How GameStop Grows Without Growing

For a company that has consolidated and dominated its retail niche, GameStop (GME) sure gets no love.

Since the George W. Bush administration, investors have been predicting the company's demise. Digital distribution of games through Microsoft's (MSFT) Xbox Live or Sony's (SNE) PlayStation Network would eliminate the need for brick-and-mortar retail, gutting GameStop. Best Buy (BBY) and Walmart (WMT) were starting competing used game trade programs that would pressure one of GameStop's core businesses. Walmart (WMT) and Target (TGT) were discounting game products, selling them at barely a profit to drive holiday store traffic. Digital-only devices like Apple's (AAPL) iPhone and iPad would eat up the mobile game market share, bypassing GameStop.

In short, investors have bet against the firm heavily. Currently, its short ratio (percentage of shares bet on to fall) is astronomically high at 48%, and has consistently been over 30% for the past 8 years!

Despite this, the company has continued to perform well for its investors. The stock is up over 70% since early 2012.

How has the company been able to achieve this?

By using its strong cash flow to generate growth for shareholders in a sometimes overlooked way.

Unimpressive Growth At A Glance

A quick glance at GameStop's revenue and operating earnings (i.e. earnings before interest and taxes, or EBIT) growth over the past five years won't excite anybody:

Not very inspiring, is it? The company's 5-year compound annual revenue growth is negative at -0.4%, and EBIT has fallen a little faster at -1.4%. All of the negative factors cited above have taken a toll, but probably the biggest factor in the company's stagnation has been the tail end of the Xbox 360/PS3 console cycle, where hardware sales are minimal and software studios began to focus their efforts on next-generation consoles.

While it is not an unreasonable argument that flat revenue and earnings performance in a difficult part of the gaming cycle is respectable performance, the fact is that GameStop has actually delivered pretty decent growth for shareholders during this period. How?

How GameStop Is Actually Growing

Let's take a look at the same charts as above, but this time lets adjust them to revenue and operating earnings on a per share basis:

That's more like it! When adjusting to per share values, GameStop has actually increased its revenue over the past 5 years at a compound annual rate of 5.9%, while EBIT has increased at a 4.9% compound annual rate. At face value, a 5-6% growth rate is decent for any large firm. For a large firm in the down part of its business cycle, it is pretty impressive. For a large company in the downside of its business cycle, who's stock trades at a 15% earnings yield (P/E ratio under 11), it could be considered robust growth!

The Power Of Share Buybacks

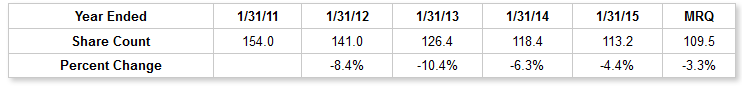

The company has accomplished this, of course, by buying back a substantial number of its undervalued shares over the past 5 years:

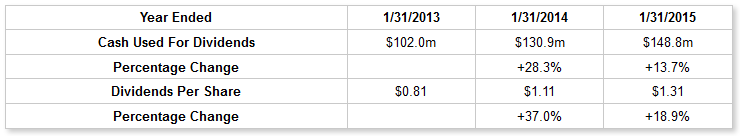

This not only juices GameStop's revenue per share and EBIT per share figures, but also allows the company to increase its dividend per share payout by a higher percentage then the actual cash outlay for dividends - creating even more value for shareholders. Compare the increase in actual cash used for dividends to the dividends per share (note - GameStop did not pay a dividend prior to 2012):

Now, share buybacks are not always a panacea. Good share buyback programs have two key attributes. One, they happen while a stock is demonstrably undervalued (a reasonable description of GME's stock). Two, the company funds them with internal cash flows, or at the very most, a manageable amount of low-interest debt (GameStop has funded buybacks strictly with free cash flow). If you want a good example of a bad, horrible, atrocious share buyback, look back a few years when Weight Watchers (WTW) took out over a billion dollars in debt to fund a share buyback around $80. Today the stock trades at $7 and the company is in serious financial straits.

Can GameStop Keep It Up?

Perhaps the key question to ask when a lot of a company's "growth" is driven by share buybacks is simply: can they continue to reduce share count?

In GameStop's case, my response would be: "why not?". GameStop remains a strong free cash flow generator (over $324 million last year) and carries a substantial amount of net cash on the balance sheet ($260 million). Even better, the current console generation, which kicked off last year, is now accelerating, and at a pace ahead of the previous generation. Analyst estimates have GameStop growing (absolute) revenues and earnings at a 7-9% pace over the next few years - far better than the last few years. The company is also expanding its business some, entering into reselling used Apple equipment and new mobile devices through Simply Mac and Spring Mobile, respectively. The firm's results, and forward expectations, do not seem like that of a stock where a 48% short ratio is warranted.

GameStop is a good example of why it is important to consider share count trends. Often for slow-growth but cash-generating firms, management can generate substantial growth for shareholders without growing the company itself.

Disclosure: Steve owns AAPL, GME, WTW.