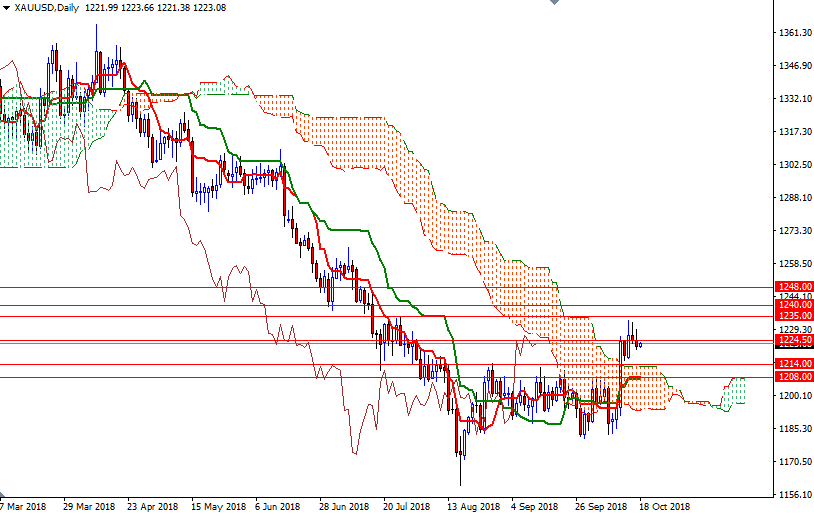

Gold Edges Lower After Fed Minutes

Gold prices fell $2.36 an ounce on Wednesday as a rebound in global equities dented safe-haven demand for gold. The dollar extended its gains after the minutes of the Federal Reserve’s latest meeting backed expectations that the U.S. central bank will continue to gradually raise interest rates. “This gradual approach would balance the risk of tightening monetary policy too quickly, which could lead to an abrupt slowing in the economy and inflation moving below the Committee’s objective, against the risk of moving too slowly, which could engender inflation persistently above the objective and possibly contribute to a buildup of financial imbalances,” the minutes said. The Federal Reserve is expected to raise rates again in December, but it appears that this expectation is factored into current market sentiment.

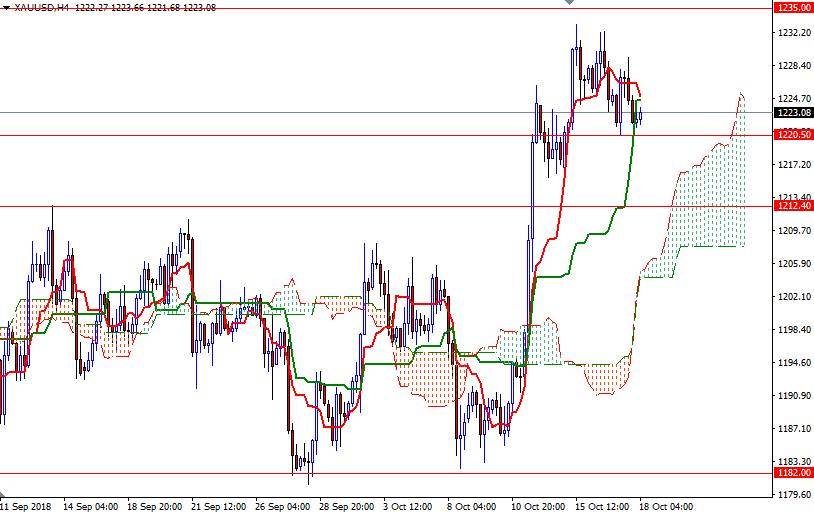

The key technical levels remain the same as the market is trapped in a relatively tight trading range. XAU/USD tested the anticipated support in the 1220.50-1219.50 area but failed to penetrate the Ichimoku cloud on the H1 chart. The bulls need to lift prices above 1225-1224.50, the bottom of the hourly cloud, to challenge the next barrier at 1228, where the top of the hourly cloud sits. A break above 1228 could foreshadow a move to 1235.

(Click on image to enlarge)

The bears, on the other hand, have to push prices below 1219.50 to tackle 1216. If this support gives way, then the market will be aiming for 1214-1212.40. Closing below 1212.40 on a daily basis suggests that prices are heading back to the 1208/5 zone.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more