Investment Managers Go "All In" On Equities

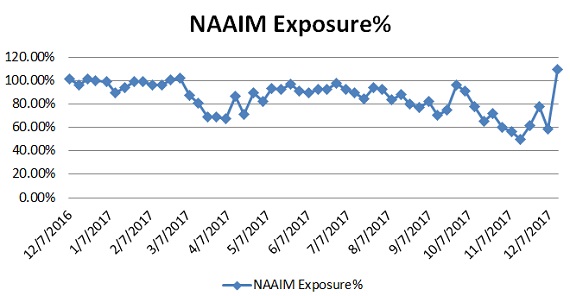

The National Association of Active Investment Managers (NAAIM) Exposure Index represents the average exposure to US Equity markets reported by NAAIM members. The blue bars depict a two-week moving average of the NAAIM managers’ responses.

As the name indicates, the NAAIM Exposure Index provides insight into the actual adjustments active risk managers have made to client accounts over the past two weeks. The current survey result is for the week ending 12/13/2017. Third-quarter NAAIM exposure index averaged 79.40%.

Last week the NAAIM exposure index was 58.42 %, and the current week’s exposure is at 109.42%. Money managers have been sitting on stockpiles of cash over the past month. Last week investors got the signal to go all in with Fed chairperson Janet Yellen indicating a dovish stance in her last fed meeting and the Republicans moving even closing to passing business friendly tax legislation.

You can see in the updated graph below the NAAIM Exposure Index exploded to the highest level in years as money managers dumped all the idle cash back into equities. The Exposure Index should remain elevated because money managers don’t want to show a lot of cash on the books for year-end reporting especially with the market at all-time highs.

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to ...

more