Indicators, Weekly Charts

A look at a few items in-day, in-week, fwiw…

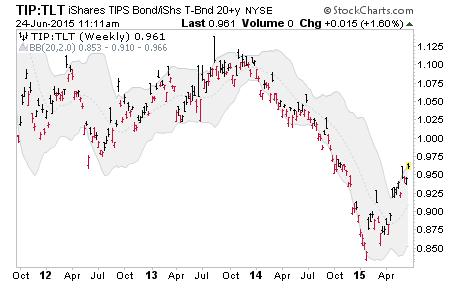

TIP-TLT ratio indicates that inflation-protected have been favored over regular long-term T bonds for all of 2015. This indicates the potential for an inflation ‘expectations’ bounce to continue.

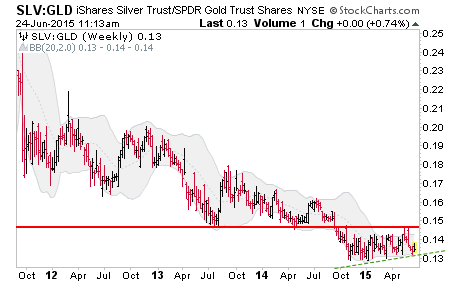

Yet the Silver-Gold ratio, another inflation barometer, still only maintains a lame uptrend through 2015 with strong resistance above.

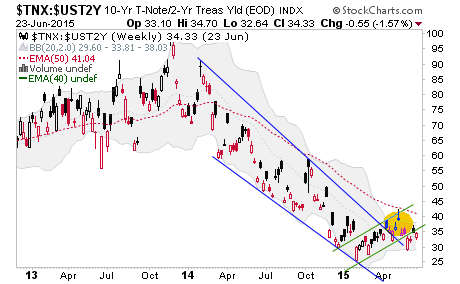

The 10-2 year yield spread has broken down from its 2015 channel and is thus not a positive for gold and not a negative for general financial markets at this juncture.

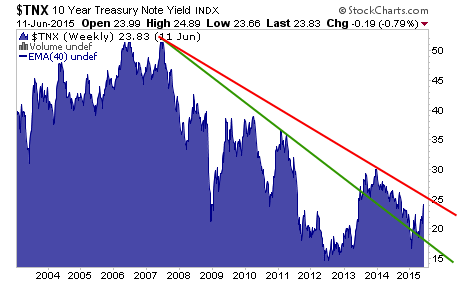

Nominal 10 year continues to aim for 2.5% as its next target. I think it ultimately will get to at least 3%.

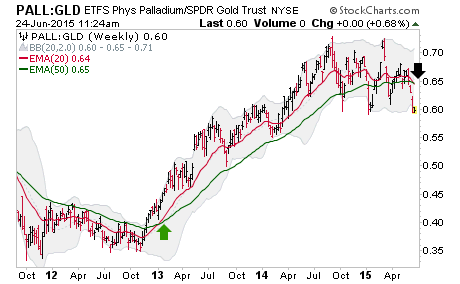

Palladium-Gold continues to look quite precarious despite other indicators foretelling no imminent threat to the economy and financial markets. It will be interesting to see which indicators ultimately are right over the span of the next few months.

Disclosure: Subscribe to more