Higher Homeownership Rates Precrisis Predicted Larger Growth Declines

from the St Louis Fed

New research shows that among advanced economies, a country’s homeownership rate prior to the financial crisis turned out to be a powerful negative predictor of both its:

- Postcrisis growth trajectory

- Subsequent change in national homeownership rate

“It makes sense for these outcomes to be related, since problems in housing and mortgage markets were at the center of the financial crisis and Great Recession," wrote William Emmons, lead economist for the St. Louis Fed’s Center for Household Financial Stability, in a recent Housing Market Perspectives report.

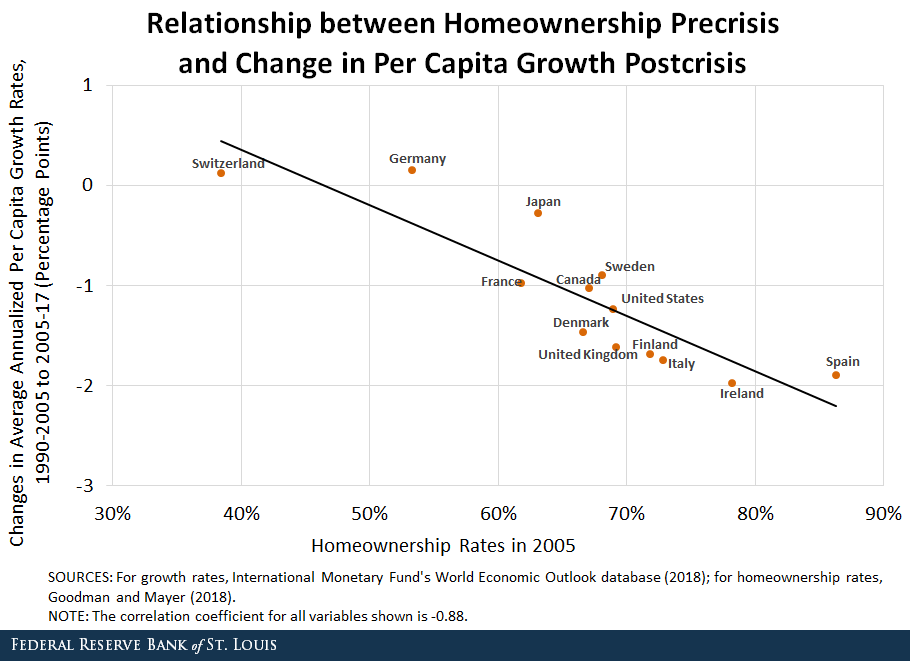

The research shows higher homeownership rates before the crisis predicted larger growth declines after the crisis, and vice versa. Relatively high homeownership rates before the crisis also predicted larger homeownership declines through 2015.

Homeownership Rates Before and After the Crisis

Emmons noted that over the past few decades, national homeownership rates have varied widely across 13 advanced economies. By 2005, homeownership rates converged somewhat, but the cross-country span remained large.

For example, of the 13 countries, Switzerland had the lowest homeownership rate in 2005 at 38.4% while Spain and Ireland had the highest rates at 86.3% and 78.2%, respectively.

Between 2005 and 2015, changes in national homeownership rates ranged from an increase of 12.9 percentage points in Switzerland to declines of more than 8 percentage points in Ireland and Spain.

In the U.S., the homeownership rate declined 5.2 percentage points from 68.9 percent in 2005 to 63.7 percent in 2015. “The large drop in homeownership in the U.S. reflects the severity of the housing crisis here," Emmons wrote.

Relationship to Postcrisis Growth

Emmons said the research also shows a clear negative relationship between a country’s average homeownership rate in 2005 and the change in its per capita growth rate between the pre- and post-crisis periods. The correlation between these two measures is - 0.88, “a very strong relationship," Emmons wrote.

In the U.S., average per capita growth fell from an annualized 1.96 percent in the 15 years before the financial crisis to 0.73 percent in the 12 years immediately after the crisis. This drop of 1.23 percentage points is the median change for the 13 advanced economies discussed in the report.

Emmons said, “The correlational evidence suggests that countries with relatively high homeownership rates are more susceptible to severe growth slowdowns and reversals in homeownership rates, at least when the source of the economic disruption is housing."

Additional Resources

- Housing Market Perspectives: National Homeownership Rates in 2005: A Powerful Negative Predictor of Post-Crisis Recovery

- On the Economy: Why Is the Homeownership Rate Still Falling?

- Dialogue with the Fed: Is Homeownership Still the American Dream?

Disclaimer: Views expressed are not necessarily those of the Federal Reserve Bank of St. Louis or of the Federal Reserve System.

No content is to be construed as investment advise and all ...

more