Important Week For Lennar Group. Here Is What To Expect

Lennar Group (LEN) reports its FQ2 ‘15 figures on Wednesday this week. The company has continued to perform well, providing a capital gain of 8.55% year-to-date (YTD) relative to the S&P 500 of 2.48%. Fundamentally, Lennar is in a good position to capitalize on a strengthening US economy and a continuation in low interests.

Estimize is predicting an EPS figure of $0.69 relative to Wall Street predictions of $0.65. Estimize also assumes higher revenues than Wall Street of $2.089B compared to $2.049B. The homebuilder has had a tendency to beat Wall Street figures consistently over the past 24 months.

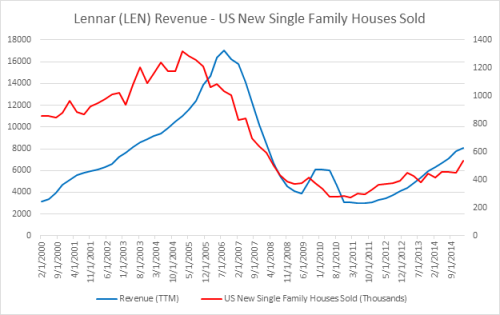

US New Single Family Houses Sold data is released on Tuesday morning and the figure will likely give some indication of how LEN will report on Thursday. LEN’s revenues are significantly influenced by new single housing sales. LEN’s “homebuilding activities primarily include the construction and sale of single-family attached and detached homes to first-time, move up, and active homebuyers.”

Historically, Lennar Corp’s revenues have been positively correlated with movements in US New Single Family Houses Sales. The graph depicted below provides a visual representation of LEN’s revenues and US New Single Houses Sold data.

Estimize are predicting a 2.07% MoM growth number for US New Single Family Houses Sold in May. If correct, LEN’s revenues will likely experience a continuation in positive revenue growth. The Estimize community is predicting an increase of 27% in revenues for FQ2 ’15 MoM.

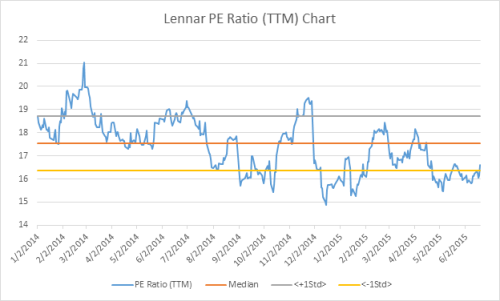

Leading into its result, LEN is trading on a PE Ratio (TTM) of 16.62X compared to its five-year average of 23.86X. The chart below displays LEN’s PE Ratio (TTM) since January 2014. As it can be recognized, the stock is currently trading at discounted levels relative to its history.

The data on US New Single Family Houses Sold will likely effect the sentiment surrounding a number of stocks including Lennar and its peers PulteGroup and DR Horton. Further, the numbers published may well be a precursor of what is expected from Lennar in terms of revenues for the FQ2 ’15 report. This week will be an interesting one for Lennar group. Active investors with vested interests in Lennar should pay attention to the housing data released on Tuesday and analyze Lennar’s quarterly when it is published on Wednesday.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.