Greek Vote To Test Eurozone

Eurozone Exit Talk Will Increase

Just when you may have thought it was safe to jump back into the European waters following the ECB’s stimulative party, elections in Greece may rock the boat. From The Wall Street Journal:

Greek voters have thrown down a gauntlet by handing an impressive victory in Sunday’s elections to Syriza, a radical left-wing party that had campaigned on a promise to secure debt relief. Greece and the eurozone now need to swiftly convince the markets and ordinary Greeks that they can reach a deal. Prolonged uncertainty would lead to capital flight and even bank runs that would inflict serious damage on the Greek economy, potentially leading to Greece’s exit from the eurozone. Much hinges on how all sides conduct themselves in the hours ahead. The markets assume that the risk of Greece exiting the euro is small, but officials close to the situation are not complacent. Some fear that the compromises required on both sides may prove too difficult.

Markets Remain On Edge

The news from Greece is not surprising nor particularly unexpected, which aligns with the still tentative nature of the risk-on vs. risk-off ratios covered in this week’s stock market video.

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

Investment Implications - The Weight Of The Evidence

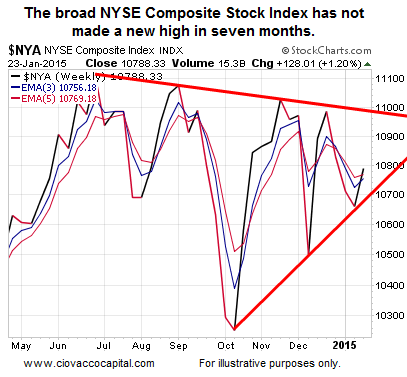

While the broad market continues to move sideways (see chart below), the bigger picture may call for a reduction in growth exposure this week. In addition to the news from Greece, a Fed announcement is coming Wednesday and GDP figures Friday.

Disclosure: This post contains the current opinions of the author but not necessarily those of Ciovacco Capital Management. The opinions are subject to ...

more