Monday, December 5, 2016 12:50 PM EDT

All of the major equity indices have hit record highs following the presidential election, but now the market is due for a consolidation to absorb overbought conditions. Further upside gains will probably be limited ahead of the December 14th FOMC announcement with a 100% expectation of a hike, that should be a non-event. As reported by Ryan Vlastelica in a recent MarketWatch article, largely been obscured in the aftermath of Trump’s underdog victory, which sparked the equity rally, a win by the Republican candidate had been widely seen as negative for markets.

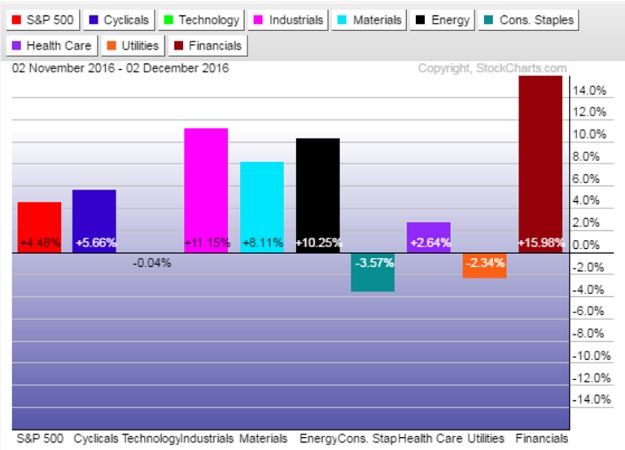

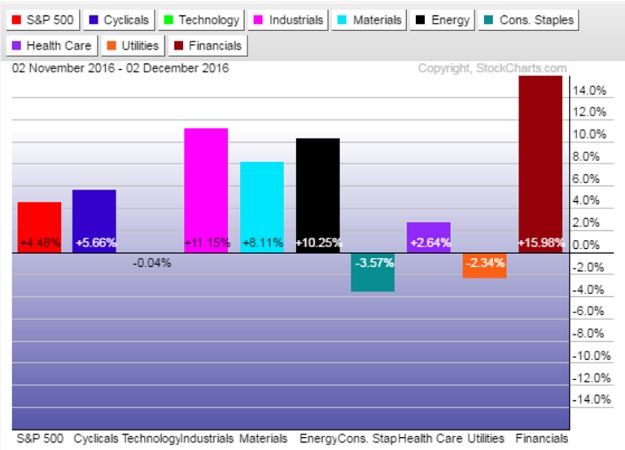

The President-elect was viewed as a wild card, lacking a track record in government and offering few or contradictory policy details. His temperament suggests a question mark more than a steady hand. “While the U.S. macroeconomic cycle may get a boost from the proposed fiscal stimulus, corporate tax reform and deregulation, both the passage and efficacy of these measures are far from certain at this moment,” J.P. Morgan wrote in a Nov. 30 note. “We think that, fundamentally, risks for equities in 2017 are higher compared to 2016. We expect an increased level of geopolitical risk and increased uncertainties related to the new U.S. administration.” “This fearless stock market looks to be underestimating the possibility of President Trump rattling risk markets during his four-year term,” wrote John Blank, chief equity strategist at Zacks Equity Research. “He remains unpredictable.” The graph below confirms are recently analysis is still valid where we stated “…The past few weeks investors having been selling off bonds, gold, utilities and other defensive sectors.

As evidenced in the updated chart below, investors are rolling into financial, industrials and other sectors expected to benefit from Republican control of the presidency and both houses of Congress. Also, historically, November begins the best consecutive six months for the stock market. There is still plenty of cash sitting on the sidelines and any price pullback should be considered a buying opportunity for stocks on your watch list.

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be ...

more

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to buy/sell Futures, Options, Mutual Funds or Equities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this Web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

Performance results are hypothetical. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as a lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Investment Research Group and all individuals affiliated with Investment Research Group assume no responsibilities for your trading and investment results.

Investment Research Group (IRG), as a publisher of a financial newsletter of general and regular circulation, cannot tender individual investment advice. Only a registered broker or investment adviser may advise you individually on the suitability and performance of your portfolio or specific investments.

In making any investment decision, you will rely solely on your own review and examination of the fact and records relating to such investments. Past performance of our recommendations is not an indication of future performance. The publisher shall have no liability of whatever nature in respect of any claims, damages, loss, or expense arising out of or in connection with the reliance by you on the contents of our Web site, any promotion, published material, alert, or update.

For a complete understanding of the risks associated with trading, see our Risk Disclosure.

less

How did you like this article? Let us know so we can better customize your reading experience.