Hot Bargains In Big Biotech

It has been an eventful year in the big pharma and biotech space, and a lot is happening in this space that biotech investors should take note of. The public has become dutifully aware of the phrase “tax inversion” due to some high profile mergers and proposed mergers trying to use acquisitions to lower overall corporate tax rates by domiciling outside the United States.

Activists have also targeted the area in 2014. Amgen (Nasdaq: AMGN), the granddaddy of biotech stocks, has seen increased pressure from agitating fund managers and Allergan (NYSE: AGN) was pushed to put itself for sale for over $60 billion after a lengthy fight with Bill Ackman and other activists this week. This uptick in activity has brought a lot of attention to the space, and I have picked my two favorite biotech plays that are trading at attractive valuations and are begging to be added to your portfolio.

The majority of the big four of biotech,Gilead Sciences (Nasdaq: GILD), Regeneron Pharmaceuticals (Nasdaq: REGN), Celgene (Nasdaq: CELG) and Biogen Idec (Nasdaq: BIIB), have had very good years with one massive buying opportunity in early March that caused significant declines across the biotech sector that soon dissipated for the larger capitalization firms within the complex.

So where will the opportunities be within the space in 2015? I continue to allocate a third of my own biotech portfolio in the small cap biotech space. These high risk/high reward plays usually have no earnings but potentially lucrative products under development and testing. I mitigate the risk of any one stock blowing up and hurting my overall performance by taking small stakes in a myriad of promising small cap concerns. However, when a company lives up to its potential returns can be staggering. This is the case for Avanir Pharmaceuticals (Nasdaq: AVNR) which is up more than 150% since being included in Small Cap Gems portfolio in our inaugural issue in July.

As exciting as the small cap biotech area can be, the majority of my biotech portfolio is orientated to large cap concerns that have established products, solid revenue growth and real earnings. This is what we will focus on within this article as I would like to talk about a couple of large cap biotech plays with great growth prospects and very reasonable valuations. I think they will continue to be winners in 2015.

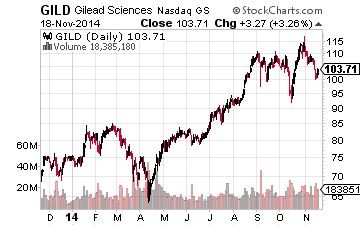

Let’s start with Gilead Sciences (Nasdaq: GILD) which has had a rare 10% pullback recently. The trigger for the decline was the news that AbbVie (NYSE: ABBV) was planning to act as a patent troll by using some patents in hopes to slow Harvoni, Gilead’s new hepatitis C combo drug just approved by the F.D.A. for use in the United States. Harvoni delivers lower costs to patients than the previous hepatitis C combo options as well as has much fewer side effects. Gilead owns both drugs in the combo which will result in more revenue to Gilead even while lowering the cost to insurers substantially. This is a win/win all the way around.

AbbVie owns neither of the drugs in the new combo and Gilead already had patents pending. Even in our litigious society, this is likely to be nothing more than a nuisance over the long term but the decline is a nice opportunity for investors who missed Gilead’s big run over the past two years to get into blue chip growth plays on the cheap.

Sovaldi (the core component of Harvoni which was approved earlier this year) and Harvoni still are just getting started in Europe and are in the approval process in Japan – with its one million hepatitis C patients. Despite this, Gilead’s hepatitis C sales should approached $12 billion in FY2014, the biggest first year sales of any drug launch in history. These two drugs look like they easily could do $20 billion in annual sales during their upcoming peak years.

The company continues to be the market leader in the HIV space as well and has improved versions of its franchise drugs coming on line in the near future here as well. Gilead has a deep pipeline with compounds to treat Leukemia, RSV and other deadly diseases in late stage testing.

The company should produce some $10 to $15 billion in free cash flow in 2015, a good portion of which will find its way to increasing stock repurchases as this will produce shareholder value given how cheap the shares currently are. Gilead almost quadrupled earnings to nearly $8 a share in FY2014. I have $10 a share in profits modeled for FY2015 giving the stock the dirt cheap valuation of 10 times forward earnings.

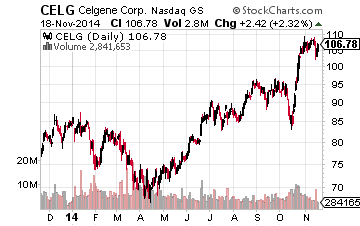

Celgene (Nasdaq: CELG) is my second favorite large cap biotech stock at the moment. There are myriad things to like about this emerging biotech juggernaut. It has a blockbuster drug called Revlimid that treats various forms of blood cancer. It also has several new compounds to treat ovarian cancer and arthritis that are garnering solid revenue growth. Most exciting is a one of the deepest pipelines in the industry. Celgene currently has some 30 Phase III trials underway or planned for new drugs and/or new indications which is a lot of “shots on goal” that bodes well for future potential blockbusters.

Over the past five years the company has delivered approximately 25% annual growth in revenues and over 30% annual increases in earnings. Despite the company’s record of delivering impressive earnings and revenue growth and its deep pipeline the shares are priced at just over 20 times next year’s projected earnings. This is only a 25% to 30%premium to the overall market multiple. Given Celgene has vastly superior growth prospects to the market as a whole I believe stock deserves at least a 50% to 60% premium to the overall market. This current valuation discount could lead to another good year for capital appreciation for Celgene shareholders in 2015 as it narrows and the company delivers against expectations.

Neither of these large cap biotechs are likely to deliver the gains of picking the right small caps in the sector will over the coming 12 months. However, neither is likely to implode either given their earnings visibility, positive catalysts and reasonable valuations. They are both good selections for investors starting to build a solid foundation for a well-diversified biotech portfolio. Gilead is lining up to be one of the core inaugural positions in the Blue Chip Gems portfolio when it launches at the end of the year as well.

I have another small cap biotech in my Small Cap Gems portfolio that’s just delivered 35% in three weeks and poised to go even higher. Click here to find out more about how Small Cap Gems can make money for your portfolio.

Disclosure: L more