How Long Can The Federal Reserve Go It Alone?

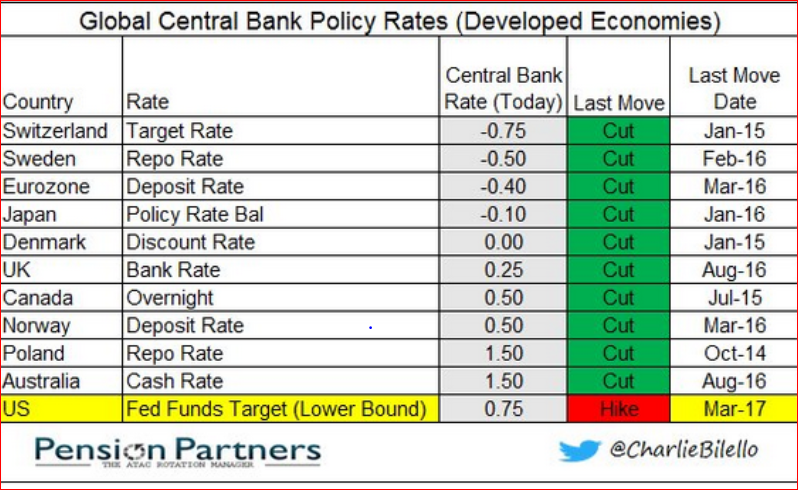

The Federal Reserve is marching to its own drum and the rest of the world is not in step. With the announcement of a 25pb hike in the Fed funds rate and the anticipation of at least two more hikes before year`s end, the Fed is out of sync with the other major central bankers.Or, is the reverse the case? The hallmark of the other central banks in the developed nations has been to cut rates, not increase them (Chart 1). These same central banks have remained on the sidelines and certainly do not offer up signals that they intend to tighten conditions and thus join in with the Fed.

Chart 1 Central Bank Policy Rates

As recent as last week, the ECB announced that “we continue to expect them ( bank rates) to remain at their present or lower rates for an extended period of time.... we confirm that we will continue to make purchases under our asset purchase program”. Although headline inflation in the Eurozone has perked up, the ECB notes that the “underlying inflation pressures continue to remain subdued”. The Bank of Japan is no hurry to tighten monetary conditions. In its last statement, the BoJ re-confirmed its policy of “yield control”. Short term rates are tethered to an interest rate of minus 0.1 per cent on deposits with the BoJ. And, the 10 -year bond rate is held to zero percent by the Bank`s QQE policy.

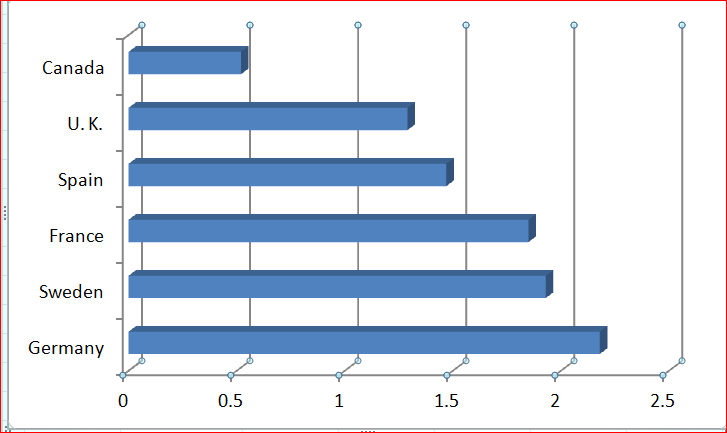

Just how much out of sync is U.S. interest policy is evident by the spread in the 2 yr note (Chart 2). The spread in favor of the United States ranges from a low of 50bps (Canada) to a high of 225 bps (Germany). More significantly, the Eurozone 2 -year rates are in negative territory, having recently fallen to a historic low of minus 0.95 per cent in Germany. Europe clearly sees the future in quite a different light.

Chart 2 US 2 year Bond Spread (March 15).

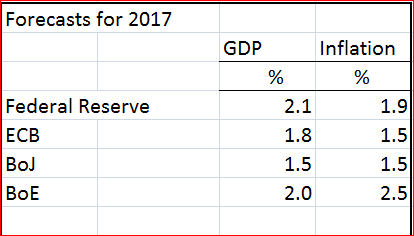

Not surprisingly, all central banks have adopted an optimistic outlook for 2017 (see Table 1). But what is more remarkable is that the outlook adopted by all three central banks is virtually identical---- expected growth is 1.5-2.0 per cent and the expected inflation of 1.5-1.9 per cent. Given that Eurozone and Japan have gone through recent bouts of deflation, these forecasts do not provide any reason to tighten policy. The Bank of England will tolerate a higher rate of inflation (in excess of 2 per cent), citing the sharp slowdown predicted by the BoE in the wake of the Brexit vote. These bankers are looking for evidence of a sustained growth before considering any policy shifts.

More interestingly is the Fed`s decision to tighten while expecting relatively subdued growth and inflation in 2017. Furthermore, the Fed does not expect that long term growth will exceed 1.9 per cent annually, a view which Yellen re-iterated in her press conference following the rate decision of March 15th. This raises the question why the Fed is prepared to continue on the path towards a Fed funds rate of 2 per cent or more by 2018 and 3 per cent in the longer term.

There is no justification for this divergence in monetary policy. All major central banks agree that growth will remain below historic norms and inflation will remain well in check. Europe, the U.K. and Japan are in no frame of mind to shift policy in the direction taken by the United States. Do not look to anyone of these central banks to make the first move to narrow the spread.

The question remains---- can the yield spreads continue indefinitely? From the U.S. perspective, any further spread widening will lead to a higher U.S. dollar and its attendant problems for the U.S. trade deficit. Although the Fed, as a matter of longstanding policy, does not set rates with a view to their impact upon the U.S. dollar, it cannot act in isolation. The more likely scenario could be that Fed will take its time in normalizing rates.

Disclosure: None.

With the dollar falling as the President portrays the US as weak and threatens starting a trade war, interest rates and inflation can rise quite a bit more. Hopefully, more of the former than the latter. We'll all sleep more comfortably when the dollar strengthens.