How Concerning Are Predictions Of A Stock Market Crash?

Forecasting Is Difficult At Best

Typically, several times a year headlines contain predictions about a coming stock market crash. Calendar year 2017 is no excpetion with recent bearish calls coming from Jim Rogers and David Stockman.

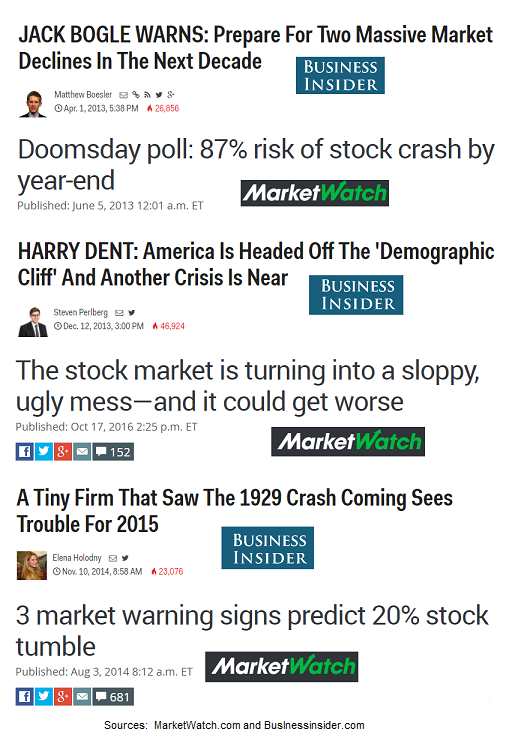

Since markets are an extremely difficult and complex animal, our purpose here is not to criticize anyone, but rather to highlight the “grain of salt” nature of any stock market forecast. The dated headlines below featured similar gloom and doom calls, and yet, global markets remain near all-time highs.

It should also be noted that crash probabilities have hit “pay attention” levels a handful of times over the last few years. For example, the market’s risk-reward profile in October 2011 and February 2016 left the door open to a multiple year bear market. In both cases, stocks righted themselves and the hard data began to improve in a meaningful way.

An Extremely Rare Stock Market Shift Recently Occurred

This week’s video covers a rare market shift that has only occurred two other times in the past 28 years. The video also compares 2016-17 to the 1987 crash, dot-com peak, and financial crisis to help us better understand the odds of bad things happening relative to the odds of good things happening. After reviewing present day facts relative to historical facts, you can make your own call.

Scary Headlines Are Not Uncommon

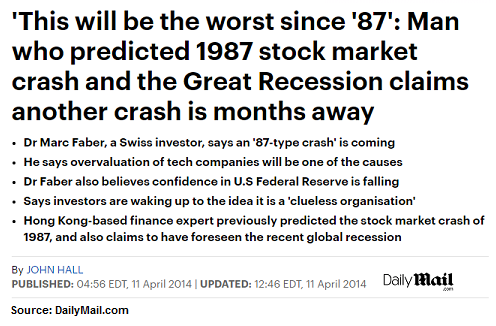

Given the difficult nature of attempting to predict a complex future, our approach will continue to focus on the facts we have in front of us today, rather than headlines similar to the one below that was published on April 11, 2014. Markets can do anything at anytime, which highlights the need to remain flexible and open to all outcomes, from extremely bullish to extremely bearish.

(Click on image to enlarge)

Could A Multiple-Year Rally Be In The Cards?

Instead of a crash, is a surprising multiple-year rally within the realm of reason? As outlined in detail in a May 30 article, 2016-2017 looks more like a major bottom than a market that is forming a major top.

Disclosure: This post contains the current opinions of the author but not necessarily those of Ciovacco Capital Management. The opinions are subject to change ...

more