Gold Slightly Down, Fed Minutes In Focus

Gold prices ended Tuesday’s session down $2.32 an ounce as the dollar rebounded and traders locked in profits ahead of the release of the minutes from the Federal Reserve’s September 25-26 policy meeting. World stock markets were mostly higher yesterday. U.S. stocks surged on the back of upbeat economic and earnings reports. Industrial production rose 0.3% in September, the Federal Reserve reported Tuesday.

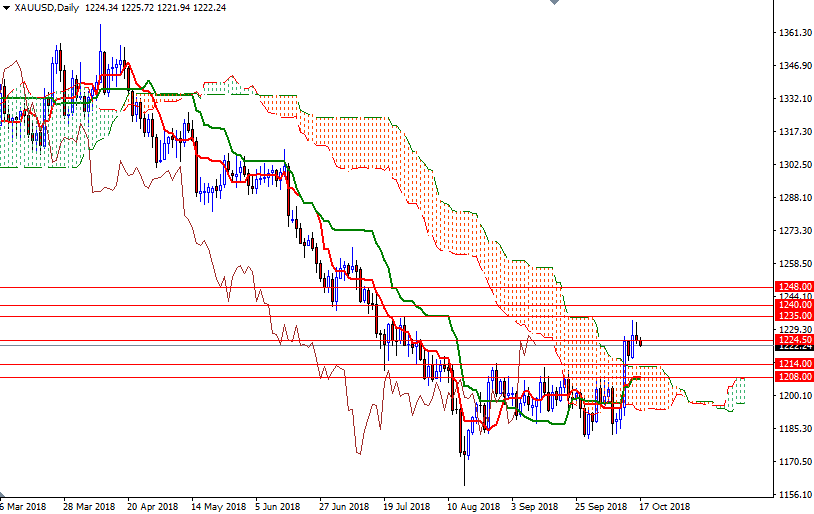

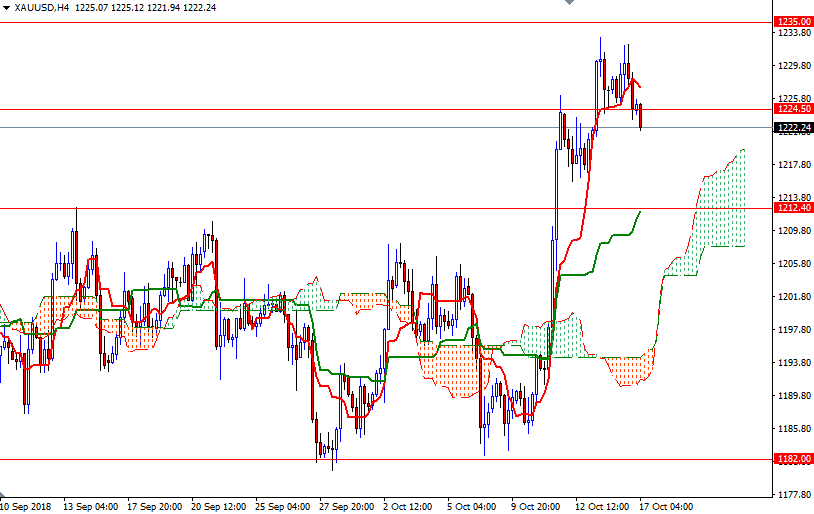

The market is trading above the daily and the 4-hourly Ichimoku clouds. In addition, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. The near-term technical outlook has improved since XAU/USD penetrated the daily cloud, but keep in mind that prices are still below the weekly cloud.

(Click on image to enlarge)

The short-term charts suggest that the market will test the support in the 1220.50-1219.50 zone. If prices fall through, then 1216 will be the next stop. The bears have to capture this strategic camp to challenge the bulls waiting on the 1214-1212.40 battlefield. The top of the daily cloud also resides in this area so a break below 1212.40 opens up the risk of a drop to 1208/5. To the upside, the initial resistance sits in the 1226.40-1224.50 area occupied by the cloud on the H1 chart. The bulls have to lift prices above the hourly cloud to make a move towards 1240/35, the confluence of the 200-week moving average and the 38.2% retracement of the bearish run from 1365.10 to 1160.05. If this resistance is broken, look for further upside with 1245.50 and 1252/48 as targets.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more