Here Is Something You Can Worry About…

One of the keys to being successful in the stock market game is having the ability to remain objective. In short, it is critical to focus on what “is” happening in the market as opposed to what you think “should” be happening. It is employing the latter approach – especially when coupled with a little thing called hubris – that can cause massive pain in a portfolio.

So here’s a tip, if you ever find yourself saying “the market is wrong,” you need to stop what you are doing and re-examine the situation. Remember, markets are never wrong, people are.

Getting to the point on this fine Thursday morning, I have opined that while absolute valuation metrics in the stock market are clearly elevated, they won’t matter until they do – and that right now they don’t matter much due to the level of interest rates and the growth in the economy. (No, I am not suggesting that the economy is hitting on all cylinders, rather that the economic growth rate is “good enough” to keep the stock market out of a big, bad bear market.)

However, in an effort to remain objective, it is important to recognize that there are some areas of the stock market that are indeed overvalued – no, make that very overvalued – and that valuation may appear to matter here. At least a little.

To be sure, the current bull market is one of the most hated and feared markets I’ve ever seen in my 36-year career. But, given the 2008 debacle and the ensuing crises in Europe that kept thing very volatile for years, investors really can’t be blamed for remaining cautious. After all, nobody wants to go through THAT again, right!

But with the Fed turning cash into trash and bonds yielding next-to nothing in the U.S. (and even worse in other places around the world), there has been little choice but to invest in the stock market. So although investors have been forced to invest in the stock market in order to find growth, they have done so begrudgingly.

Exhibit A in my argument here is the popularity of “low volatility” funds and ETFs. So, if an investor is worried about the risk in the stock market, it makes sense that they would invest in something that is supposed to be “safer” than the major indices.

Enter the “low vol” trade. The problem here is this is a trade that has become “crowded” to say the least.

In fact, according to the computers at Ned Davis Research, the median Price/Earnings ratio for the S&P Low Volatility Index stood at 24.5 in the spring of this year. And while the data only goes back 44 years, it is important to note that (a) the mean P/E for this “low vol” index since 1972 has been just over 13, (b) this P/E was 14 at its peak in 1987, (c) the P/E was just over 18 in 1999, and (d) currently stands at 22.

To put this into mathematical terms, the current P/E ratio for the “low vol” index is currently more than two standard deviations above the average. Yikes.

Apparently this is starting to matter to investors – but again, I’m going to say that it only matters a little at this stage.

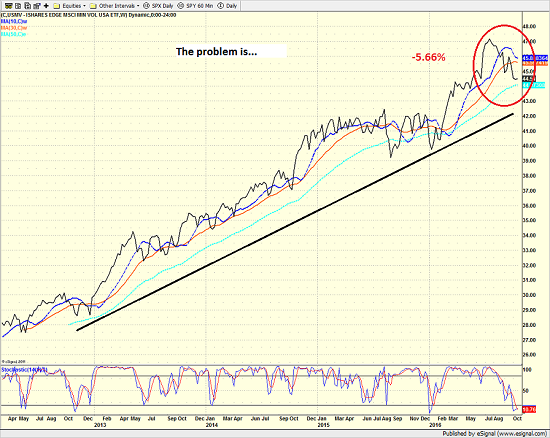

iShares Min Vol ETF (USMV) – Weekly

As the chart above indicates, the iShares Min Vol ETF (USMV) has pulled back 5.7% from its recent high, which is more than double the decline seen in the S&P 500.

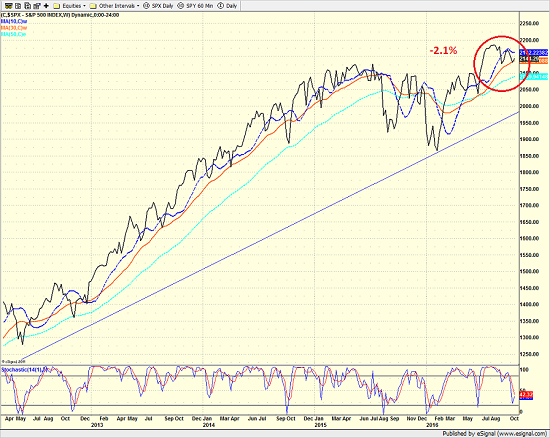

S&P 500 – Weekly

One of the points here is that investors need to remember that when a trade – ANY trade – becomes too popular, a “reversion to the mean” move tends to occur. As such, it is not at all surprising to see that the USMV has pulled back more than the major indices during the recent sloppy period in the market. The reason is simple. Folks don’t want to get caught in a wildly overvalued trade when the music stops.

For the record, we owned the USMV for much of the first half of the year in our Global Macro models as I too wanted a little “safety” in our long equity positions. My models said I needed to be long stocks, so I responded by “holding my nose” and using what was perceived to be a “safer” trade.

However, as our models became more upbeat on stocks in the early summer, we decided it was time to quit being a weenie and get long the market properly. Thus, I am pleased to say that we no longer own these “low vol” funds in the Global Macro models.

In closing, let me say that the valuations in the “low vol” space is indeed a reason to be concerned, but perhaps not reason alone to leave. However, it is important to note that “crowded” trades do tend to perform worse during broad market declines. So, one should NOT expect these “safe” areas of the stock market to save them when/if the bears come to call again.