Insider Buying & S&P Intrinsic Value

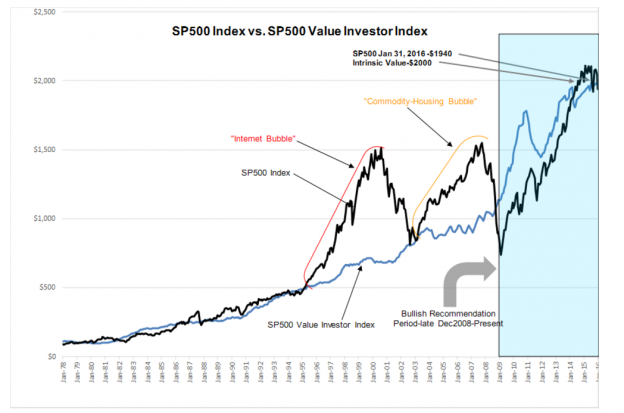

The SPY is ~90 pts below intrinsic value….

“Davidson” submits:

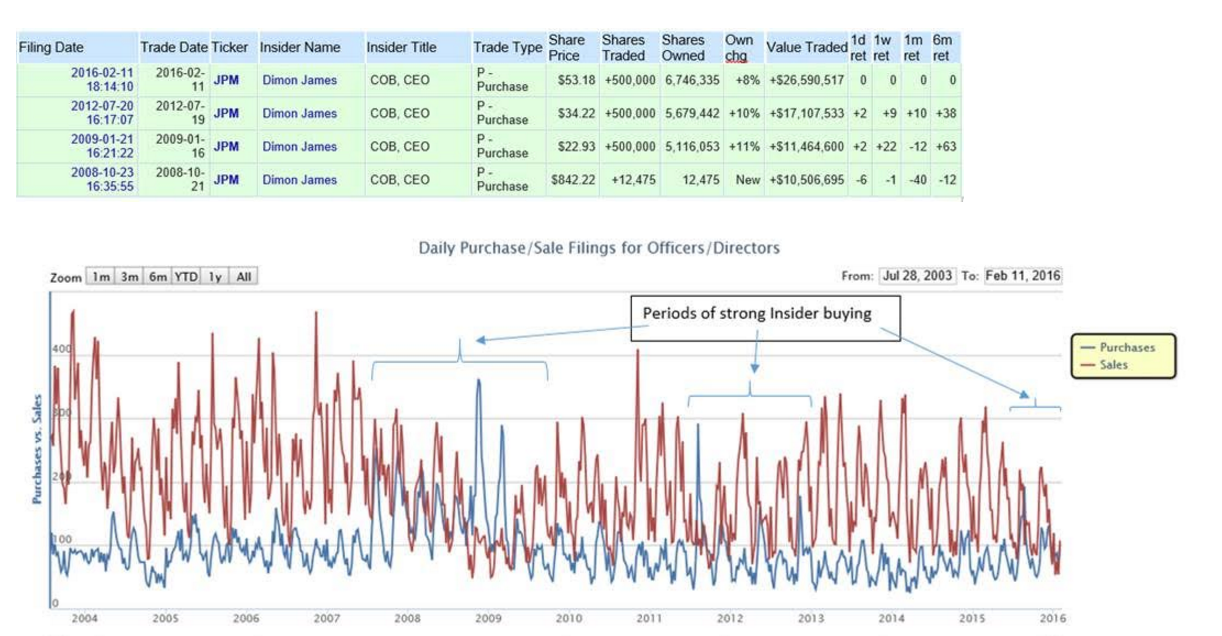

Corporate insiders in general have a better sense of when their share prices are undervalued relative to future business prospects. The chart at openinsider.com shows that when markets have compressed prices for whatever reason, corporate officer outright buying of shares (not option exercises) increases dramatically relative to selling. Three recent periods reflect this, mid-2007 to mid-2009, fall-2011 to earlt-2012 and mid-2015-to Present. Each of these periods coincide with periods when the SP500 has traded below the SP500 Value Investor Index just as we see today. If one looks closely at the openinsider.com chart one will notice that since 2007 the pace of insider selling has been closer to that of insider buying than the period prior to 2007. The only time insider selling appears to have shifted somewhat back to its earlier relative level vs. insider buying has been in 2014. This coincides to SP500 moving to ~5% excess of the SP500 Value Investor Index.

Even in 2014 the relative activity of sellers/buyers remained less than that seen prior to 2007. There is a loud signal being provided today. Jamie Dimon, CEO of JP Morgan (JPM), for instance just bought 500,000shrs for the first time since July 2012 (500,000) and before that his last purchase of size (500,000) was Jan 2009. Each represented an excellent time for investors to have purchased JP Morgan. I encourage investors to use the link to confirm the reported insider activity.

(Click on image to enlarge)

Corporate insiders have long been referred to as Value Investors. One should expect them to be better acquainted with future corporate business prospects than other investors due to their access to the daily flow of global and corporate business information. I once attained some recognition analyzing this information. I still use it, but lean much more on parsing management’s process for building shareholder value. My general research notes are limited to my investors. My specific company research is further limited to specific investors.

Using reported insider trading as reported to the Securities Exchange Commission has offered valuable insight to investors since Ed Buck’s Vicker’s Insider Weekly Report of the 1970s. Stronger insider buying has always been correlated with lower stock prices. Seeing higher insider buying today is to be expected if future business prospects are better than market pricing psychology.

Current markets are a buying opportunity!!

I’ ll add top this that Wells Fargo’s WFC Kovacevich announced yesterday he was buying WFC stock:

Video Length: 00:03:07

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other ...

more