Housing Data Of Horrors

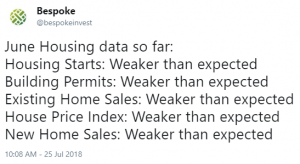

Housing data that has been released this month has been absolutely brutal. Below is a tweet from our @bespokeinvest Twitter feed earlier this morning that sums up the data well:

Stock price movements are forward-looking, which explains the drop we’ve been seeing in the homebuilder ETF for the last six months. As the rest of the market rebounded off of the first quarter correction lows, the homebuilder stocks continued to trend lower. A combination of rising interest rates and the Trump tax plan (which reduced deductions for many homeowners) have been a double whammy, and it’s now showing up not only in homebuilder stock prices but also in housing-related economic data.

As shown in the one-year chart for the homebuilder ETF (ITB) below, investors are looking at a pretty significant breakdown yet again if the ETF closes below $37.

While it has yet to negatively impact the rest of the stock market, continued weakness in housing will eventually get the market’s attention.

We cover housing and the rest of the economy in our daily more