Gross Margins Alarmingly Continue To Contract In Q1 2017 For Bed Bath & Beyond

If you’re a brick & mortar retailer, your business has been under siege for a lengthy period of time. Your foot traffic, sales and earnings are likely waning and flagging negatively in the face of a brutal onslaught from the likes of e-commerce titans. Bed Bath & Beyond (BBBY) has proven to be a victim of this era’s shift from brick & mortar consumption toward e-commerce retail sales.

The home goods retailer has been victimized to the extent that in 2016 EPS fell by roughly 10% even as the company was buying back large quantities of its own shares. In my article titled Bed Bath & Beyond Reports A Continued Gross Margin Contraction But Beats Q4 Expectations, I discuss the problems that found the retailer in poor standing with consumers and shareholders alike. While sales were slightly higher in the year before, the retailer’s saving grace for those higher sales were largely based on new store openings and acquisitions. Organic sales were large, lower year-over-year inclusive of double-digit e-commerce sales growth.

In the 1st quarter of 2017, Bed Bath & Beyond found itself in the increasingly worrisome position of expressing poor sales and earnings. Both operating metrics missed analysts’ estimates in the Q1 period with earnings falling while sales grew to $2.7bn, an increase of only 10 basis points. The biggest issue with the sales increase, as it has been in previous quarters, came from same-store-sales that fell approximately 2 percent even as digital sales grew above 20% for the period. Stripping out digital sales, storefront sales fell mid-single digits. Earnings per diluted share were $.53 and missed analysts’ estimates by roughly $.13 a share. It’s not just that earnings per diluted share missed analysts’ estimates, it’s that they fell substantially year-over-year. In Q1 2016, Bed Bath & Beyond reported earnings of $.80 per share. This year’s EPS of $.53 a share is a reduction of roughly 40 percent. It begs to discover how the company will perform for the remainder of the year and with consideration to the retail landscape not showing favor for the retailer.

As it was in each of my previous Bed Bath & Beyond analytical works, it was during the Q1 2017 period. Gross margins continue to contract for the home goods retailer and contract in a most concerning manner. The most recently ended period marks an 11th straight quarter in which Bed Bath & Beyond reported contracting gross profit margins. Gross margin for the quarter was approximately 36.5% as compared to approximately 37.4% of net sales in the first quarter of last year. The 90 basis point declines in gross profit margins is also a decline quarter-over-quarter and a stacked annual decline of nearly 160 bps. For the Q1 2017 period, the gross margin decrease as a percentage of net sales was primarily due to, in order of magnitude: An increase in net direct to customer shipping expense as a result of the Bed Bath & Beyond free shipping thresholds being at $29 for the full quarter this year while it was at $49 for about half of the first quarter last year. Second, an increase in coupon expense resulting from an increase in redemption, partially offset by a decrease in the average coupon amount. Simply put, as Bed Bath & Beyond’s digital sales continue to grow they are simultaneously eroding the company’s profitability in such a competitive e-commerce landscape that demands lower shipping fees to consumers. Bed Bath & Beyond is forced to eat the shipping costs and to the detriment of profits and shareholder returns. The retailer’s options are clearly limited to its ability to compete.

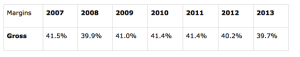

A crisis has long since been brewing under the surface of Bed Bath & Beyond’s sales performance for several years now, even if we look back some ten years. Gross margins tell the story and foreshadow the future for most retailers and that is no more proven the case when we look at Bed Bath & Beyond’s gross margins. As it has become routine, I always offer to investors/readers a review of Bed Bath & Beyond’s gross margins in the following chart:

(Click on image to enlarge)

As indicated in the chart taken from my 2015 article titled Bed Bath & Beyond's Gross Profit Margins Come Home To Roost, Bed Bath & Beyond’s gross margins are well below, well below even Financial Crisis levels. It begs to question with the economy on solid footing, what would happen to Bed Bath & Beyond during recessionary economic conditions. But with respect to the here and now and despite an abysmal 1st quarter performance, Bed Bath & Beyond did not offer a revision to its FY17 guidance. Coming into the year the retailer offered an admission that sales would be higher by low to mid-single digits with earnings falling low single digits to 10 percent. Given the exacerbated EPS declines in the 1st quarter and with no clarity of improving metric performance by management for the 2nd quarter in view, I’m of the opinion that Bed Bath & Beyond’s CEO is putting investor capital at significant risk. The long-established trends for gross margin contraction and their increasing weight on earnings suggest that Q2 will find the CEO revising FY guidance downward for both sales and earnings. Below is what CEO Steve Temares had to offer on the Q1 2017 Conference Call with Investors and Analysts:

It remains to be seen whether these challenges were more pronounced in, or unique to, the first quarter due to the smaller sales base in this period, and/or a later start to the summer selling period. We believe we'll have better visibility after the second quarter and if necessary we'll update our full year modeling assumptions at that time. We'll provide further information related to the second quarter and full year 2017 on our next quarterly conference call on Tuesday, September 19.

For the sake of investors who believe they may be acquiring a deeply valued retailer with a relatively clean balance sheet and steady cash flows, I offer to you a second glance at the company’s deteriorating gross profit margins. In 2015, BBBY shares traded at roughly 11 X FY15 EPS. Many believed a bargain was to be had in shares of BBBY at that time and many, many articles suggested as such. Having said that, in 2016 BBBY shares traded at roughly 9 X FY16 EPS. Today, shares are trading at roughly 7 X FY17 EPS. BBBY shares have been proven to be nothing more than a value trap, as gross margins weigh on EPS and EPS continues its decline thus far in 2017. And this, all of this with Bed Bath & Beyond investing in its digital facing sales, adding logistic capabilities and efficiencies, acquiring companies in the e-commerce arena, revising its return policies, adding new products, categories and brands and of course increasing its loyalty and rewards program that commenced in 2016. When retailers offer they are “doing this, that and the other to improve results”, if you don’t know the value of those initiatives it is likely because the retailer knows the initiatives aren’t incremental enough to improve metrics. If they were incremental, they would likely outline the value as to encourage investor sentiment. In the case of Bed Bath & Beyond and its peers, they’ve all outlined a plethora of ongoing initiatives that have found with them little to no metric improvements.

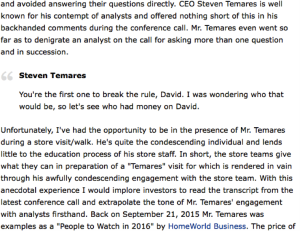

Bed Bath & Beyond’s situation is increasingly worrisome and if you’ve heard me say that before, even within this narrative, you’ll likely continue hearing it. The CEO’s callous way for which he has handled the declining metric performance is only slightly usurped by his discourse with analysts on quarterly conference calls. Temares carries a contemptuous manner towards answering analysts’ questions and has ever since the company finally started allowing for quarterly conference calls. I first raised this concern to investors in Q1 of 2016 in my article titled Bed Bath & Beyond Gross Margins Continue To Contract In Q1 2016. How fitting a title for review given the state of business for the retailer and juxtaposing a CEO that, for some unknown reason, is still at the helm. Having said that, Temares’ compensations has been reduced and rightfully so. But back to my point concerning the CEO’s demeanor as depicted from the Q1 2016 conference call and denoted below:

(Click on image to enlarge)

If you had the notion that from this exchange with analysts in the past that Temares would have changed his “tune”; read the latest quarterly transcript to understand the error in that assumption. I’m of the opinion that Mr. Temares well understands the improbability of greatly improving the trends in the Bed Bath & Beyond business near term. More than likely and most understandably, the management team is discouraged about not being able to defend its business from the ever-evolving retail landscape that is experiencing a seismic shift in means of consumption. It hasn’t been and isn’t able to fend off the likes of Amazon (AMZN) and other e-commerce retailers. Bed Bath & Beyond’s own Beyond store (e-commerce business segment) verifies and validates its core brick & mortar business as being antiquated.

It is due to the aforementioned results, analysis and reasoning that Bed Bath & Beyond will likely embark on a shrinking program in the mid-term. Many of the retailer’s leases will come up for lease renewal as they do every year. During this renewal period, the company will likely review lease renewals of the underlying retail business for profitability, sales and with respect to long-term forecasting. While most Bed Bath & Beyond stores are profitable, that may not be the case in the future as is being indicated in most every metric outlined by the retailer. As such, the retailer has the ability to deny a lease renewal and close a store’s operations. Behind the scenes and without significant media coverage, Bed Bath & Beyond has been closing a number of World Market Cost Plus stores, as the acquired retail concept simply hasn’t boosted Bed Bath & Beyond’s sales results since acquired. World Market Cost Plus is basically a larger Pier One Imports (PIR) footprint. And of course, we all have recognized the significant pressures on the Pier One Imports business for a number of years. Taken from the Q1 2017 Quarterly Transcript, here is what Bed Bath & Beyond’s management offers on the subject matter regarding its retail footprint:

As we've said, the pace of our store opening has slowed and we've increased the number of store closing over the past several years. And as leases come up renewal, if we cannot reach acceptable terms with our landlord, we would expect the pace of store closings to increase as a result of our assumptions regarding brick-and-mortar store traffic in future years, as well as the continuation of our market optimization strategy.

Without any real and incremental solutions to solve the problems plaguing Bed Bath & Beyond’s business, the hints of shrinking the business only further highlight its distressed state. By and large, the only new verbiage on the quarterly conference call centered on the longstanding Pack & Hold, back-to-college business operation.

Earlier this week, we published our campus ready college catalogue that highlight these products, services and solutions, as well as the tools needed by our college bound customers and their parents to transition smoothly to campus life. The book features a variety of great products to design a stylish and well-organized home away from home, information how to build a better bed as well as inspirational ideas and how to personalize your living space. And our popular pack and hold service which allows you to shop out store close to home and then pickup your items at our store close to campus. We also are working with colleges to expand our ship directly to campus program and our move in events which may take place on campus or at a store close to campus.

Pack & Hold has been in operation at Bed Bath & Beyond since 2002. It’s one of the reasons they dominate the business of college students heading back to campus and dorm rooms across the nation. At the heart of Pack & Hold is the consumers’ opportunity to start a registry with all the goods they will need for setting up their dorm or residence on or off campus. A student or student’s parents can simply go to any Bed Bath & Beyond store or online and enter any item they want directly into the registry. In stores, this is done with an RF scanner and online it is done with a click of the mouse. When the registry is complete, in-store personnel will pull every item on the registry, pack the goods and ship them to the provided, closest campus store address. The student or parent can then, on any date they choose, pick-up the goods closest to campus residence. This operation has been in place a long, long time and is one of the leading back-to-college operations in retail, to the extent it is being utilized today. So while management decided to add some level of improvement to the program it is likely, and as most improvements have proven, not incremental.

There remain two potential catalysts for shares of BBBY as they currently trade around $30 a share and have been more than cut in half since the 2015 highs. One catalyst would be the event of a CEO change. Steve Temares has proven incapable of driving shareholder value and for every failed attempt over the years. Given his failed attempt to capture a bonus package in 2016 and the recent reduction in his total compensation, the BOD may be stimulating a change at the helm of Bed Bath & Beyond. The second potential catalyst would be activist investor involvement. While this may occur, like most other activist involvement that becomes public, any boost in the stock from the event may prove fleeting and as such a good opportunity to reduce one’s exposure to the name. In any event, investors are best positioned with respect to the fundamentals of the company’s business operations, which are trending poorly for an extended period of time.