Gold Pullback Very Likely Over; Now On The Way To $1,400+

Market Update

I am currently traveling in Italy. Of course, I keep an eye on the banking crisis here. But so far people actually don't seem to care. Nobody is afraid of losing their money. Nobody is lining up in front of the banks. Instead the general belief is that as long as Italy is in the Eurozone it will be bailed out. But make no mistake. We are in the endgame of this fiat money experiment. It can take just a couple of months or even ten years. In the end the Euro will not survive while the US Dollar probably has just started a new bear market.

Central bankers and politicians will do everything to keep this ponzi scheme running. That means more money printing and more liquidity injections. That´s why I strongly believe we have now entered the so called 'crackup boom' [ref. Ludwig von Mises --ed.]. Everything will move up, which basically just means that your paper Euros and Dollars will simply lose purchasing power. You need to protect yourself against this disastrous development. Gold, Silver, mining stocks, commodities, cryptocurrencies and the general stock-market (especially biotech) will be the safe havens. We already have some well performing positions and I will continue to present more opportunities.

My main focus remains on Gold, which has just finished a pullback and should be on the way towards $1,415 - $1,430 in the next couple of weeks. My Gold model remains in bull mode and I don't see any short-term challenges here. In fact I guess Gold will move towards $1,500 before we will witness a severe and large multi-month pullback back to $1,300 or lower.

The S&P has been breaking out to new highs and our Biotech ETF is up already 25%!

Bitcoin has likely just started a pullback which might offer another chance to buy lower, but we have to be patient here.

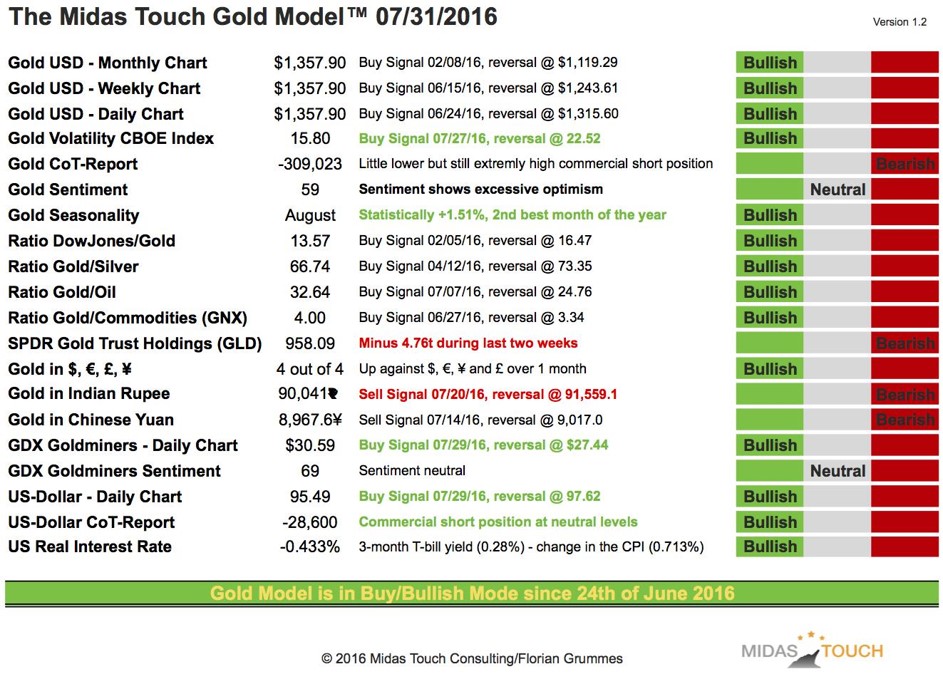

The Midas Touch Gold Model bullish since 24th of June

(Click on image to enlarge)

Compared to my last public report two weeks ago we have the following bullish changes:

Gold Volatility CBOE Index

Gold Seasonality

GDX Goldminers - Daily Chart

US-Dollar - Daily Chart

US-Dollar CoT-Report

Two signals shifted to bearish readings:

SPDR Gold Trust Holdings

Gold in Indian Rupee

One signal improved to neutral:

Gold Sentiment

Overall the model remains in strong bull mode since 24th of June. The recent pullback from $1,377 down to $1,310 did not change the model´s bullish result!

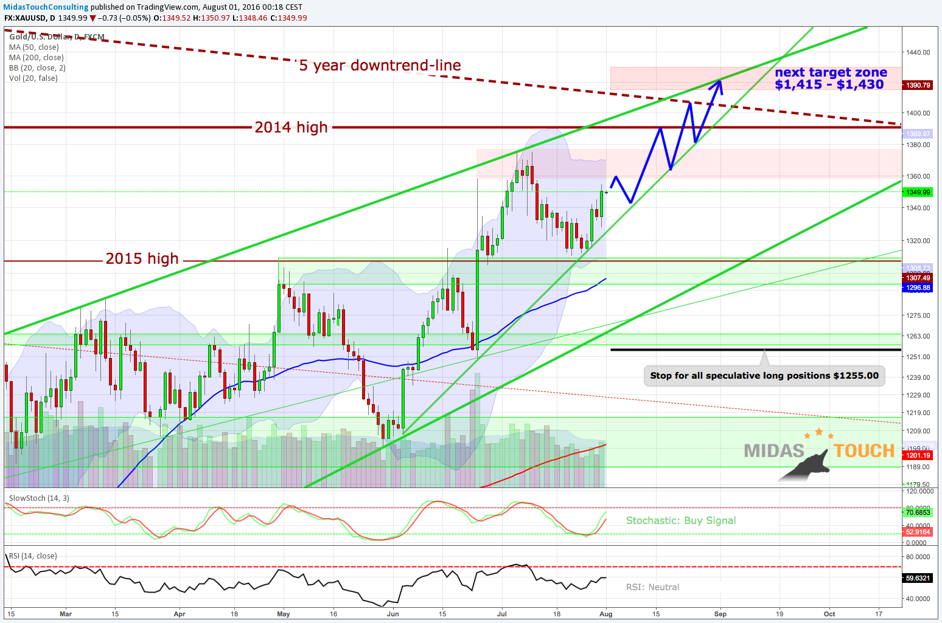

Gold – Pullback very likely over and now on the way to $1,400+

(Click on image to enlarge)

With last week´s bullish turnaround the pullback that had started on 6th of July is very likely over. Gold is acting very strong and bullish. Whether you like it or not and whether you believe it is overbought or not. The price is pushing higher. I think Gold could move to $1,415 - $,1430 until end of August.

So any little pullback is another buying opportunity. Unfortunately, the last dip missed my entry zone by just $5. But we are long since early June below $1,210 already.

Overall gold is on the way to $1,500 - $1,530. Our mantra remains to buy the dips. Even if I repeat myself: Don't short this baby bull, please. Once we reach levels around $1,500 it will make sense, but not now.

With the current strength in the precious metals sector I now suggest postponing any physical investments until we get a larger pullback. I am pretty sure we will see $1,250 - $1,300 again after Gold reaches my current target zone $1,500 - $1,530. But this will take time - at least a couple of months from here. Just remain patient and humble. Only if you are not invested at all should you start moving 3 to 5% of your assets into physical gold & silver at current prices. Otherwise just wait.

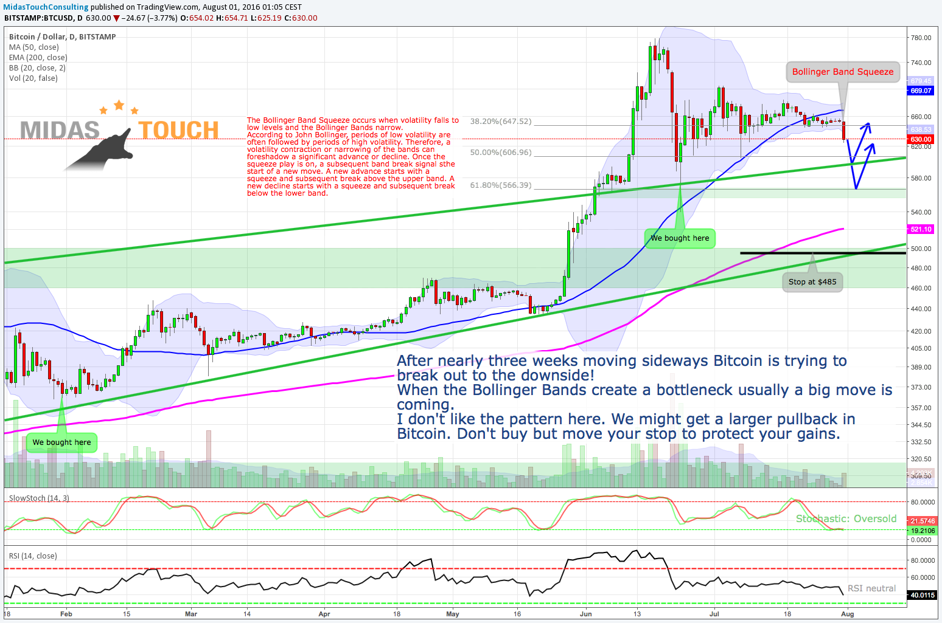

Bitcoin – Bollinger Band Squeeze - A pullback is coming

(Click on image to enlarge)

Bitcoin has been moving sideways for the last three weeks. With the low volatility this has led to a very narrow Bollinger Band. Today Bitcoin is breaking down from this bottleneck. Not a good sign, which is typically followed by a strong move in this direction.

The first target is the uptrendline around $595 - $600. Worst case will be a pullback down to the EMA200 around $521. We are long and want to stay in this trade as long as possible without giving back all of our profits. So we will move the stop just below the important support zone at $500. Don´t buy here even though Bitcoin is getting oversold. The Bollinger Band Squeeze points to lower prices first.

Action to take: Hold your bitcoins.

Stop Loss: Move your stop to $495 (end of the day stop)

Profit Target: $800 and $1,000

Timeframe 6 -18 months

Initial Risk($80) / Reward($430) = 1 : 5.4 (very good ratio!!)

Position Sizing: Don´t risk more than 1% of your equity.

Portfolio & Watchlist

Our positions in precious metals and Bitcoin have been holding up very well.

The S&P Biotech Bull 3x ETF (LABU) is strongly moving in our direction as well. We are up already more than 25% within two weeks! Now it´s important to make sure that a winner is not turning into a loser again. Therefore move your stop to $35.00.

The iPath Grains ETF (JJG) at the same time is losing ground. Keep your stop at $27.50. The agriculture sector is very oversold and should be ready for a bounce. If not we will be stopped out.

For now there are no new positions and recommendations. But watch your inbox. I will recommend a new mining stock very soon.

(Click on image to enlarge)

Long-term personal belief (my bias)

Officially Gold is still in a bear market but the big picture has massively improved and the lows are very likely in. Gold was able to push above the January 2015 high at $1,307 and we are finally looking at a series of higher highs. If this bear is over a new bull-market should push Gold towards $1,500 - $1,530 and Silver towards $26.00 within the next 8-24 months.

My long-term price target for the DowJones/Gold-Ratio remains around 1:1. and 10:1 for the Gold/Silver-Ratio. A possible long-term price target for Gold remains around US$5,000 to US$8,900 per ounce within the next 5-8 years (depending on how much money will be printed..).

Fundamentally, as soon as the current bear market is over, Gold should start the final (3rd) phase of this long-term secular bull market. 1st stage saw the miners closing their hedge books, the 2nd stage continuously presented us news about institutions and central banks buying or repatriating gold. The coming 3rd and finally parabolic stage will end in the distribution to small inexperienced new traders & investors who will be subject to blind greed and frenzied panic.

Bitcoin could become the "new money" for the digital 21st century. It is free market money but surely politicians and central bankers will try to regulate it soon.

If you like to get regular updates on our gold model, gold and bitcoin you ...

more

The problem though is that a lot of very well financed powers dislike gold...

Safe to say #Gold and #Silver will take your money a long way. Nice article!

Thanks sir for sharing

#Gold and #silver... the underappreciated assets as of late. Personally, I like silver more than gold though as it has a lot more room to run.