Good Time To Take Profits

Trading Strategy

Not all investors are sold on the Trump rally, however with some worrying about valuations or a forthcoming pullback. The potential impact that President Trump could have on the domestic and global economy continues to cause uncertainty or concern among some investors, though encouraging others. Also influencing investor sentiment are earnings, consumer sentiment and the magnitude and timing of future interest rate increases.

Jeff Hirsch in the Almanac Trader mentions how tempestuous March markets tend to drive prices up early in the month and batter stocks at month end. Julius Caesar failed to heed the famous warning to “beware the Ides of March” but investors have been served well when they have. Stock prices have a propensity to decline, sometimes rather precipitously, during the latter days of the month. March is the end of the first quarter, which brings with it Triple Witching and an abundance of portfolio maneuvers from The Street.

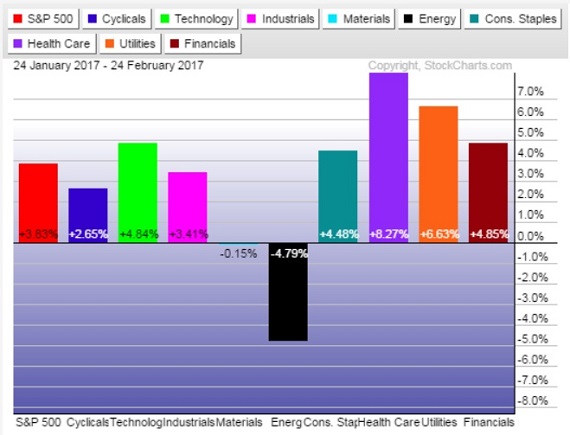

At such frothy levels a smart move is to consider taking some profits from the recent run up or at least hedging long bullish positions. In the near term we don’t fight the trend which is our friend. Until stocks prove otherwise, every pullback or pause should be considered an opportunity to load up on shares from your target stock list. In the graph below, defensive stocks are the leading sectors with the Energy group being the only loser.

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be ...

more