Inflation Is Finally A Factor

On Wednesday, Fed chair Janet Yellen let all the air out of the balloon. The widely anticipated hike in the Fed Funds target rate by the Open Market Committee was made real when she said, “In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1/2 to 3/4 percent.”

The move was fairly well cooked into the market by the time she spoke. What wasn’t anticipated, though, was the release of a new dot plot that raised the odds for three rate hikes in 2017. The Street was banking on just two.

When you parse all the Fed-speak, you get the sense that Yellen and the FOMC believe there’s little more the Committee can do to foster fuller employment. There’s maybe a tenth of point more to shave off the unemployment rate. That leaves the Fed to focus more fully on its other mandate – managing inflation. Inflation’s still not at the Fed’s target rate but expectations are rising, most particularly since the election.

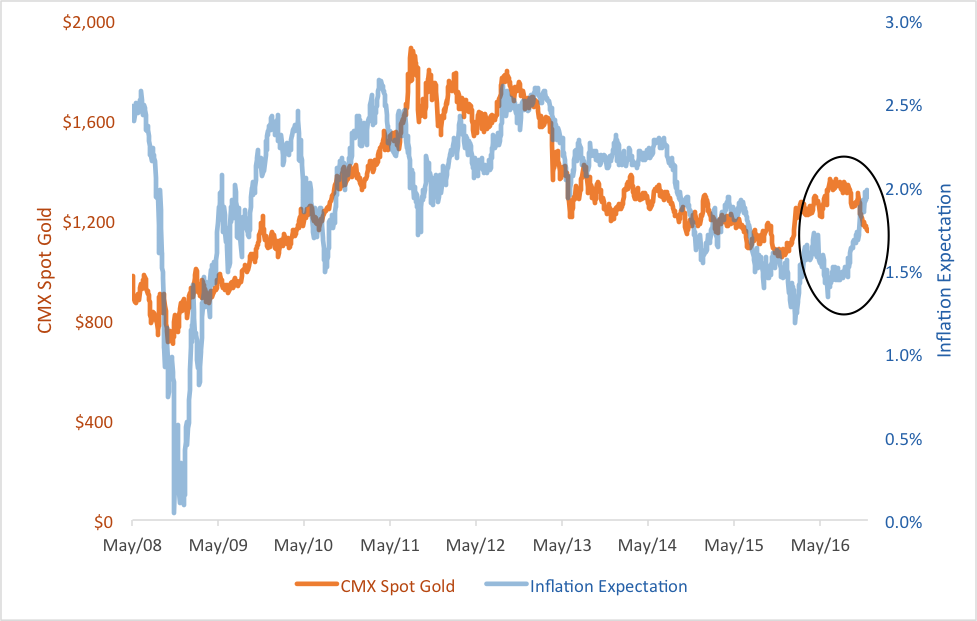

Below you’ll see a chart showing inflation expectations derived from the 10-year Treasury market. Notice the steep ascent in the expected rate since September. Overlaid on the inflation expectations is the spot gold price. Gold is often touted as the ultimate inflation hedge. As you can see, gold and inflation expectations have more or less moved in the same general direction. Sometimes more and sometimes a lot less.Sometimes, gold’s trajectory and inflation expectations diverge significantly.

(Click on image to enlarge)

In 2011, for example, gold reached its apex price as inflationary expectations were actually sinking. There was an awful lot of daylight between the two trend lines in September and October. And, now, the same thing’s happening (see the oval). As the outlook for inflation began to gain ground, in the fall, gold prices tumbled.

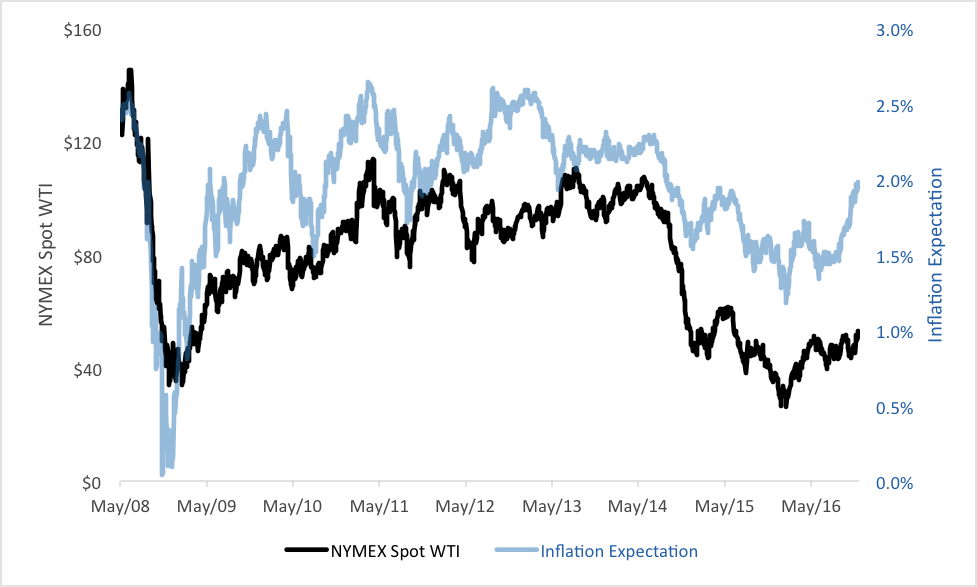

Gold may be an inflation hedge but it’s really not a very good one.A better one is oil. There’s much better tracking of inflationary expectations with oil prices (see the chart below). Oil prices have exhibited a bullish bias since August, in line with heightened prospects for inflation.

(Click on image to enlarge)

This shouldn’t be a surprise. After all, oil is inflation. Or, rather, the price of oil distillates figures prominently in the calculation of the Consumer Price Index.

So, if you’re really worried about future inflation, don’t look for a hedge that shines. Look, instead, for one that shimmers.

Disclosure: Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) ...

more