Industrial Production Growth - Very Strong

Industrial Production - Solid Growth

The industrial production report is always pivotal in measuring the economy. It’s especially important now that we've disconnected soft indicators from the hard reports.

It’s interesting that the September ISM manufacturing PMI fell slightly. However, industrial production growth accelerated on a year over year basis. It also beat estimates on a month over month basis.

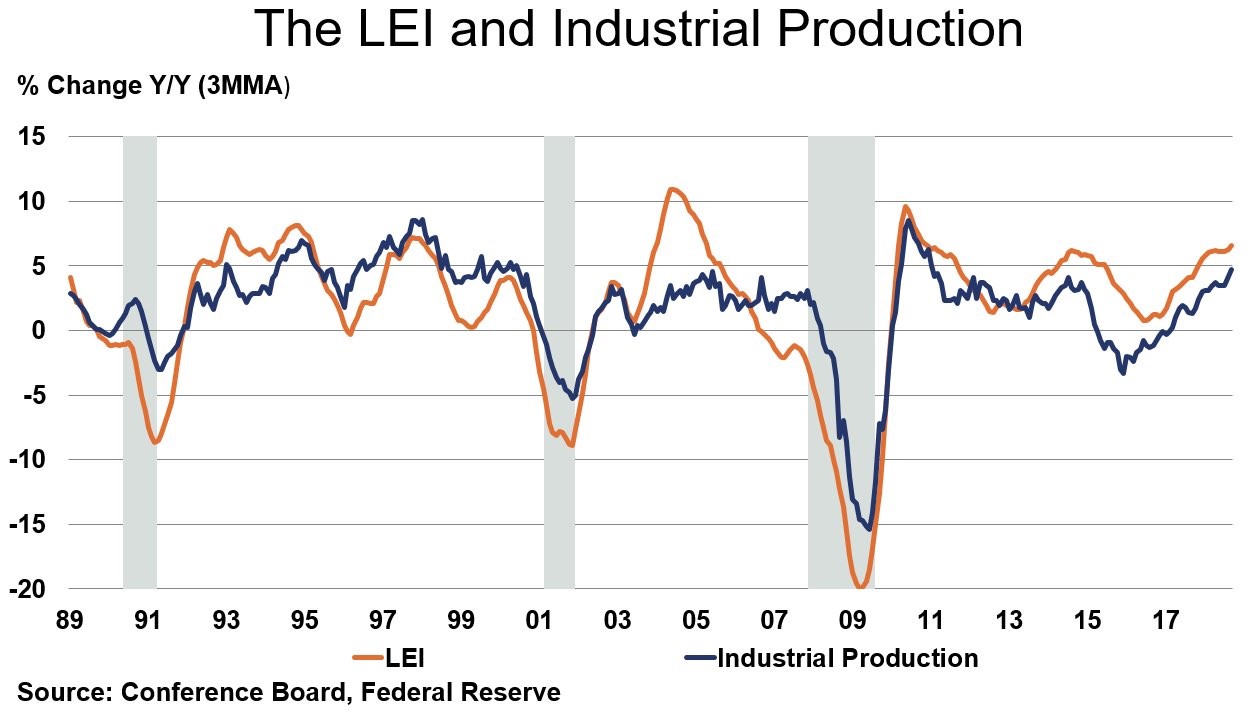

The chart below shows the 3 month moving average of the leading economic indicators. It also shows industrial production are at near peak cycle growth rates.

Leading economic indicators were up 0.5% month over month. This matched expectations and were above last month’s growth of 0.4%. New records in this index imply a recession isn’t nigh.

Since the stock market is in this index, it should weaken slightly in October because of the correction.

Month over month industrial production growth was 0.3% which beat estimates for 0.2%. This was great growth since August had 0.4% month over month growth.

Manufacturing growth was 0.2% which met estimates. It was 0.1% below August’s growth. Capacity to utilization was 78.1% which missed estimates for 78.2% and was flat with last month.

Industrial Production - There is still slack in the economy which should allow it to expand further.

Manufacturing utilization was up 0.1% to 75.9%.

Mining production was up 0.5% month over month and 13.4% year over year. Utility production was flat month over month and up 5.4% year over year.

Manufacturing volumes were up 3.5% year over year. Nominal production growth was almost 6%. Motor vehicles were up 1.7% in September and 7% year over year.

Hurricane replacement sales helped. Also, they will help next month because of Hurricane Michael. Hi-tech production was up 0.6% month over month and 6.9% year over year.

Materials production growth was 0.2% and 8% year over year. Business equipment growth was 0.8% and 3.6% year over year. Consumer goods production was up 0.2% and 2.5%.

Industrial Production - This was a solid report throughout the sub-categories.

The areas of weakness were non-industrial supplies and construction supplies. Non-industrial supplies were flat month over month and up 2% year over year. Construction supplies growth was hurt by tariffs as it fell 0.6% month over month and rose 2.4% year over year.

This report showed strength as industrial production growth was 5.1%. However, it’s still not consistent with the Empire Fed and ISM manufacturing reports. Those imply double-digit growth.

In this case, I don’t think investors will mind the difference if hard data is improving.

There’s not really a case for bearishness if you’re just disappointed year over year growth isn’t 10%. Since 1989, year over year industrial production growth has never been in the double digits.

This great report makes me question the slowdown ECRI has been predicting for about a year.

Industrial Production - Maybe Buy Industrials

A record percentage of fund managers think the global economy is late cycle. They are slightly optimistic on American growth and very pessimistic on global growth.

This industrial production report calls into question their thinking.

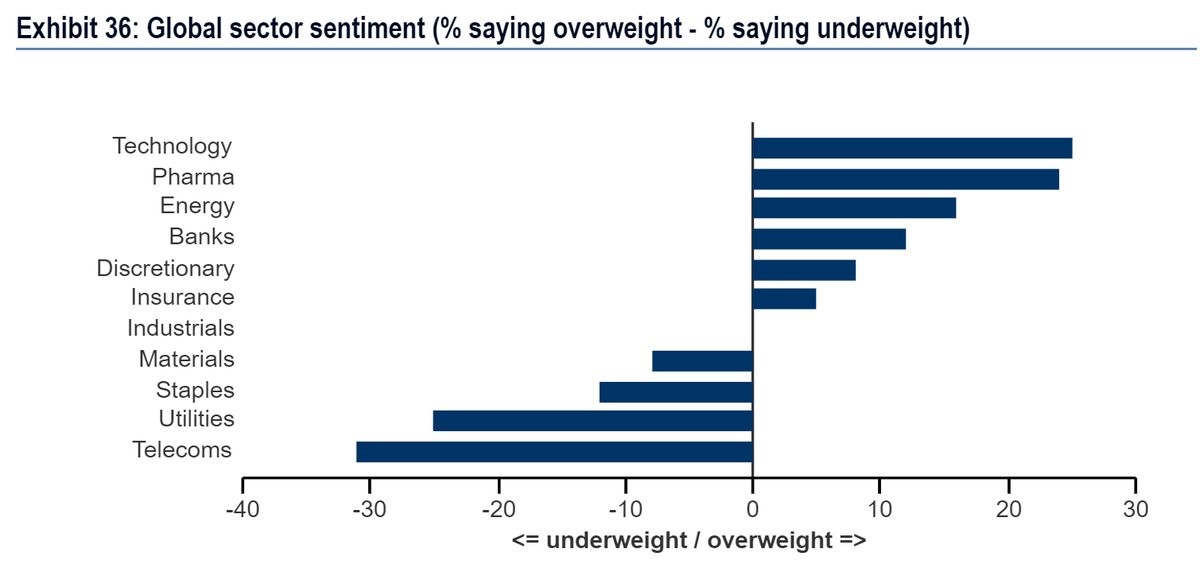

As you can see from the chart below, fund managers are underweight industrials globally. This could be an opportunity to buy these stocks given the great American growth. The most important factor could be the tariffs since manufacturing is highly impacted by trade.

It’s also worth noting fund managers say they are overweight technology even though some of the major internet stocks have been doing poorly.

Tencent and Facebook are two examples as they are down 33.1% and 12.13% year to date.

It’s also notable to point out that fund managers are following their answers to the question about global growth. You can’t be so U.S. centric and claim they are all long the stock market because the S&P 500 is up year to date. The ACWI world stock market ETF is down 2.34% year to date.

Industrial Production - Reinforcing Impact Of Tariffs

Tariffs are still a factor which will hurt farmers and trade growth unless we make a new deal.

The American economy was finally fully recovered from the financial crisis. And real wage growth looks ready to accelerate. A lot of the blame for historical median real wage growth weakness should be put on the 2008 recession not the trade deficit.

Without the trade war, the economy would have been even more spectacular in the first half. And, the slight slowdown in the 2nd half would be less severe.

Just because many overall growth numbers haven’t been severely impacted by the trade war, doesn’t mean it’s a good idea.

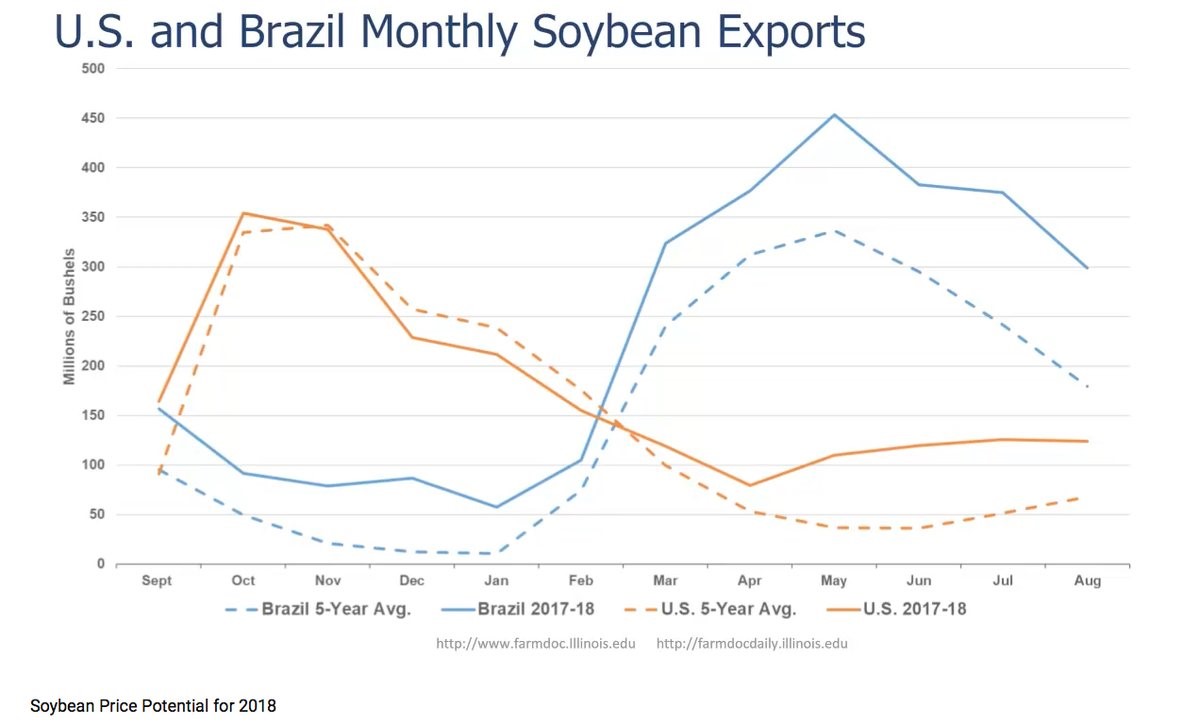

As you can see from the chart below, American soybean exports were above the 5 year average in August. Also, Brazilian exports were even higher above the country’s 5 year average.

This export growth is about to be put to the test as China switches from American to Brazilian soybeans. The issue for China is that American harvests are in October while Brazilian harvests dwindle.

Brazilian harvests usually peak in May. South America has the opposite seasons as America. The question awaiting American farmers is how long China can hold out buying as many soybeans as they usually do.

The chart below shows the incremental impact American tariffs on Chinese goods will have.

As you can see, consumer goods were strategically avoided with the first round of $50 billion in tariffs. And the next $200 billion is having a bigger impact on consumer goods. 23% of the tariffs are on them.

The 25% tax rate which is set to start in 2019 will have an even stronger impact on consumer. Don’t be lulled to sleep by the small effects of the initial tariffs.

The situation will probably get worse before it gets better. Key is figuring out when it starts to get better. That means determining when a trade deal will be struck.

Industrial Production - Conclusion

The industrial production report was very strong. Leading indicators show a recession is not on the horizon.

The round of tariffs currently in place are starting to effect consumer goods for the first time. And, the spike in the tariff rate to 25% in 2019 could catalyze a slowdown.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more