International Earnings Seize The Day

Let’s continue to look at this earnings period because it will direct stocks for the next few months unless North Korea and the debt ceiling bring new headline risk. As you can see from the chart below, the firms that had more international exposure had better revenue growth and margin expansion (their profits showed even more growth). International firms had 1.3% more revenue growth than domestically oriented firms and had 5.5% higher earnings growth. I think this is the start of a new trend because the dollar is weakening. International firms have outperformed domestic firms all year as the equity market correctly priced in the dollar weakness.

The best representation of this bifurcation is the difference between the S&P 500 and the Russell 2000 performance. The Russell 2000 is only up 2.74% year to date while the S&P 500 is up 10.14% year to date. Some bears will claim that the small caps are forecasting impending doom, but part of this underperformance is because they rallied after Trump’s election as they expected regulation and tax cuts. From November 3rd to December 30th, the Russell 2000 was up 17.31% as regional banks skyrocketed. This change is partially sector rotation caused by outperformance and partially disappointment on Trump’s agenda not getting passed.

(Click on image to enlarge)

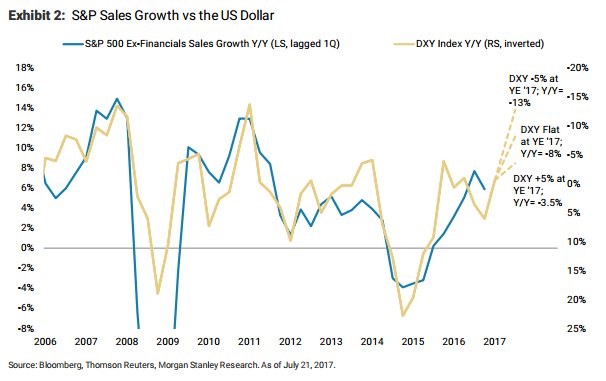

The chart below explains how the weakness in the dollar directly leads to sales growth. The weakness in 2015 was caused by the strengthening dollar which helped push oil prices lower. Economic weakness results from and causes the dollar to increase. It’s like the analogy, ‘which came first, the chicken, or the egg?’ It depends on the circumstance. If you can predict where the dollar will go, you can predict earnings results. However, it might be necessary to predict monetary policy, fiscal policy, and global economic growth to get the value of the dollar which is tough. I think the dollar will fall in the next few months because of the strengthening emerging markets. Their economies are rebounding as trade is improving. Brazil might be able to end its recession if it can fix its political issues. Some worry about the country getting pension reform, done but I think the bar is much lower. If it can simply get stability at the top, avoiding every politician which gains power running into a scandal, then the economy will take care of itself.

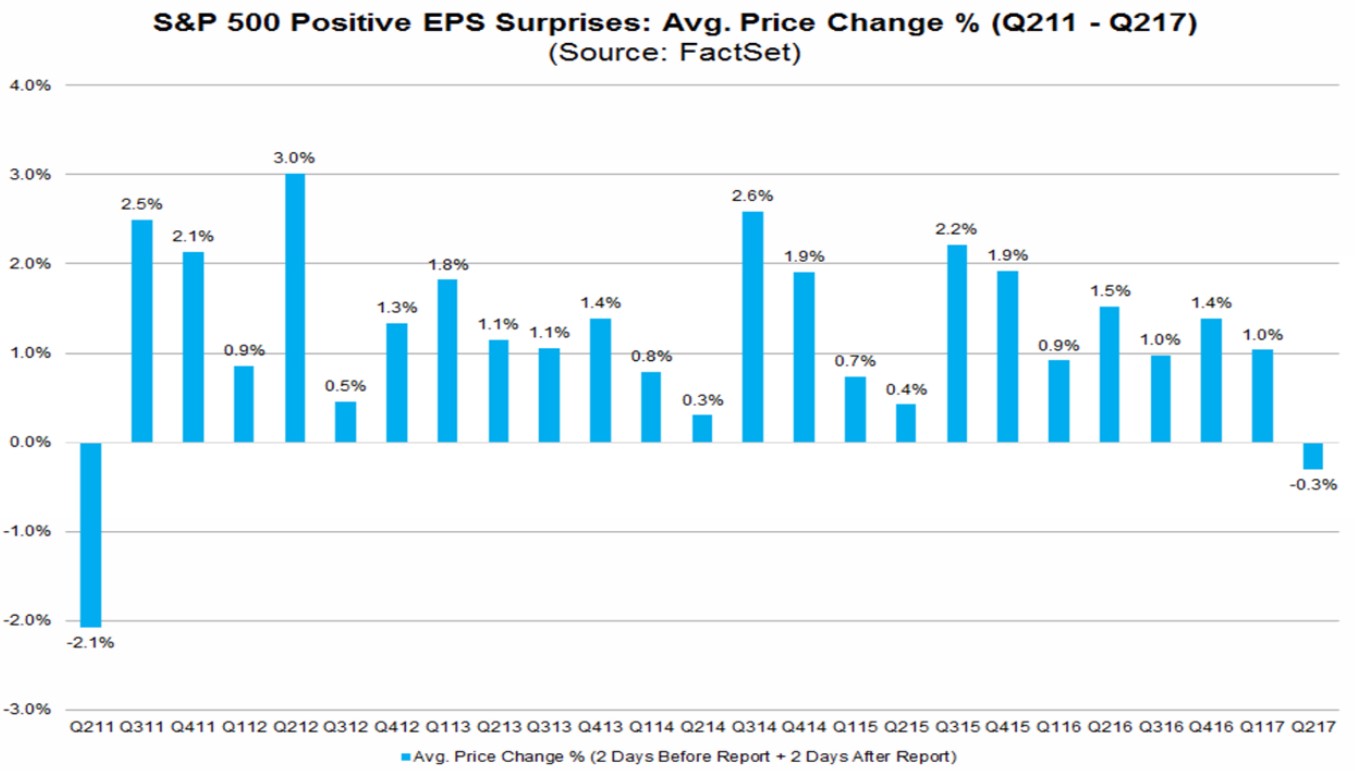

We reviewed previous data about firms beating earnings estimates while falling. The chart below is separate data from FactSet which shows that stocks which had positive surprises fell in the two days leading up to the release + the two days after the release for the first time since Q2 2011. This chart doesn’t look nearly as scary as the chart which showed the first decline since Q2 2000. That’s why I wasn’t quick to panic about the possibility of another 2000 crash. There will always be similarities between various market periods, but a lot of this is noise. The takeaway is that some investors, particularly tech investors, got overzealous. You can see that in the averages as there hasn’t been a 5% correction since last year. I’m sure many bulls would rather see a pause in the rally instead of a sharp correction.

Selloffs help investors get in at lower prices, but the positive publicity of a rising market gets more investors to take the plunge. That’s human nature. Often, I discuss how the increase in lending standards are responsible for the decline in the home ownership rate. However, there is also a bias against buying a house because of the recent crash. Personally, I’m looking at houses and I hear people discuss the downside to doing so. If we had this discussion 12 years ago, everyone would say to buy a house. Now everyone is discussing buying stocks. These trends don’t go away easily, but when they do a lot of people get burned.

(Click on image to enlarge)

We’ve discussed that one of the reasons why the market hasn’t responded to a great Q2 is because Q3 earnings estimates are falling like a rock. The chart below details the fall as analysts have shaved over 50 cents off their estimates for Q3 in the past few weeks. The results will likely beat expectations, but they probably won’t meet the expectations set in 2016. There would need to be about a 4.5% beat on current expectations to match the expectations for $34.50 in earnings. Judging by the trend, there’s still probably more room for it to fall which is why I’m skeptical about it matching $34.50. The sector which has taken the biggest hit in terms of estimate revisions is energy. On June 30th, energy was expected to see 157.3% growth and now it’s only expected to see 105.5% growth. FactSet has S&P 500 earnings only growing 5.2% in Q3 which is a year over year slowdown in the growth rate as FactSet is showing there was 10.2% growth in Q2. The expectation was for 6.4% growth. That’s closer to 5.2%, but, as I said, the revisions will probably fall a bit more. It’s also possible that the earnings beats aren’t as high as last quarter since the aggregate earnings surprise percentage came in above average in Q2. It was 6.1% above expectations which is higher than the 5-year average of 4.2%.

(Click on image to enlarge)

Conclusion

We’re seeing two countervailing trends which I have discussed this year come to fruition. Firstly, the year over year earnings growth rate will slow in Q3 compared to Q2 because of energy. Secondly, the weak dollar will stymie any weakness as it improves sales growth. Don’t get too scared about firms not rallying on earnings beats. I would only get worried if Q3 earnings come in close to expectations instead of beating them. If that were to happen, stocks would fall more that 5%. It’s tough for firms to miss expectations because they are usually lowered before the reports come out. That’s the charade Wall Street has gone through this cycle. FactSet has S&P 500 earnings growing at 11.1% in 2018. That’s doubtful as the first half will have tough comparisons. However, I wouldn’t want to make an outright prediction because it’s far too early. We’ll have to see how strong the rebound in global trade is first.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more