Health Care Going Strong

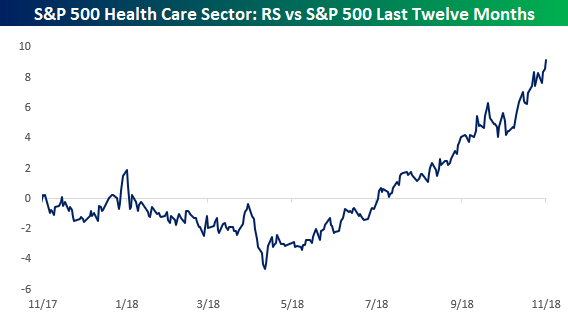

The Health Care sector has been on an impressive run this year. While not immune from the downturn this Fall, it has recovered nicely with exceptional relative strength. Heading into the final month of the year, Health Care is outperforming the S&P 500 by an enormous margin. Granted it had been in a solid uptrend since the spring, but with the S&P 500 seeing a substantial amount of red since the peak on September 20th, it comes as no surprise that investors would flock to a more defensive sector.

Although Health Care’s strong relative strength may not jump out when looking at the sector’s price chart, the pattern forming since the broader market peak look promising. Since bottoming in late October, Health Care came back to test resistance at around $1080. After failing that test, it pulled back making a higher low, and with another day of gains today, it has finally broken out above former resistance.

In the table below, we highlight the 24 stocks within the Health Care Sector that are up since the S&P 500’s closing high on 9/20. Cigna (CI) has been the best performer during this time rising 10.83%. Right on CI’s heels are Eli Lilly (LLY) and Merck (MRK) which have also both seen double-digit gains. While the same cannot be said for Cigna, LLY and MRK have also seen extraordinary gains YTD. HCA Healthcare (HCA) has the second-best growth YTD at 65.54% and also ranks the fourth best since the peak.

We update sector relative strength charts each week in our Sector Snapshot report to compare the performance of the ...

more