Gold Prices May Fall As US Jobs Data Validates Chart Setup

Gold prices ventured higher amid risk aversion yesterday as expected, with a drop in bond yields boosting the relative appeal of non-interest-bearing alternatives. A late-day recovery on Wall Street put this dynamic in reverse however, with rates rising alongside share prices as the yellow metal retreated to finish the session little-changed.

Crude oil prices were already pressured by the early risk-off push when it because apparent that OPEC and its allies would not reach a deal on a new round of coordinated output cuts at a meeting in Vienna. That understandably amplified the move lower. The last-minute improvement in risk appetite made itself felt here as well however, with the WTI contract trimming the day’s losses as US stocks seesawed upward.

COMMODITIES MAY FALL AS US JOBS DATA BOOSTS DOLLAR

November’s US jobs report headlines the economic data docket from here. An on-trend rise of 198k in nonfarm payrolls is expected while the unemployment rate holds at a five-decade low of 3.7 percent and wage growth matches the nine-year high of 3.1 percent set in the prior month. Leading PMI survey data echoes such forecasts, pointing to significant labor price pressure despite relatively steady economic activity.

Outcomes broadly in line with these projections may serve to drive home the point that the Fed’s recent pivot toward a more data-dependent posture need not imply a dovish swing in policy. That stands to boost recently soggy interest rate hike bets, sending the US Dollar and punishing anti-fiat alternatives epitomized by gold. Crude oil may also suffer alongside the spectrum of USD-denominated assets.

OPEC+ OUTPUT CUT DEAL UNLIKELY TO IMPRESS MARKETS

A follow-up meeting of the so-called OPEC+ collective – a group comprising officials from the cartel and like-minded oil producers such as Russia – is also noteworthy. They will try to mend yesterday’s disappointing outing with a deal to reduce collective output in 2019. Anything short of an implausibly large drawdown may fail to impress however as US exports surge. Indeed, they hit a record high last week.

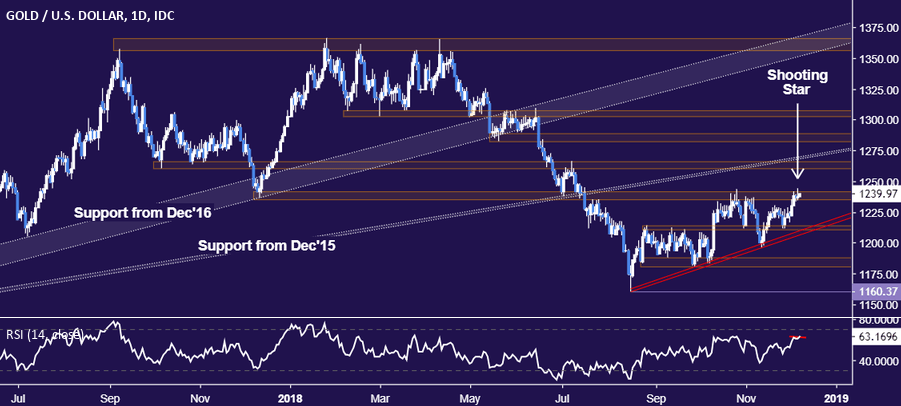

GOLD TECHNICAL ANALYSIS

The appearance of a Shooting Star candlestick coupled with negative RSI divergence on a test of resistance in the 1235.24-41.64 area hints gold prices may turn lower. A break below rising trend line support at exposes the 1180.86-87.83 zone next. Alternatively, a daily close above 1241.64 opens the door for a test of the 1260.80-66.44 region.

(Click on image to enlarge)

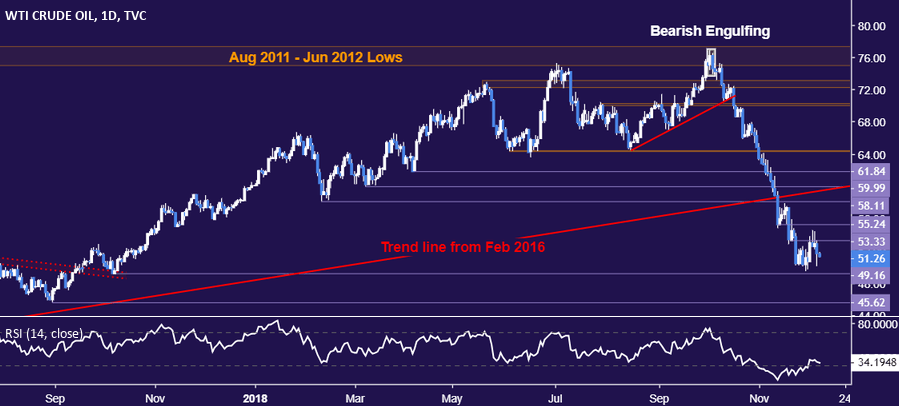

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices recoiled from resistance at 53.33 (former support, falling trend line), as expected. From here, a daily close below the October 9, 2017 bottom at 49.16 targets the August 31, 2017 low at 45.62. Alternatively, a rebound through 53.33 aims for support-turned-resistance at 55.24.

(Click on image to enlarge)

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more