Investors Don’t Care About Great Earnings

Earnings Season Has Been Great But Investors Sell Anyway

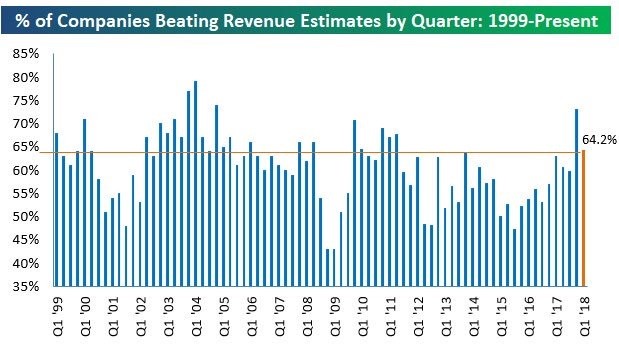

One of the major themes heading into this earnings period was that the estimates were extremely high, making it tough for them to be beaten. The hope was that if earnings estimates were beaten more often than average, the market would break out of its recent phase of increased volatility. The S&P 500 has had two lower highs since the peak in January even though earnings have been better than expected so far. The worry was that the bar was too high since estimates started the quarter growing 17.1%; the estimates hadn’t been lowered like they usually are. That worry was unfounded, yet stocks haven’t reacted positively. Furthermore, the worry that earnings improvements would come from the tax cuts while sales were weak was also unfounded. As you can see from the chart below, the percentage of companies beating their revenue estimates is 64.2% which is near the long term average. That’s impressive as sales estimates have done nothing but go up in the weeks leading up to earnings season.

(Click on image to enlarge)

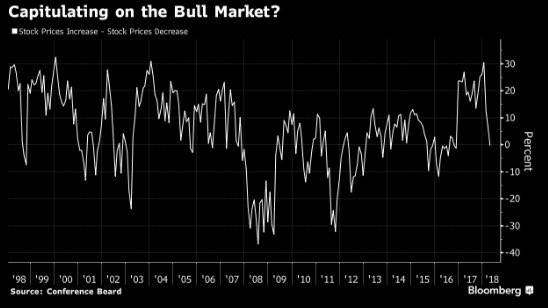

The trend in this earnings season has been that most firms beat estimates and then their stock is stable or drops. If a firm has a bad quarter, its stock gets destroyed. I don’t need to reiterate the old firms which I’ve already discussed, because there are new firms everyday which fit in this category. I will review two great reports later in this post which saw investors flea their stocks. As you can see from the chart below, the conference board survey shows retail investors have become much less bullish on stocks in the past few weeks. It takes unrelenting negative sentiment to ignore great earnings since that’s supposed to be how investors value firms. Investors have become jittery due to worries about tariffs and rate hikes. It’s true that the Fed will become a problem in 2019, but looking at individual firms’ great earnings should trump the worries. It’s reasonable to assume we’d be in a bear market without these fantastic reports.

(Click on image to enlarge)

Caterpillar Reports Great Results & Raises Guidance

Caterpillar led the market lower in the afternoon, but that’s not how the trading day started. Caterpillar reported $2.82 in EPS which beat the expected result by a wide amount. Expectations were only for $2.13. Revenues were $12.9 billion which beat the estimate for $12.1 billion. Not only did it beat results, it raised guidance for 2018 by $2. Now it expects $10.25 to $11.25 in EPS. That’s much better than the consensus for $8.39 to $10.60.

Caterpillar was up 4% at the beginning of the day, but it closed down 6.2%. That’s a huge negative when reviewing technical analysis. It’s a 10.4% drop from 10:00AM. Caterpillar is an interesting stock because of the action. In 2016 the stock was up even though bad earnings reports were coming out. Investors knew the cyclical name was putting in a bottom. Now when great results are coming out, the stock is falling. It’s down about 15% from the peak in January. Because of the slowing economy and fears of a trade war, it’s not surprising to see this name rolling over. This is a stock you buy when the PE multiple is high (earnings are low) and sell when the PE multiple is low (earnings are high). The PE multiple doesn’t get that high in expansions because investors know that these profits aren’t sustainable.

As you can see, the action is a leading indicator and the earnings are a lagging indicator. The surprising aspect of earnings season for me is that the entire market is acting like Caterpillar. For example, Netflix stock went up after it reported and now is down 8.22% from its recent peak. There are certainly reasons to sell Netflix as it is expensive, is going to need to spend a lot on content to keep its subscribers happy, and has negative free cash flow. However, this decline is about a sentiment shift as investors take profits. To be clear, one negative fundamental catalyst which occurred this week is the firm announced a $1.9 billion junk bond offering which is its biggest round ever. However, it’s debatable how surprising that was. My point about sentiment still stands.

United Technologies Also Beats & Raises Guidance

The other major manufacturing and industrial firm to report great earnings and see its stock fall is United Technologies. The EPS was $1.62. It was $1.77 on an adjusted basis. This beat estimates for $1.52. Revenues were $15.24 billion which beat estimates for $14.64 billion. The guidance was for adjusted earnings of $6.95 to $7.15 which was above the previous guidance of $6.85 to $7.10. Revenue guidance was raised from a range of $62.5 billion to $64.0 billion to $63 billion to $64.5 billion. Just like Caterpillar, the stock opened up and closed lower. The big difference is the volatility was lower. It opened up 2.4% and closed down 1.1%. That’s a 3.48% move lower.

Earnings Estimates Move Up Slightly

For many years in this bull market, stocks have moved up while earnings estimates have fallen. This year, stocks have fallen while earnings estimates have moved up. I expect the earnings estimates for 2018 and 2019 to fall throughout the year except during earnings season. Since firms are beating estimates, we’ll see the earnings estimates move up slightly. $174.44 in earnings in 2019 would be fantastic. The current S&P 500 multiple on that is 15.1. Stocks will be cheap if they don’t move up in the next 12 months and those results are hit. I think the reason stocks are falling is because investors don’t believe the optimism. They think a trade war, the end of the business cycle, and quicker rate hikes can push down those earnings. Some of the fears are warranted which is why the trading action is fair. I have been wrongly bullish because I figured the present day results this quarter were enough to push off worries about the future. Clearly, they haven’t yet.

(Click on image to enlarge)

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more