Interest Rates At Key Support Levels…

(Click on image to enlarge)

The 10 year US treasury bond interest rate is the benchmark for fixed income. Over the last 12 months, interest rates reached a generational low of 1.33% in July 2016. They rallied sharply post-election, almost doubling to 2.62%, on the expectation of higher growth and inflation. And have since traded sideways to lower over the last few months. Today the 10 year rate has declined back to 2.14% as I type this. However there is a confluence of support here that could potentially provide the next leg up in rates.

The chart above shows the price action. The support zone is a combination of the 38% retracement level of the rally off the 2016 lows. There is also an open gap from November 10th just a few ticks below. The support zone comes in between 2.11% and 2.13%.

I’ll be watching these levels carefully over the next few weeks. If it holds, I would expect a move higher in the vicinity of 4% (where I believe the real rate of interest should be – discussed below). If it fails, we still have the nice round number of 2%. But much time spent below that puts the uptrend in serious jeopardy.

(Click on image to enlarge)

This decline in long term rates has flattened the yield curve to its lowest levels in 8 years. It’s something the Fed must consider as it begins normalizing monetary policy, as an inverted yield curve has been a precursor to most recessions and bear markets post WWII. At this point it’s not anything to worry about. But at some point monetary policy will become restrictive enough to expire the business cycle. We are not anywhere near that point yet.

(Click on image to enlarge)

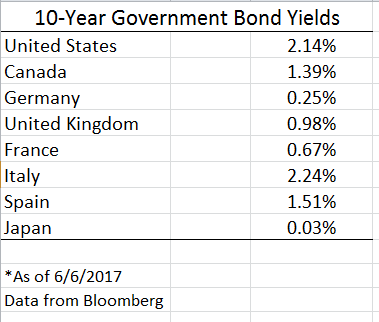

We must also take the global fixed income picture into context. US rates are at historic lows, but a case can be made that they still have value when taken into context with the global picture. Germany’s bonds are yielding 0.25%, and Japan is 0.03%. The only comparable yields in the developed world are Italy and Spain, both of which are currently struggling with double digit unemployment and shaky banking systems.

So what happens if interest rates continue to rally? Many have cited this market rally as being a bubble ready to explode at any moment. The problem with historical valuation methods (price/earnings, price/sales, price/cash flow, etc) is they don’t take into account for inflation and interest rates.

It’s true that trailing and forward price to earnings ratios are on the high side, however inflation and interest rates are also lower than at anytime in at least the last 20 years.

There is no perfect formula here, but I personally like using the equity risk premium as a gauge of valuation. The equity risk premium takes the earnings yield of the S&P 500 and it subtracts it from the interest rate of the 10 year.

Currently the earnings yield is 5.54% (forward S&P 500 earnings of 135 divided by the current price level of 2439), while the 10 year rate is 2.16%. This means the equity risk premium is 3.38%, which makes stocks still attractively valued even at these high levels. It also means that investors are getting compensated for the extra risks they are taking in stocks compared to the relatively risk-free rate of US treasuries.

Let’s assume the 10 year rate rallies to 4.00%, which accounts for 2% GDP growth and 2% inflation. The equity risk premium would still be positive at the current earnings yield. At some point interest rates will rally high enough to make current valuations high or even extreme. And corporate profits could decline and make the earnings yield on stocks less attractive to fixed income.

I do think there may be a bubble in corporate fixed income (and sovereigns too for that matter) as companies take advantage of low rates. But that’s probably not a near term concern as long as GDP growth and inflation remain subdued.

The key is to understand what purpose fixed income serves in your portfolio. If your looking at fixed income to continue the stellar performance of the last 20-30 years, your probably going to be disappointed going forward. You’ll probably be better off in stocks if you can handle the risk.

Most people can not stomach the volatility of being 100% in stocks. If you find yourself reacting to stock market volatility, then you know you’ve taken on more risk then you can handle. In this case bonds still serve a quality purpose, and you shouldn’t be scared out of owning bonds even in spite of the potential for higher rates in the future.

Disclosure: None.

Nothing on this article should be misconstrued as investment advice. Trading and investing is very risky, please consult your investment advisor before making any ...

more