Hurricane Florence Takes Aim At North Carolina: Insurers Could Lose $20 Billion

Hurricane Florence To Impact The Economy

The biggest news on Tuesday was the potential for hurricane Florence to deliver catastrophic damage to North Carolina, South Carolina, and Virginia later this week. All those states along with Maryland and Washington D.C. are under states of emergency.

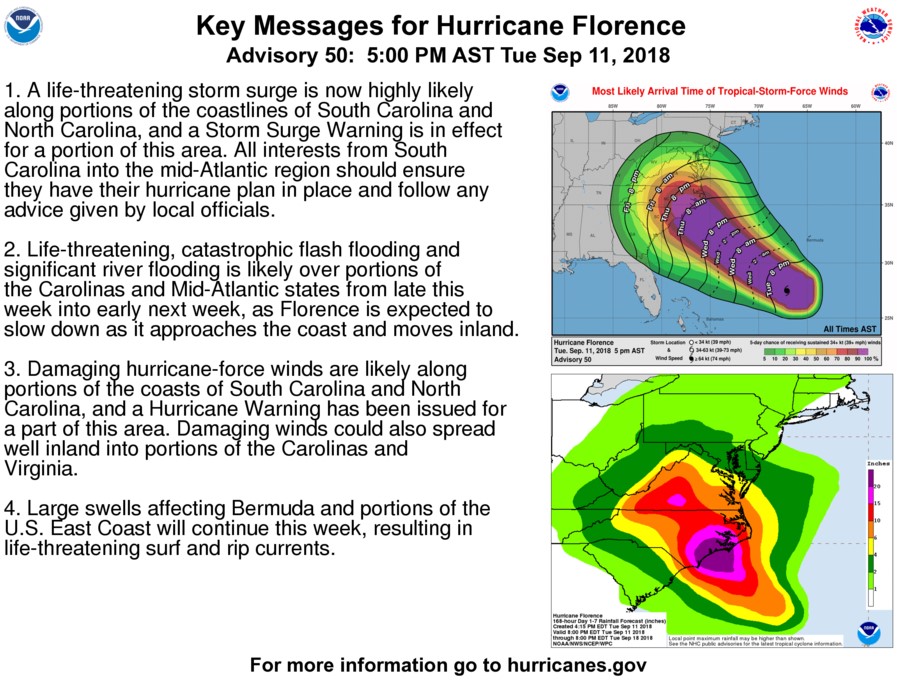

You can see the graphic below shows parts of North Carolina will face over 20 inches of rain. This could be the worst storm to hit Carolina in 60 years because of its strength and because it will stall over land which means more flooding.

The worst part of the storm will be storm surge since it causes the most deaths. There is expected to be 15-20 feet of storm surge in the worst hit areas likely in North Carolina.

This will have a big effect on the economy. Any data taken from September which includes the mid-Atlantic region will no longer give us insight into how growth is trending.

Destruction of houses could cause prices to increase as there will be less supply. Then building will commence, which will boost home builder stocks.

There will also be thousands of cars destroyed which will create the need to purchase new ones in October. Just like Harvey last year, this storm could impact Q3 GDP growth and help Q4 growth.

JP Morgan estimated that this hurricane will cause the insurance industry to lose between $8 billion and $20 billion, depending on the timing and intensity of the storm.

Travelers stock fell 3.75% from Friday to Monday, but it was up 0.2% on Tuesday. The hurricane is probably priced in somewhat.

If it gets worse, then the stock will fall. AIG stock is down 2.84% in the past 3 trading days. The storm’s speed is currently 140 miles per hour. It should hit the coastline with about 115 mile per hour winds.

It will hit either North Carolina or South Carolina on either Thursday night or Friday morning.

Lowe’s shipped 800 truckloads of disaster related products to 100 stores. Boeing suspended operations in Charleston, South Carolina where it has 6,700 employees.

Hurricane Florence - Stocks Rally Again

The S&P 500 rallied 0.37% on Tuesday as it had back to back green days after going red every day last week.

The Nasdaq was also up again as it increased 0.61%. The VIX was down 6.64%. The tech sector rebounded from its mini correction as it increased 0.84%.

Since its bottom last Thursday, Facebook stock is up 2.1%. Twitter stock was up 1.18%.

It’s not surprising that Snap did the best as it was up 1.59% because it has a high beta. However, I don’t think that company has a bright future because of weakening user trends.

Telecom and energy were the best sectors as they increased 1.08% and 0.98%. Consumer staples and utilities were the worst sectors as they were down 0.35% and 0.39%. Oil was up 0.84% to $69.83.

Hurricane Florence - U.S. China Trade War

There wasn’t any news on the trade skirmishes because the incoming hurricane dominated headlines.

However, it’s worth reviewing the potential impact of a trade war. FactSet came up with the table below which shows the impact a potential trade war could have on various markets.

It’s not surprising that America would be one of the worst hit because it is starting these skirmishes. The American stock market could fall as much as 21.88% in the most conservative scenario.

Only Canada and Israel fair worse. Only Japan would see its equity market increase. As far as the bond market’s reaction, Japan is also expected to fair the best.

FactSet expects Japanese bonds to increase 10.76% in the most optimistic scenario and increase 21.47% in the most conservative scenario. The Saudi Arabian bond market would be the worst hit as it is expected to fall 11.06% in the most conservative scenario.

Hurricane Florence - Treasuries Sell Off Again

The treasury market has been selling off ever since wage growth in the August BLS report beat estimates.

On Tuesday, the 10 year bond yield increased from 2.93% to 2.97%. The 2 year bond yield increased from 2.71% to 2.74% which is its highest yield this cycle. The curve stayed the same as the difference between the 2 yields is 23 basis points.

The Fed is now free to raise rates without inverting the curve because inflation and growth estimates have increased. The current odds for at least one rate hike in December are 79.1%.

As you can see from the chart below, the short treasuries position is very extended. However, it has been extended all year and yields have still increased.

I’ll stick by my position that it’s unlikely that the 10 year yield will hit and stay above 3%. If it does, it’s great news for equities. It means the chance of a recession in 2019 is very low.

Hurricane Florence - CPI Preview

Economic data in a few weeks will start to be muddled by hurricane Florence which is why the reports from August are important.

CPI is one of the most important measures of inflation. The bond market is seeing more inflation ever since the BLS report. Month over month headline CPI is expected to be up 0.3% which is above 0.2% in July. It is expected to be up 2.8% year over year which is below the 2.9% increase in July.

Core CPI is expected to be up 0.2% on a month over month basis which is the same as July. It’s expected to be up 2.3% on a year over basis which is down from 2.4% in July.

As you can see, inflation is expected to be modest despite the increase in nominal wage growth. That’s the best case scenario for improvement in real wage growth.

Hurricane Florence - Conclusion

Stocks are near their record high, but everyone is focused on hurricane Florence which has 140 mile per hour winds and is about to hit the Carolinas and impact Virginia.

This will have similar impact to hurricane Harvey which hit Texas last year. Hurricane Florence is expected to be one of the top 10 costliest hurricanes in American history.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more

Surge is still high. Winds down but that doesn't change the surge of a huge storm. Katrina showed us that.