How Energy Shortages Really Affect The Economy

Many people expect energy shortages to lead to high prices. This is based on their view of what “running out” of oil might do to the economy.

In this post, I look at historical data surrounding inadequate energy supply. I also consider some of the physics associated with the situation. I see a strange coincidence between when coal production peaked (hit its maximum production before declining) in the United Kingdom and when World War I broke out. There was an equally strange coincidence between when the highest quality coal peaked in Germany and when World War II broke out. A good case can be made that inadequate energy supply is associated with conflict and fighting because leaders recognize how important an adequate energy supply is.

Some of my previous analysis has shown that if we view energy in terms of average energy supply per person, the world as a whole may be again entering into a period of inadequate energy supply. If my view is correct that inadequate energy supply leads to increased conflict, the recent discord that we have been seeing among world leaders may be related to today’s low supply of energy. (My energy analysis considers the combined energy supply available per person from fossil fuels, nuclear, and renewables. It is not simply an oil-based analysis.)

The physics of the low energy situation may be trying to “freeze out” the less efficient portions of the economy. If successful, the outcome might be analogous to the collapse of the central government of the Soviet Union in 1991, after oil prices had been low for several years. Total energy consumption of countries involved in the collapse dropped by close to 40%, on average. The rest of the world benefitted from lower oil prices (resulting from lower total demand). It also benefitted from the oil that remained in the ground and consequently was available for extraction in recent years, when we really needed it.

The idea that oil prices can rise very high seems to be based on the oil price increases of the 1970s and of the early 2000s. While oil prices can temporarily rise very high, it is hard to make a case that they can remain high for an extended period. For one thing, high oil prices tend to cause recessions and lower employment. In such an environment, the affordability of energy products is lower, and oil prices tend to fall. For another, it is easy for the Federal Reserve to get oil prices back down by raising interest rates. In fact, the Federal Reserve is raising interest rates right now.

In my opinion, we should be more concerned about low oil prices than high because we live in a world economy with huge debt bubbles. Debt bubbles are part of what enable today’s high employment. Debt bubbles support employers that are close to the edge financially; they also support buyers who would not be able to afford automobiles or college educations, if loans were to become more expensive because of higher interest rates. Employment in the affected industries would be cut back, leading to recession.

Because of these issues, pricking the debt bubble is likely to lead to a major recession and, indirectly, lower energy prices, as in late 2008 (Exhibit 12). These lower prices are not good news because energy providers of all kinds need fairly high energy prices to survive–probably equivalent to oil at $80 per barrel or higher. If energy prices stay persistently low, the world is likely to see much lower oil supply, in part because oil exporters need the tax revenue that they obtain from high-priced oil to fund their programs.

A Self-Organizing Economy Needs Energy to Fulfill Its Promises

The problem that has arisen many times in the past is that energy supply becomes inadequate, relative to what the economy needs to operate. This energy shortfall is virtually never explained to the public. It is only apparent to the occasional researcher who realizes that this might be the issue.

The amount of energy that a networked economy needs to operate depends on:

- The number of people alive at the time,

- The industry that has been put in place, and

- The promises, such as retirement promises, that have been made to citizens.

Adequate energy supply is important for jobs and their pay levels. A rising supply of energy per capita tends to add jobs. The Asian countries shown in Figure 1 are some examples of countries where rising energy supply has given rise to more non-agricultural jobs.

Figure 1. Energy consumption per capita based on BP Statistical Review of World Energy 2018 total energy consumption data and UN 2017 Population Estimates of three selected countries. Energy consumption includes oil, natural gas, coal, and many smaller types of energy consumption, including wind and solar.

The jobs added rarely pay high salaries compared to those in the developed world, but they have helped raise the standard of living of those who have obtained them.

A falling supply of energy consumption per capita tends to make jobs that are high-paying more difficult to obtain. If energy per capita falls, there may still be a reasonable number of jobs, but many of them won’t pay well. High energy jobs such as building new schools and resurfacing roads tend to disappear, while jobs requiring little energy consumption, such as waitress and bartender, are added. Figure 2 gives some examples of European countries that have seen declines in energy consumption per capita in recent years.

Figure 2. Energy consumption per capita based on BP Statistical Review of World Energy 2018 total energy consumption data and UN 2017 Population Estimates of three selected countries. Energy consumption includes oil, natural gas, coal, and many smaller types of energy consumption, including wind and solar.

When jobs that pay well become more difficult to find, a significant share of the population starts believing that there is no room for additional immigrants, regardless of how needy they may be. This seems to be part of the dynamic many countries have been encountering recently.

If growth in energy supply is inadequate, other physics-related issues also arise:

- Inadequate economic growth, because it takes energy to create goods and services

- A tendency toward debt defaults, and the resulting deflation of asset bubbles

- Downward pressure on wages, in situations where machines or lower-paid workers can be substituted for somewhat routine work

- Difficulty collecting adequate tax revenue

- A tendency toward aggressive behavior between countries and actual wars

Physicist François Roddier has examined how economies allocate resources when there is a problem with scarcity. He finds that when there is an inadequate total energy supply, this shortage is reflected in growing wage and wealth disparity. Thus, the goods and services made possible by energy supplies are disproportionately allocated to a small proportion of individuals at the top of the economic hierarchy, while those at the bottom receive a falling share.

He likens the increasing share of wages/wealth going to the top to steam rising. At the same time, he sees the falling share of energy consumption going to those at the bottom of the hierarchy as freezing out those who are contributing the least to the economy. Using this approach, some portion of the economy can be maintained in a temporary energy scarcity, even if the most vulnerable parts are lost.

How a Few Past Low-Energy Problems Resolved

First Low-Energy Consumption Period: Peak Coal in the United Kingdom, 1914

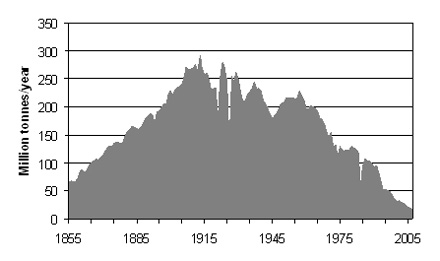

Figure 3. United Kingdom coal production since 1855, in a figure by David Strahan. First published in New Scientist, 17 January 2008.

The UK problem in the 1914 time-period was a coal problem. The coal whose delivered cost was lowest had been produced first. It was near the surface and geographically close to where it was ultimately to be used. Many types of costs rose as the easy-to-extract and deliver coal was exhausted. For example, more worker-hours were needed per ton of coal extracted.

If the costs of extracting and delivering coal rose, a person might think that these higher costs would be passed on to consumers as higher prices. (This is the hypothesis behind the ever-rising oil price theory.) Thus, a person might expect that coal prices would rise because coal companies needed more revenue to handle what was becoming an increasingly inefficient mining and delivery process.

This wasn’t the way it really worked, though, because customers couldn’t afford the higher costs. The wages of most citizens didn’t rise because the amount of goods and services the economy could produce depended upon the quantity of coal that was produced and delivered. If the economy were to take workers from outside the coal industry to compensate for the industry’s higher need for labor, it would further act to reduce the economy’s total output, because the new coal workers would no longer be performing their previous jobs.

Mining companies (sort of) solved their wage problem by paying miners an increasingly inadequate wage. Strikes by workers and lockouts by employers became an increasing problem in the 1910 to 1914 period. Probably not coincidentally, World War I started in 1914. The war provided jobs for miners and others who could not otherwise find jobs that paid a living wage.

Ultimately, World War I worked out well for the UK. The fact that it was on the winning side allowed the UK to remain the dominant world power until 1945, despite its declining coal production. Being dominant, the British pound sterling remained as the world reserve currency. This status made it easier for the UK to borrow, allowing it to import coal, even when it otherwise lacked funds to pay for it.

Second Low-Energy Consumption Period: 1920 to World War II, in the United States

The situation here seems to be more complex. The low energy problem that underlay World War I hadn’t really been resolved; it had mostly been moved elsewhere. Also, Germany, which was the other major European coal producer besides the UK, was reaching a peak in its predominant type of coal production, hard coal (Figure 4). Because of these issues, European demand for imported goods from the US dropped dramatically. In particular, the US had been a big supplier of food to Europe during World War I, but this source of demand disappeared after 1918 when soldiers returned to their fields.

Figure 4. Hard coal production in Germany 1792 to 2002. Chart by BGR.

With respect to US demand for coal, the big issue besides low demand from Europe was internal US demand. Mechanization was starting to replace unskilled workers, both on farms and in factories. Mechanization of farming created a double problem: it added more food than was really needed, and it created a combination of winners and losers. The winners were those with the new mechanization who could produce food cheaply; the losers were those who still used processes that required much more manual labor. Available food prices fell far below the non-mechanized cost of food production. City dwellers were also winners thanks to the lower food prices.

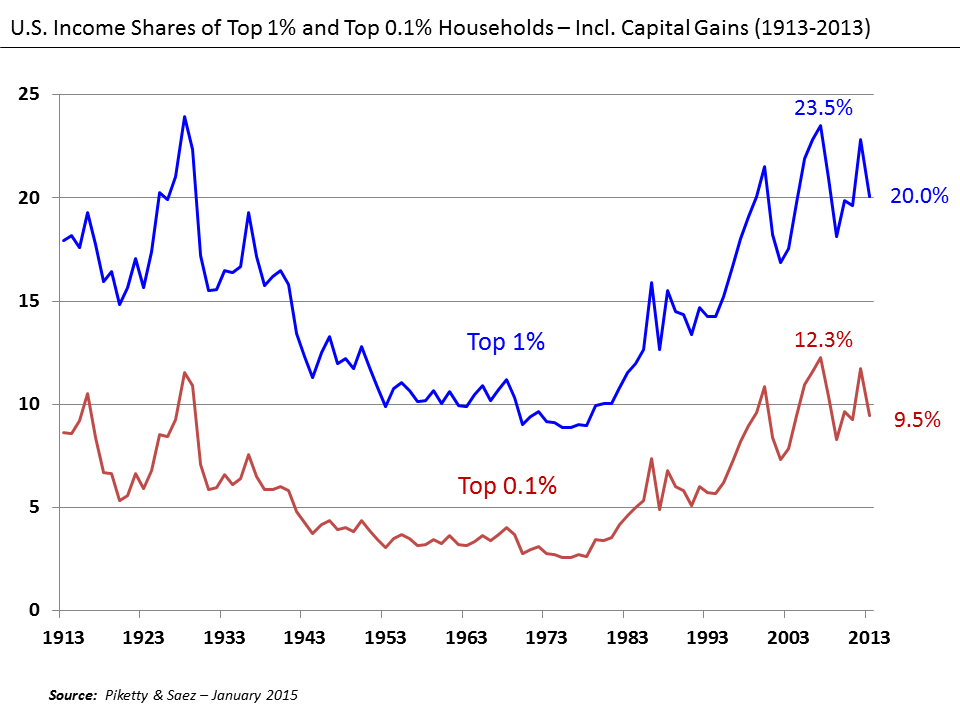

Wage disparity became an increasingly serious problem in the 1920s (Figure 5). Workers with low wages could not afford to buy many goods and services. The laws of physics require energy consumption (“dissipation”) whenever heat or motion are produced. Thus, physics requires that energy products be used in the manufacturing and delivery of goods and services. Following this logic through, the low wages of workers displaced by mechanization further acted to reduce demand for US energy supplies, over and above European coal problems.

Figure 5. U. S. Income Shares of Top 1% and Top 0.1%, Wikipedia exhibit by Piketty and Saez.

Debt levels grew in the Roaring 20s, partly driven by the apparent advantages of the new mechanization. In 1929, the debt bubble began to collapse, showing the underlying weakness of the economy.

The problems of the late 1920s to 1930 bore a striking resemblance to those of today. Wage disparity had become a major issue because of the displacement of many workers mechanization and immigration. In response, tariffs were added: the Fordney-McCumber Tariff of 1922 and the Smoot-Hawley Tariff of 1930. Limits were also set on the number of immigrants, in the hope that reduced competition from immigration would help raise the wages of unskilled workers.

Eventually, the low-demand-for-energy problem was solved with World War II. The extra demand of World War II added many women to the workforce for the first time. US energy consumption grew thanks to the war effort. The large wage increase about this time (Figure 6) primarily reflects the addition of many more workers to the labor force.

Figure 6. Three-year average growth in wages and in average personal income, based on data from the Bureau of Economic Analysis. Disposable personal income includes transfer payments such as Social Security and Unemployment Insurance. It also is net of taxes. The denominator in this calculation is the total US population, so the changes reflect the effect of adding a larger share of the population to the workforce.

World War II was a winning strategy economically for the United States. Wages rose rapidly during the early 1940s, as did “Disposable Personal Income,” which is closely related. In addition, the US dollar took over as the reserve currency from the British pound in 1945. This gave the United States the power to import more goods and services (including oil) than it would have been able to if it had been more limited in its ability to borrow.

If we analyze US coal production, we see the interplay between geological limits and demand (really, what is affordable for consumers). With respect to geological limits, US anthracite coal hit an apparently geologically limited production peak in 1918. It hit when there was a fall-off in demand for imported food from Europe, so coal prices were almost certainly falling (Figure 7).

Figure 7. US coal production by type, in Wikipedia exhibit by contributor Plazak.

The US production of the second-highest quality coal, bituminous coal, rose rapidly between 1870 and 1918 when its production path suddenly changed to a jagged plateau, which lasted until about 1930. Coal production then dropped precipitously, as the economy sank, and did not rise again until the time of World War II. This pattern very much follows the “demand” pattern expected based on the earlier discussion. The wage disparity of the 1920s seems to have led to flattening production, with a steep drop with the problems of the 1930s. Looking out at 1990 in Figure 7, bituminous coal may have hit a geological production peak. Energy prices are this time were low (Figure 10), again pointing to low prices being associated with peaks in the production of a type of energy supply, not high prices.

Production of the two lowest qualities of coal (sub-bituminous and lignite) coal did not begin until 1970. The rapid ramp-up of coal supplies helped cushion the peak in oil production in the United States, which occurred (coincidentally or not) the same year, 1970. We see a shift toward ever-lower quality of energy resources, but we do not see a pattern of spiking of prices associated with peak demand. Instead, low prices seem to be associated with peaks in production.

Third Low Energy Consumption Period: Dip from 1980 – 1984, Related to High-Interest Rates

A person might expect the peaking of US oil production in 1970 to have had a major impact on US energy consumption, but a much larger drop in energy consumption occurred in the 1980 to 1983 period, when the US raised interest rates to a high level, causing a recession.*

(Click on image to enlarge)

The resulting dip in oil consumption sent oil prices from an average inflation-adjusted price of $110 per barrel in 1980, down to $32 per barrel in 1986. At such low energy prices, energy exporters have difficulty collecting enough tax revenue and obtaining enough funds for new wells. Only the sturdier exporting nations could survive.

The energy exporter that did not survive was the Soviet Union. It took until 1991 for the financial strains of low oil prices to collapse the central government of the Soviet Union. With its collapse, much of the industry of the Soviet Union permanently was destroyed, reducing energy consumption by close to 40%. Even thirty years later, the per capita energy consumption of the former Soviet nations remains far below its mid-1980s plateau level (Figure 9).

(Click on image to enlarge)

Figure 9. Per Capita Energy Consumption by Part of the World, based on data of BP Statistical Review of World Energy 2018 and 2017 UN Medium Population Estimates. The Russia+ grouping is the Commonwealth of Independent States, shown in BP Statistical Review of World Energy 2018. It is slightly smaller than the former Soviet Union.

Analysis

Looking at these situations, there is little evidence with respect to the UK and German coal production that geological peaks in production are associated with high prices. Instead, they seem to be associated with conflict among nations.

Apart from conflict, the other issue associated with peaks in coal production seems to be falling demand, and thus falling prices. The reason for geological peaks is likely to be inadequate profitability. Inadequate profitability occurs because rising costs of production and transport can no longer be recouped with higher prices. A person might say that the limit on rising coal production is the affordable price. It is reasonable to expect that the same is true for oil.

There is also little evidence that energy scarcity causes high prices if energy scarcity is defined as low energy consumption per capita for all types of energy products combined. Instead, energy scarcity tends to cause wage disparity. Energy scarcity is also a concern for government leaders because they can see the need for an adequate supply of inexpensive energy if they are to be able to compete in the world marketplace. Goods made with an expensive energy mix tend to be high-priced, and thus they tend to be non-competitive in the world market.

Local customers are also unlikely to be able to afford goods made with expensive energy products because the additional wages are being used to support what is essentially a less efficient type of production. There are many ways that energy costs can rise, including:

- Need for more human labor

- Higher wages for labor, perhaps because of more education or location

- Need for the use of more energy products in the making of new energy products

- Need for more debt financing

- Higher interest rates

- More machinery, including pollution-control equipment

- Need to lease land at a higher cost

- Higher taxes

Regardless of where the extra costs come from, they don’t actually produce more of the energy products that are essential to making the economy operate as it should. The higher costs are simply a drag on the economy, which must be hidden in some way. Approaches to hiding the problem include reducing interest rates, outsourcing manufacturing to low-wage countries, and replacing some unskilled workers with computers or robots.

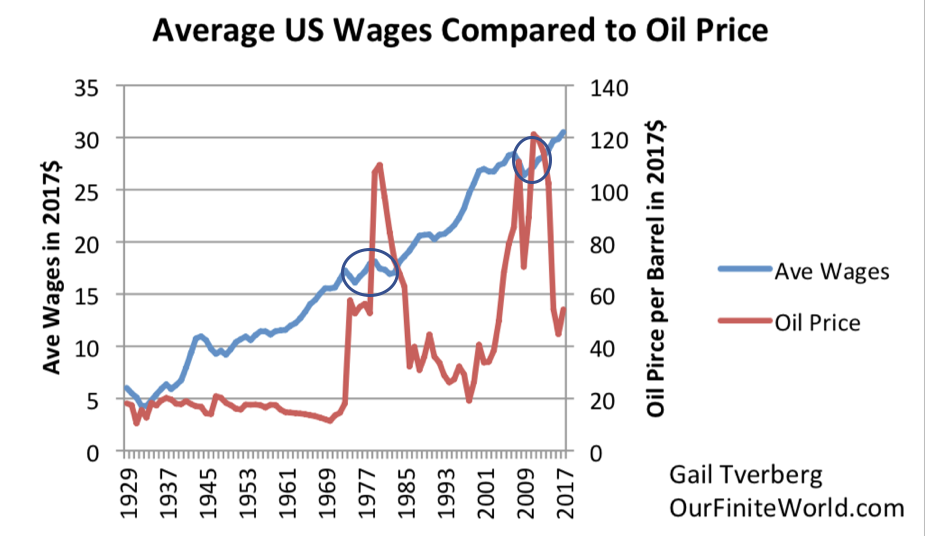

Prices seem to be tied more to what customers can afford than to the cost of production. Note that when energy supplies were low in the 1920 to 1930 period, oil prices declined. This pattern occurred because the growing wage disparity led to more people who could not afford very many goods and services made with oil products.

Figure 10. Historical inflation-adjusted oil prices, based on inflation-adjusted Brent-equivalent oil prices shown in BP Statistical Review of World Energy 2018.

Looking at Figure 11 below, we see a situation where US average wages seem to rise only if oil prices are low. If oil prices are high, it becomes more economical to send manufacturing to countries using cheaper energy products and offering lower wages. Such substitution leads to fewer US jobs and recession.

Figure 11. Average wages in 2017$ compared to Brent oil price, also in 2017$. Oil prices in 2017$ are from BP Statistical Review of World Energy 2018. Average wages are total wages based on BEA data adjusted by the GDP price deflator, divided by total population. Thus, they reflect changes in the proportion of the population employed as well as changes in wage levels.

The Federal Reserve is very much aware of the fact that high oil prices lead to high food prices, and thus are a problem for the economy. It may also be aware of other issues related to high oil prices, such as loss of competitiveness in the world market.

The Federal Reserve has a powerful tool for fixing the problem of high oil prices–its Open Market Committee can raise short-term interest rates, and thereby make loans more expensive. For example, if interest rates can be changed so that auto loan interest rates rise from 5% to 6%, this makes automobile monthly payments more expensive, and thus reduces demand for cars. Indirectly, this reduces demand for oil, both for manufacturing them and for operating them.

In fact, the Federal Reserve seems to have been a major contributor to the Great Recession of 2007-2009. It first lowered interest rates in the early 2000s and helped create a debt bubble, particularly in sub-prime housing. It later raised interest rates. The higher interest rates plus high oil prices popped the debt bubble.

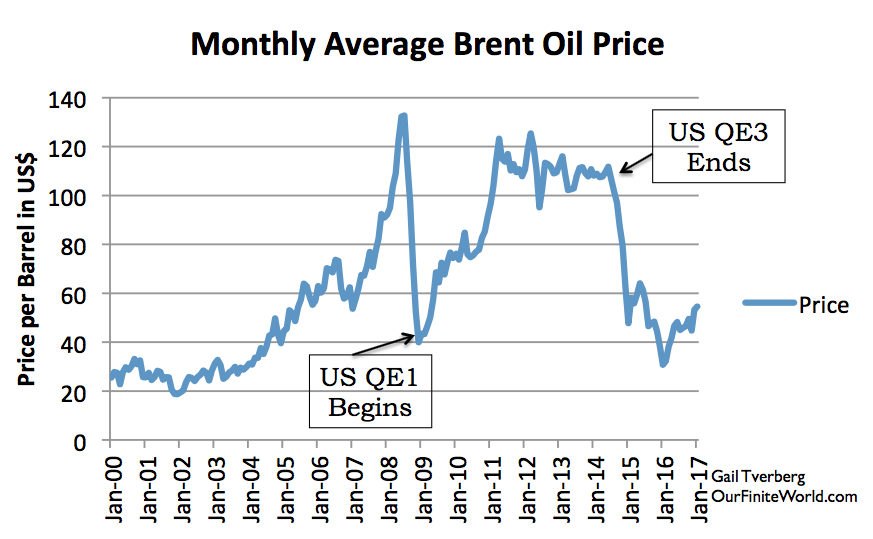

Quantitative Easing (QE) is a program that was added in recent years to adjust interest rates, over and above the impacts available from changes to short-term interest rates. Figure 12 shows that these interest rate changes seem to have had a close correspondence to turning points in oil prices. QE was added in late 2008 to reduce interest rates and thus raise oil prices. Removing QE seems to have had the opposite impact.

Figure 12. Monthly average spot Brent oil prices based on US Energy Information Agency data, together with dates when the US began and ended Quantitative Easing.

What we are facing going forward is a debt bubble made possible by a long period of very low-interest rates. The Federal Reserve now seems to be intent on popping this bubble by raising short-term interest rates and selling Quantitative Easing securities at the same time. If the Federal Reserve does succeed in popping the debt bubble, oil prices (as well as other energy prices) could fall very low again. If I am right, we can expect another major recession. It will be characterized by low demand, low commodity prices and layoffs in many industries.

Conclusion

The more a person looks at the story of how rising oil prices might allow oil extraction indefinitely, the less reasonable it seems. If the story about oil prices rising endlessly were true, we would have seen coal prices rise endlessly in Europe a century ago, when it was the dominant form of supplemental energy available. It didn’t happen.

Instead, what we need to be concerned about is the possibility of rising conflict. The energy situation may become increasingly like a game of musical chairs if the amount available from sellers at an affordable price falls too low. The winners will attempt to obtain an adequate supply for themselves. It is not clear that this strategy can have winners, but perhaps I have not considered all of the possible outcomes.

One of the issues with inadequate energy supplies is the difficulty in obtaining adequate tax revenue. If tax revenue is an issue, there is likely to be a push to reduce donations to organizations that act to bring countries together, such as the European Union and the United Nations. Subsidies of all types are likely to be on the chopping block. Government services of all types are also likely to be reduced or eliminated, from bridge repairs to retirement programs for the elderly.

Most of us have never been taught about resource wars. The wide availability of fossil fuels eliminated the need to even think about a possible lack of energy resources or other limited resources such as fresh water. Unfortunately, resource conflict may be back in some new 21st-century version in the not too distant future.

Needless to say, I am not advocating conflict and cutting programs. It is just that energy problems and financial problems are very closely linked. This is the way that things seem to work out.

Disclosure: None.

The Fed is less concerned about popping the bubble than making rates rise back towards some area of normalcy as well as clearing a little room for QE by lowering their current QE for the time being. They should have been doing this years ago. It is dangerous to be tightening this late in a cycle but their behavior has been illogical for so long they feel they must do it before another downturn.

As for downturn speculation, the US is inflating the deficit which is spurring economic growth for now with no major collapse in the dollar or over inflation for the time being. We should be safe for now as long as there isn't a big spike in oil prices, the trade war gets worse, or real war breaks out and affects things like oil.

The Trump administration seeks to limit the success of China. China's economic success would profit American industry. Chinese people love American products. But perhaps Trump believes a China success would require too much energy. That is a dismal conclusion that needs a fix.

This is certainly one of the most interesting articles published in Talkmarkets. The Fed prunes wages. I wrote about that. But it pops bubbles at the same time. It is having difficulty popping tech inspired housing bubbles, however. Tech may be insulated from this energy story, compared to other industry. Tech makes money without the need for as much energy. And it profits off of automation.