Investment Outlook August 2016

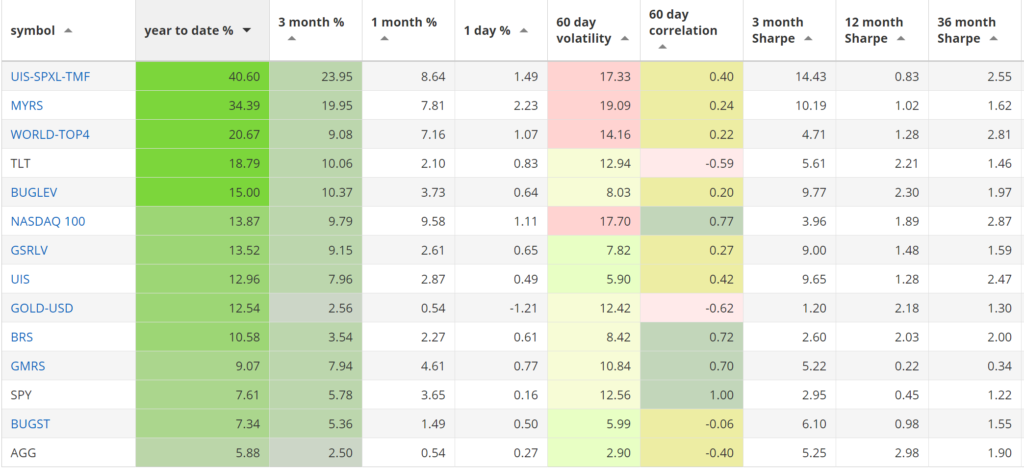

Our top year-to-date strategies:

- The Leveraged Universal strategy with 40.6% return.

- The Maximum Yield strategy with 34.3% return.

- The World Top 4 with 20.6% return.

SPY, the S&P500 ETF, returned 7.6%, year-to-date.

News:

- Our in-house software is available for licensing to professional clients.

- We are looking for registered investment advisers and wealth managers to partner with.

Market comment:

Sentiment across mainstream media remains cautious despite the S&P500 index breaking to a new all time high, on July 8th. Many investors continue to perceive both the S&P and Treasuries as overpriced and due for a correction. Increased geopolitical risk includes the recent coup attempt in Turkey and a highly unstable environment in Syria. Europe has somewhat recovered from the Brexit shock only to find itself in a new controversy over troubled Italian banks. The ECB is continuing the controversial path of negative rates policy and widespread corporate bond purchases. Increasingly low yields have many wealth advisors prepare their clients for an era of lower future returns while they issue warnings of increased volatility. Short term traders remain baffled at this somewhat ‘unresponsive’ market, where neither the Turkey failed coup or the news from Italy have managed to ‘spike’ the VIX, which has steadily crawled down to a low 11.8.

And yet we are enjoying a wonderful year. Our top two strategies continue to provide handsome returns: 34% for MYRS and 40% for 3x UIS. Our average return of all our strategies is 15.8%.

July was most kind to our Nasdaq 100 strategy as it recovered 9.5% from a recent correction. It is up 13.8% for the year. Our current leaders, the MYRS and 3x UIS strategies continue on to higher profits with July returning 8.6% and 7.8% respectfully. The World Top 4 strategy follows with 7.1%. The BUG leveraged added 3.7% and is up 15% for the year. Our core conservative UIS is at a respectable 12.9%. Looking at 3 month Sharpe ratios, we get a similar picture: The winners in risk adjusted performance are the UIS strategies, the Maximum Yield strategy, the BUG strategies as well as our Global Sector Rotation Low Volatility strategy (GSRLV).

As we enter August the market seems unfriendly and difficult to predict. Although we cannot (and will not) predict future price action, we do know that U.S. elections tend to favour markets so we would try to participate in this market early on. With our strategies having allocations to defensive assets (gold, domestic and foreign bonds) as well as growth assets, we can participate in the current market and let the strategies pick out the winners and balance out excessive downside risk. Our favourite strategies this month are UIS, the BUG, BRS and GLD-USD as a diversifier.

QuantTrader now available for licensing.

QuantTrader is our proprietary software that we use to run and test our strategies. It was originally developed by Frank Grossmann for his own personal use. It is an intuitive tool meant for professional traders, advisers and wealth managers. Although built in pure C++ it has a very simple interface suitable for client viewing. It runs all Logical-Invest strategies and can provide strategy signals on demand. More advanced users can easily tweak strategies by adjusting parameters as well as using their own lists of stocks/ETFs. Users can also create a strategy to allocate across LI strategies by treating our strategies as ETF themselves.

Logical Invest, July 30, 2016

Strategy performance overview:

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)