Guideposts For Bulls And Bears

Short-Term Outlook Remains A Mixed Bag

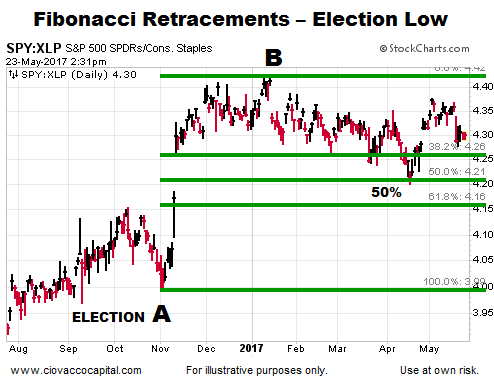

While the primary trend still strongly favors the bulls, the bears have made some progress on the momentum and vulnerability fronts. The chart below shows the performance of the S&P 500 (SPY) relative to defensive-oriented consumer staples (XLP). From a bullish perspective, the ratio recently held at the 50% retracement, which leaves the door open to the uptrend continuing and the ratio going on to make a higher high. From a bearish perspective, the ratio has not made a higher high since January, which speaks to waning and vulnerable momentum. Intermediate-term bearish odds would improve if the ratio breaks below and stays below the three major Fibonacci retracement levels.

The Way Forward

This week’s stock market video highlights the importance of market fractals in the context of very long-term trends.

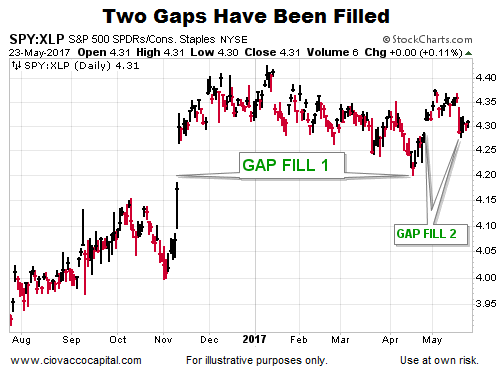

Markets Like To Revisit Gaps

It is very common for markets to retest gaps prior to resuming the existing trend. Therefore, when charts have unfilled or untested gaps, it leaves the door open to future gap-filling weakness. The SPY/XLP ratio had a massive gap up after the U.S. election. The election gap was retested in April and thus far falls in the successful retest category. The ratio experienced a smaller gap up in late April. Last week, the April gap was revisited and, thus far, it appears to be a successful retest. The bears want to see price migrate below the gaps, allowing them to be classified as failed breakouts.

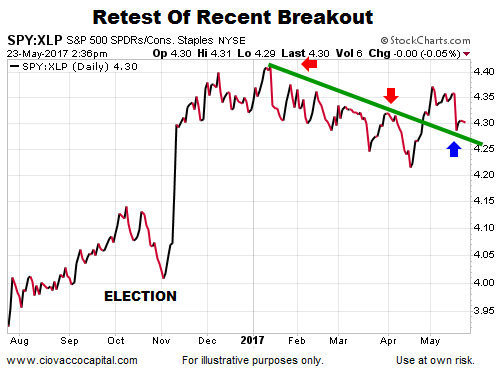

Bulls Want To See A Higher High

The mixed-bag theme also applies to the SPY/XLP chart below. It is hard to get too excited about the market’s tolerance for risk when the ratio below is making a series of lower highs and lower lows (see downward-sloping green trendline). The bulls have reason to hope with the recent break above the green trendline. The first pass back to the trendline held (above blue arrow). Bearish odds would improve if the ratio is unable to hold above the green trendline.

This entry was posted on Tuesday, May 23rd, 2017 at 5:56 pm and is filed under Stocks - U.S.. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

Disclosure: This post contains the current opinions of the author but not necessarily those of Ciovacco Capital Management. The opinions are subject to change ...

more