Imbalances In Global Current Accounts

Four of the largest economies in the world (the US, UK, China and Germany) have different current account positions, and at the same time, their economies are growing at rather different rates.

The current account balance simply indicates if a country has a deficit or surplus in its goods and services trade with the rest of the world. The current account position is often wrongly interpreted as indicating that a country’s economy is either weak (i.e. is in deficit) or strong (i.e. in surplus). A current account deficit simply indicates that a country imports more goods and services than it exports.

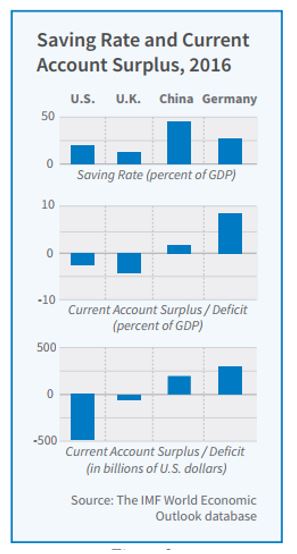

In accounting terms, the current account balance is the difference between a country’s savings and its investments. In other words, a positive current account balance indicates that the nation is a net lender to the rest of the world (Germany and China), while a negative current account balance indicates that it is a net borrower from the rest of the world (the U.S. and U.K.). As well, in accounting terms, a current account surplus increases a country’s net foreign assets by the amount of the surplus, and a current account deficit decreases it by the same amount.

In 2016 the U.S. and the U.K recorded substantial current account deficits, while China and Germany had correspondingly large current account surpluses. As Mervyn King points out in a recent NBER Reporter (No.3, Sept. 2017), the following four large economies are currently on a unbalanced economic growth path. In effect, the Chinese and German economies are growing too fast because of their CA surpluses, while the American and British economies are growing too slowly.

Disclosure: None.