Tuesday, November 20, 2018 4:08 AM EDT

Gold prices rose as bond yields declined amid risk aversion, boosting the relative appeal of non-interest-bearing alternatives. Crude oil prices probed lower alongside equities but the move reversed course midday after IEA Executive Director Fatih Birol opined that spare production capacity in Saudi Arabia is “very thin”, implying relatively little scope for boosting supply.

GOLD MAY RISE IN RISK-OFF TRADE, CRUDE OIL EYES API DATA

Looking ahead, sentiment may remain in focus for gold prices. S&P 500 futures are pointing to another risk-off day ahead, which may continue to offer a degree of support as yields retreat. Crude oil is eyeing API inventory flow data in the meanwhile. The outcome will be judged against forecasts calling for a 2.5 million barrel build expected to be revealed in official EIA statistics Wednesday.

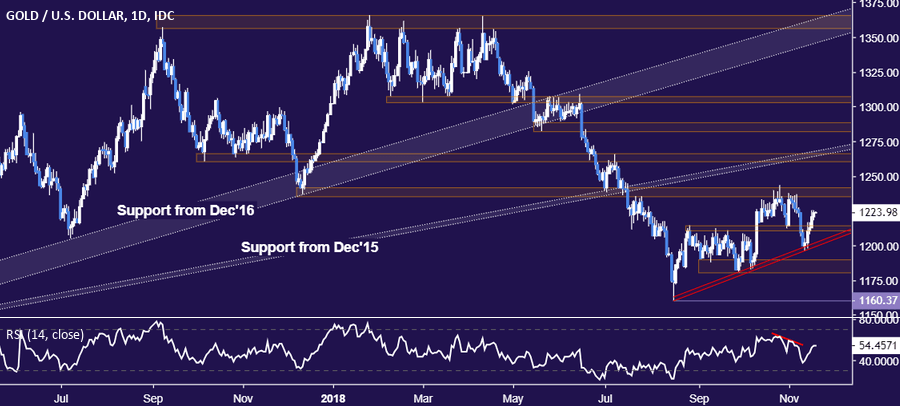

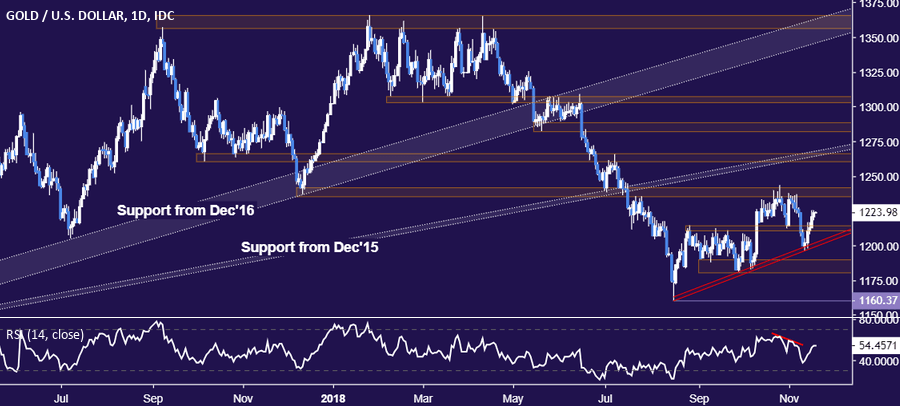

GOLD TECHNICAL ANALYSIS

Gold prices continue to edge higher after reclaiming a foothold above the 1211.05-14.30 area. Resistance is now in the 1260.80-66.44, with a daily close above that targeting the 1260.80-66.44 region. Alternatively, a reversal back below 1211.05 aims for trend line support at the $1200/oz figure.

(Click on image to enlarge)

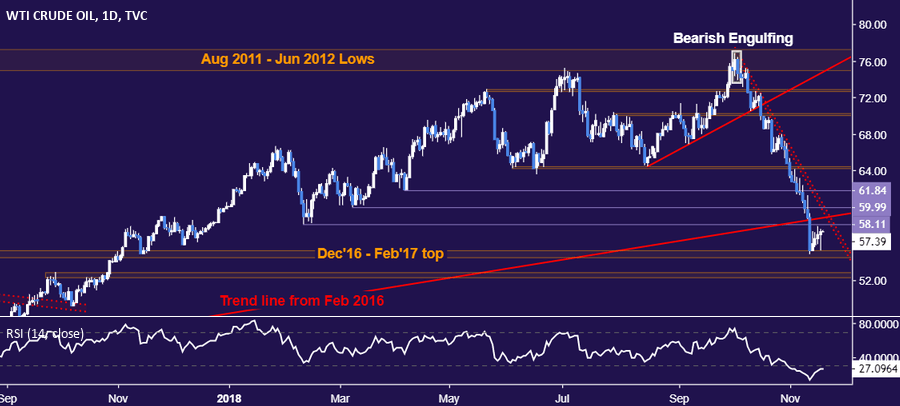

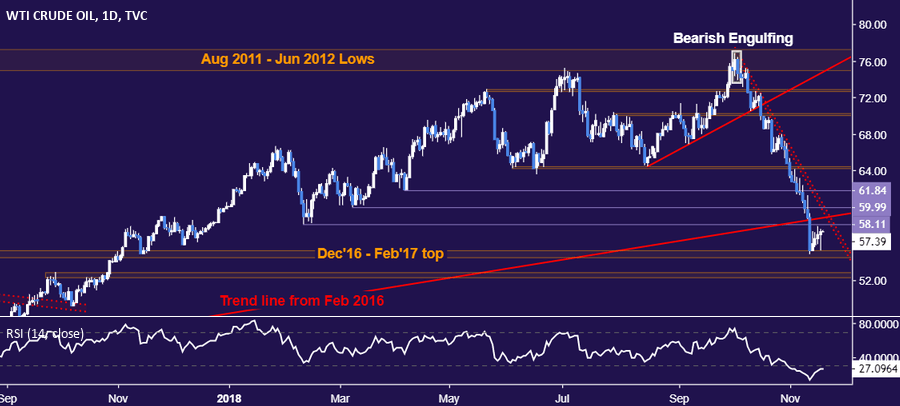

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are inching upward en route to a resistance cluster capped at the $60/bbl figure. A daily close above that opens the door for a test of 61.84. Alternatively, a reversal through support in the 54.48-55.21 area exposes the 52.34-83 zone next.

(Click on image to enlarge)

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment Indicator.DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the fundamental and technical influences driving the currency and commodity markets. With nine internationally-based analysts publishing over 30 articles and producing 5 video news updates daily, DailyFX offers in-depth coverage of price action, predictions of likely market moves, and exhaustive interpretations of salient economic and political developments. DailyFX is also home to one of the most powerful economic calendars available on the web, complete with advanced sorting capabilities, detailed descriptions of upcoming events on the economic docket, and projections of how economic report data will impact the markets. Combined with the free charts and live rate updates featured on DailyFX, the DailyFX economic calendar is an invaluable resource for traders who heavily rely on the news for their trading strategies. Additionally, DailyFX serves as a portal to one the most vibrant online discussion forums in the forex trading community. Avoiding market noise and the irrelevant personal commentary that plague many forex blogs and forums, the DailyFX Forum has established a reputation as being a place where real traders go to talk about serious trading.

Any opinions, news, research, analyses, prices, or other information contained on dailyfx.com are provided as general market commentary, and does not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

** All times listed in GMT. See the full DailyFX economic calendar here.

less

How did you like this article? Let us know so we can better customize your reading experience.