Gold Treads Water Ahead Of FOMC Minutes

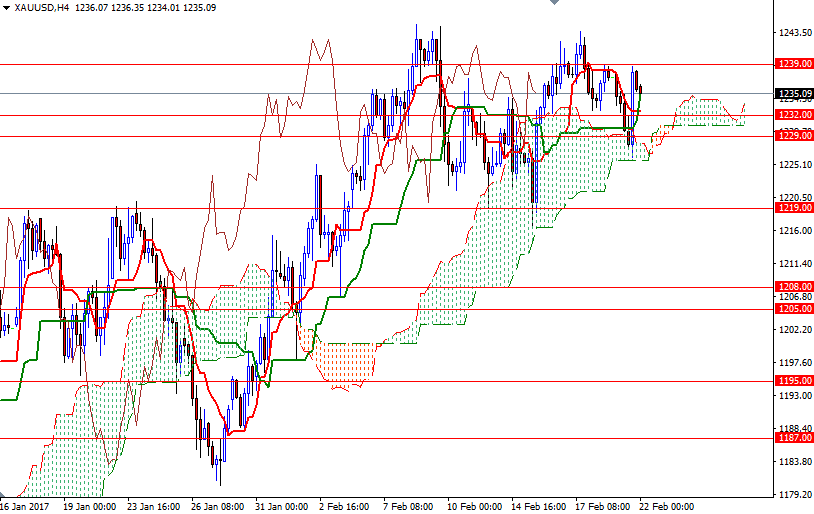

Gold prices ended a choppy trading session on the downside Tuesday. The XAU/USD pair initially pulled back towards the $1225 level after the support in the $1232/29 gave way but bounced up from there and tried break through $1239. The market is currently at $1235.09, slightly lower than the opening price of $1236.07.

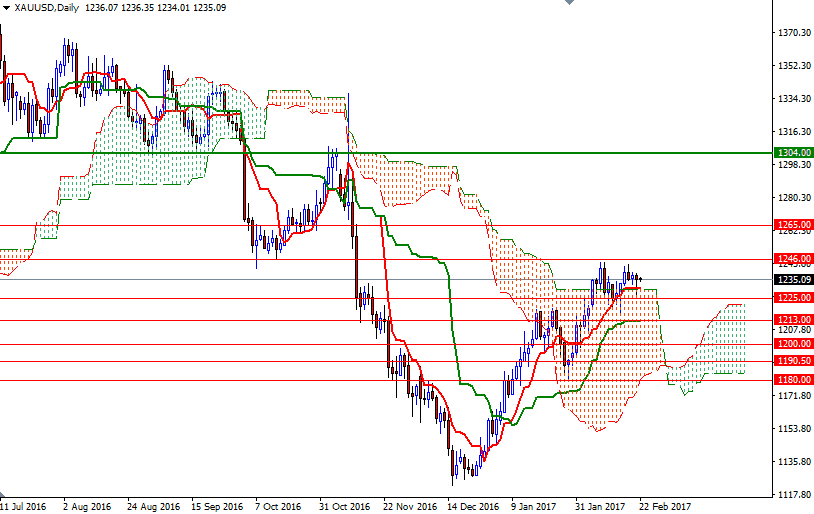

While hawkish comments from Fed officials underpinned the U.S. dollar, the European political concerns helped gold recover early losses. As the key levels are holding, the market remains well within the consolidation that we’ve seen for some time. The short-term technical charts remain bullish, with the market trading above the daily and the 4-hourly Ichimoku clouds, though flat Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines indicate the absence of a strong momentum.

(Click on image to enlarge)

The initial resistance level stands at 1239, followed by 1247/6. I think a break up above 1247 could give the bulls the extra power they need to challenge the bears waiting at 1252. Once the bulls clears 1252 on a daily basis, the market may proceed to 1261. To the downside, keep an eye on the 1232/29 are where the daily Tenkan-Sen and the top of the daily cloud converge. Below that, 1225 stands out as an obvious support. If this support is broken, then 1220/19 will be the next port of call. Breaking down below there would pave the way towards 1213/1.

(Click on image to enlarge)

Disclosure: None.

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade ...

more