportunity for management to deliver a better than expected report and supply investors with some optimism. The Container Store is currently trading on a PE multiple (TTM) of 37.34X earnings which is near its average of 36.62X.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.