Individual Investors Ironically Turn Bullish

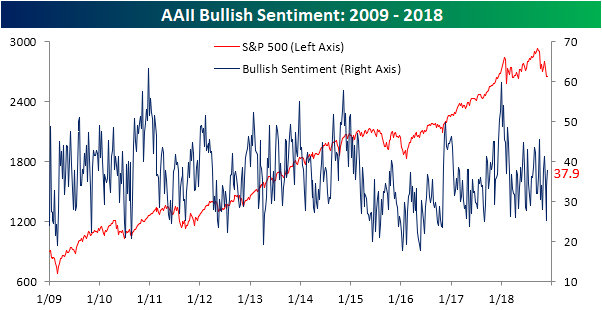

This may be hard to believe after the past few of days, but individual investor’s outlook on markets from the AAII survey actually saw a bump in bullish sentiment this week. Bullish sentiment rose for the second week in a row to 37.94% from last week’s 33.88%. This is off of one of the lowest readings of the year from only a few weeks ago.

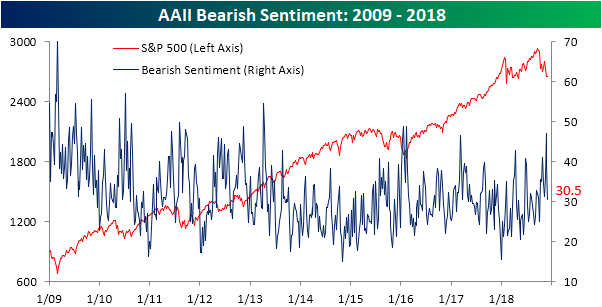

As always, as bullish sentiment rose, bearish sentiment took a hit returning back towards the historical average. Bearish sentiment fell to 30.5%. This is well off the high of 47.14% hit a couple weeks ago.

Neutral sentiment also saw a decent bump this week rising to 31.55%. Coming off of lows, this could indicate that investors are growing increasingly uncertain with how markets have performed recently.

As we mentioned last week, much of the more optimistic outlook from this week’s survey likely came as the result of Fed Chair Powell’s speech. Seeing as the survey polling closes Wednesday, this week’s results may not have fully taken into account Tuesday’s stock rout; just as last week’s survey likely did not take into account Powell’s speech. In other words, as the expected rise in bullish sentiment came this week, next week we should expect to see a rise in bearish sentiment especially if this price action keeps up.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more